U-Haul 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Inherent Limitations on Effectiveness of Controls

The Company's management, including the CEO, CAO and CFO, does not expect that our Disclosure Controls or

our internal control over financial reporting will prevent or detect all error and all fraud. A control system, no matter

how well designed and operated, can provide only reasonable, not absolute, assurance that the control system's

objectives will be met. The design of a control system must reflect the fact that there are resource constraints, and

the benefits of controls must be considered relative to their costs. Further, because of the inherent limitations in all

control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud

will not occur or that all control issues and instances of fraud, if any, within the Company have been detected. These

inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can

occur because of simple error or mistake. Controls can also be circumvented by the individual acts of some persons,

by collusion of two or more people, or by management override of the controls. The design of any system of

controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance

that any design will succeed in achieving its stated goals under all potential future conditions. Projections of any

evaluation of controls effectiveness to future periods are subject to risks. Over time, controls may become

inadequate because of changes in conditions or deterioration in the degree of compliance with policies or

procedures.

There have not been any changes in the Company’ s internal control over financial reporting (as such term is

defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the most recent fiscal quarter that have

materially affected, or are reasonably likely to materially affect, the Company’ s internal control over financial

reporting.

Item 9B.

Other Information

New Financings

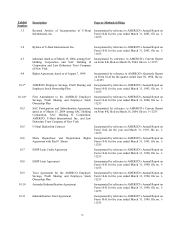

On June 7, 2006, U-Haul International, Inc. and certain subsidiaries entered into a $150.0 million term loan

facility with BTMU Capital Corporation that is expected to be drawn down over the next several months to fund the

acquisition of new rental trucks. The credit facility is secured by a portion of the Company’ s new truck rental fleet.

The above discussion is merely a description of select terms of the agreements and is qualified in its entirety by

reference to our agreements with BTMU Capital Corporation filed as Exhibits 10.85, 10.86 and 10.87 hereto.

On June 7, 2006, U-Haul International, Inc. and certain subsidiaries entered into a $50.0 million term loan facility

with Bayerische Hypo-und Vereinsbank that is expected to be drawn down over the next several months to fund the

acquisition of new rental trucks. The credit facility is secured by a portion of the Company’ s new truck rental fleet.

The above discussion is merely a description of select terms of the agreements and is qualified in its entirety by

reference to our agreements with Bayerische Hypo-und Vereinsbank filed as Exhibits 10.91 and 10.92 hereto.

The existing Merrill Lynch Rental Truck Amortizing Loan and Revolving Credit Agreement were amended to

clarify their security interests in only those trucks serving as collateral for those loans. The above discussion is

merely a description of select terms of the amendments and is qualified in its entirety by reference to such

amendments with Merrill Lynch Commercial Finance Corporation filed as Exhibits 10.88 and 10.89 hereto.

47