U-Haul 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Real Estate Backed Loans

Real Estate Loan

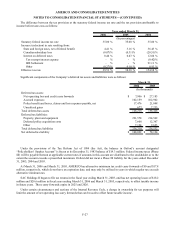

Amerco Real Estate Company and certain of its subsidiaries and U-Haul Company of Florida are borrowers under a

Real Estate Loan. The lender is Merrill Lynch Commercial Finance Corp. The original amount of the Real Estate Loan was

$465.0 million and is due June 10, 2010. The borrowers have the right to extend the maturity twice, for up to one year each

time. U-Haul International, Inc. is a guarantor of this loan.

The Real Estate Loan requires monthly principal and interest payments, with the unpaid loan balance and accrued and

unpaid interest due at maturity. The Real Estate Loan is secured by various properties owned by the borrowers. The

principal payments of $222.4 million made in the second quarter were sufficient to allow us to make interest only payments

in the third and fourth quarters of fiscal 2006.

The interest rate, per the provisions of the Loan Agreement, is the applicable London Inter-Bank Offer Rate (“LIBOR”)

plus the applicable margin. At March 31, 2006 the applicable LIBOR was 4.70% and the applicable margin was 2.0%, the

sum of which was 6.70%. The applicable margin ranges from 2.00% to 2.75% and is based on the ratio of the excess of the

average daily amount of loans divided by a fixed percentage of the appraised value of the properties collateralizing the loan,

compared with the most recently reported twelve months of Combined Net Operating Income (“NOI”), as that term is

defined in the Loan Agreement.

The default provisions of the Real Estate Loan include non-payment of principal or interest and other standard reporting

and change-in-control covenants. There are limited restrictions regarding our use of the funds.

Senior Mortgages

Various subsidiaries of Amerco Real Estate Company and U-Haul International, Inc. are borrowers under the Senior

Mortgages. The lenders for the Senior Mortgages are Merrill Lynch Mortgage Lending, Inc. and Morgan Stanley Mortgage

Capital Inc. The Senior Mortgages are in the aggregate amount of $474.2 million and are due July 2015. The Senior

Mortgages require average monthly principal and interest payments of $3.0 million with the unpaid loan balance and

accrued and unpaid interest due at maturity. The Senior Mortgages are secured by certain properties owned by the

borrowers. The interest rates, per the provisions of the Senior Mortgages, are 5.68% per annum for the Merrill Lynch

Mortgage Lending Agreement and 5.52% per annum for the Morgan Stanley Mortgage Capital Agreement. The default

provisions of the Senior Mortgages include non-payment of principal or interest and other standard reporting and change-

in-control covenants. There are limited restrictions regarding our use of the funds.

U-Haul Company of Canada is the borrower under a mortgage backed loan. The loan was arranged by Merrill Lynch

Canada and is in the amount of $9.7 million ($11.4 million Canadian currency). The loan is secured by certain properties

owned by the borrower. The loan was entered into on June 29, 2005 at a rate of 5.75%. The loan requires monthly

principal and interest payments with the unpaid loan balance and accrued and unpaid interest due at maturity. It has a

twenty-five year amortization with a maturity of July 1, 2015. The default provisions of the loan include non-payment of

principal or interest and other standard reporting and change-in-control covenants. There are limited restrictions regarding

our use of the funds.

A subsidiary of Amerco Real Estate Company is a borrower under a mortgage backed loan. The lender is Morgan

Stanley Mortgage Capital, Inc. and the loan is in the amount of $23.9 million. The loan was entered into on August 17,

2005 at a rate of 5.47%. The loan is secured by certain properties owned by the borrower. The loan requires monthly

principal and interest payments with the unpaid loan balance and accrued and unpaid interest due at maturity. It has a

twenty-five year amortization with a maturity of September 17, 2015. The default provisions of the loan include non-

payment of principal or interest and other standard reporting and change-in-control covenants. There are limited

restrictions regarding our use of the funds.

Various subsidiaries of Amerco Real Estate Company and U-Haul International, Inc. are borrowers under a mortgage

backed loan. The lender is Lehman Brothers Bank, FSB and the loan is in the amount of $23.5 million. The loan was

entered into on October 6, 2005 at a rate of 5.72%. The loan is secured by certain properties owned by the borrower. The

loan requires monthly principal and interest payments with the unpaid loan balance and accrued and unpaid interest due at

maturity. It has a twenty-five year amortization with a maturity of October 11, 2015. The default provisions of the loan

include non-payment of principal or interest and other standard reporting and change-in-control covenants. There are

limited restrictions regarding our use of the funds.

F-21