U-Haul 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

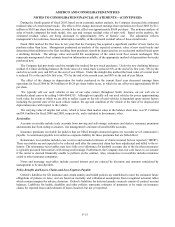

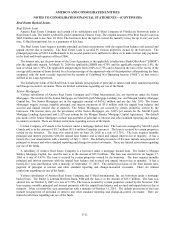

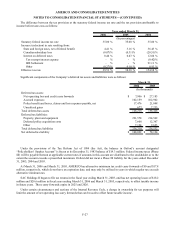

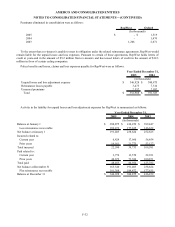

SAC Holding II Corporation Notes and Loans Payable to Third Parties

SAC Holding II Corporation notes and loans payable to third parties were as follows:

2006 2005

Notes payable, secured, 7.87% interest rate, due 2027 $ 76,232 $ 77,474

(In thousands)

March 31,

Secured notes payable are secured by deeds of trusts on the collateralized land and buildings. Principal and interest

payments on notes payable to third party lenders are due monthly in the amount of $0.6 million. Certain notes payable

contain provisions whereby the loans may not be prepaid at any time prior to the maturity date without payment to the

lender of a Yield Maintenance Premium, as defined in the loan agreements.

On March 15, 2004, the SAC entities issued $200.0 million aggregate principal amount of 8.5% senior notes due 2014

(the “new SAC Notes”). SAC Holding Corporation and SAC Holding II Corporation are jointly and severally liable for

these obligations. The proceeds from this issuance flowed exclusively to SAC Holding Corporation and as such SAC

Holding II has recorded no liability for this.

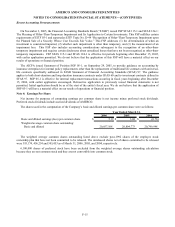

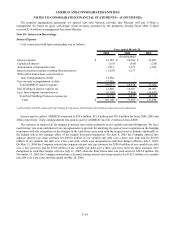

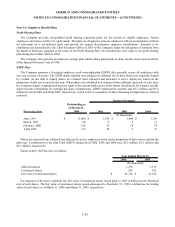

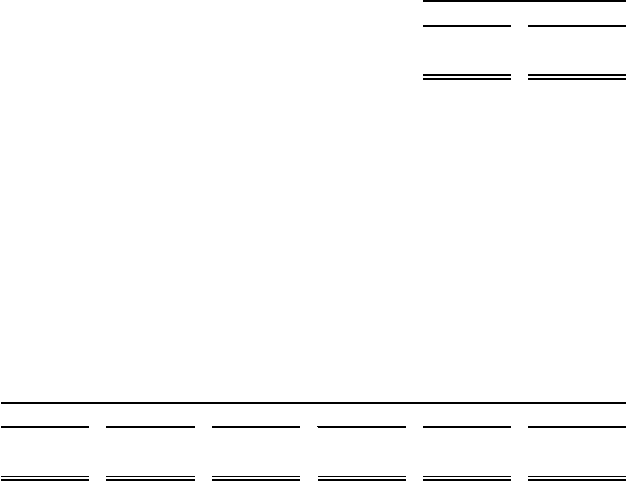

Annual Maturities of SAC Holding II Corporation Notes and loans Payable to Third Parties

The annual maturity of SAC Holding II Corporation long-term debt for the next five years and thereafter is as

follows:

2007 2008 2009 2010 2011 Thereafter

Notes payable, secured $ 1,313 $ 1,422 $ 1,656 $ 1,791 $ 1,937 $ 68,113

March 31,

(In thousands)

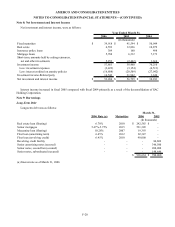

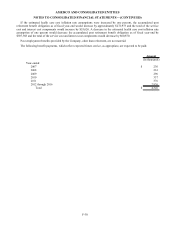

W.P. Carey Transactions

In 1999, AMERCO, U-Haul and Real Estate entered into financing agreements for the purchase and construction of

self-storage facilities with the Bank of Montreal and Citibank (the “leases” or the “synthetic leases”). Title to the real

property subject to these leases was held by non-affiliated entities.

These leases were amended and restated on March 15, 2004. In connection with such amendment and restatement, we

paid down approximately $31.0 million of lease obligations and entered into leases with a three year term, with four one

year renewal options. After such pay down, our lease obligation under the amended and restated synthetic leases was

approximately $218.5 million.

On April 30, 2004, the amended and restated leases were terminated and the properties underlying these leases were

sold to UH Storage (DE) Limited Partnership, an affiliate of W. P. Carey. U-Haul entered into a ten year operating lease

with W. P. Carey (UH Storage DE) for a portion of each property (the portion of the property that relates to U-Haul’ s truck

and trailer rental and moving supply sales businesses). The remainder of each property (the portion of the property that

relates to self-storage) was leased by W. P. Carey (UH Storage DE) to Mercury Partners, LP (“Mercury”) pursuant to a

twenty year lease. These events are referred to as the “W. P. Carey Transactions.” As a result of the W. P. Carey

Transactions, we no longer have a capital lease related to these properties.

The sales price for these transactions was $298.4 million and cash proceeds were $298.9 million. The Company realized

a gain on the transaction of $2.7 million, which is being amortized over the life of the lease term.

As part of the W. P. Carey Transactions, U-Haul entered into agreements to manage these properties (including the

portion of the properties leased by Mercury). These management agreements allow us to continue to operate the properties

as part of the U-Haul moving and self-storage system.

U-Haul’ s annual lease payments under the new lease are approximately $10.0 million per year, with Consumer Price

Index (“CPI”) inflation adjustments beginning in the sixth year of the lease. The lease term is ten years, with a renewal

option for an additional ten years. Upon closing of the W. P. Carey Transactions, we made a $22.9 million earn-out deposit,

providing us with the opportunity to be reimbursed for certain capital improvements we previously made to the properties,

and a $5.0 million security deposit. U-Haul met the requirements under the lease regarding the return of the earn-out

deposit which was refunded in fiscal 2006.

F-23