U-Haul 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

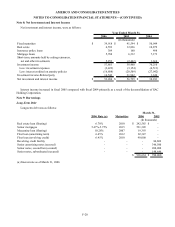

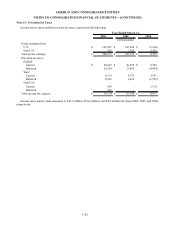

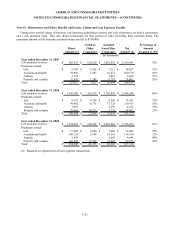

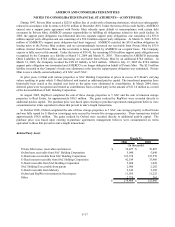

The difference between the tax provision at the statutory federal income tax rate and the tax provision attributable to

income before taxes was as follows:

2006 2005 2004

Statutory federal income tax rate 35.00 % 35.00 % 35.00 %

Increase (reduction) in rate resulting from:

State and foreign taxes, net of federal benefit 4.41 % 3.16 % 36.43 %

Canadian subsidiary loss (0.07)% (0.31)% (20.51)%

Interest on deferred taxes 0.44 % 0.43 % 12.04 %

Tax-exempt interest expense - % - % (0.42)%

IRS Settlement - % - % 91.11 %

Other (0.27)% 0.10 % 0.93 %

Effective tax rate 39.51 % 38.38 % 154.58 %

Year ended March 31,

(In percentages)

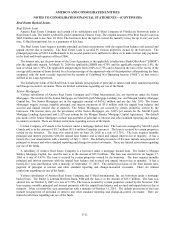

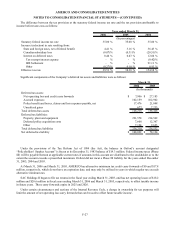

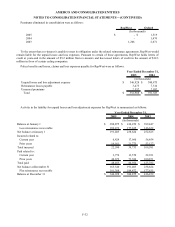

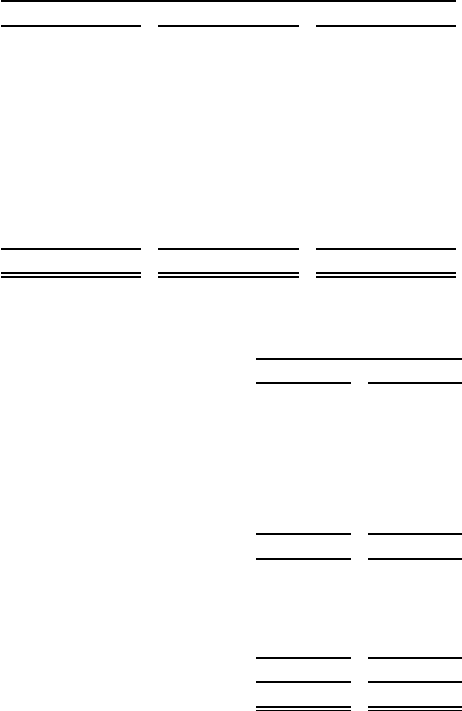

Significant components of the Company’ s deferred tax assets and liabilities were as follows:

2006 2005

Deferred tax assets:

Net operating loss and credit carry forwards $ 7,906 $ 27,183

Accrued expenses 102,159 102,962

Policy benefit and losses, claims and loss expenses payable, ne

t

17,476 21,048

Unrealized gains 677 7,235

Total deferred tax assets 128,218 158,428

Deferred tax liabilities:

Property, plant and equipment 221,578 214,562

Deferred policy acquisition costs 7,608 12,367

Other 7,124 9,623

Total deferred tax liabilities 236,310 236,552

Net deferred tax liability $ 108,092 $ 78,124

March 31,

(In thousands)

Under the provisions of the Tax Reform Act of 1984 (the Act), the balance in Oxford’ s account designated

“Policyholders’ Surplus Account” is frozen at its December 31, 1983 balance of $19.3 million. Federal income taxes (Phase

III) will be payable thereon at applicable current rates if amounts in this account are distributed to the stockholder or to the

extent the account exceeds a prescribed maximum. Oxford did not incur a Phase III liability for the years ended December

31, 2005, 2004 and 2003.

At March 31, 2006 and March 31, 2005, AMERCO has alternative minimum tax credit carry forwards of $0 and $17.8

million, respectively, which do not have an expiration date, and may only be utilized in years in which regular tax exceeds

alternative minimum tax.

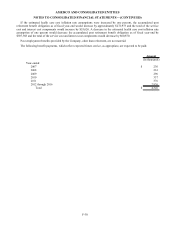

SAC Holdings II began to file tax returns in the fiscal year ending March 31, 2003, and has net operating losses of $18.2

million and $20.6 million in fiscal years ending March 31, 2006 and March 31, 2005, respectively, to offset taxable income

in future years. These carry forwards expire in 2025 and 2026.

Under certain circumstances and sections of the Internal Revenue Code, a change in ownership for tax purposes will

limit the amount of net operating loss carry forwards that can be used to offset future taxable income.

F-27