U-Haul 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During March 2004, SAC Holding Corporation ceased to be a VIE and AMERCO ceased being the primary

beneficiary of SAC Holding Corporation. As a result of this, AMERCO deconsolidated its interests in SAC Holding

Corporation at that time. AMERCO remains the primary beneficiary of its contractual variable interests in SAC

Holding II Corporation for fiscal 2005 and 2004.

Revenues for fiscal 2005 fell $175.8 million, primarily as a result of the above mentioned deconsolidation.

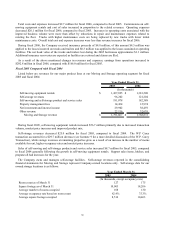

Total costs and expenses were $32.7 million in fiscal 2005, compared with $154.3 million in fiscal 2004. Total

costs and expenses fell $121.6 million, primarily as a result of the above mentioned deconsolidation.

Earnings from operations were $10.5 million in fiscal 2005 compared with $64.7 million in fiscal 2004. Earnings

from operations fell $54.2 million in fiscal 2005 compared with fiscal 2004, primarily as a result of the above

mentioned deconsolidation.

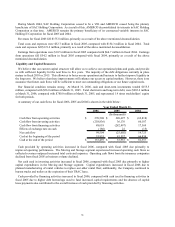

Liquidity and Capital Resources

We believe that our current capital structure will allow us to achieve our operational plans and goals, and provide

us with sufficient liquidity for the next three to five years. The majority of the debt obligations currently in place

mature in fiscal 2010 or 2015. This allows us to focus on our operations and business to further improve liquidity in

the long term. We believe that these improvements will enhance our access to capital markets. However, there is no

assurance that future cash flows will be sufficient to meet our outstanding obligations or our future capital needs.

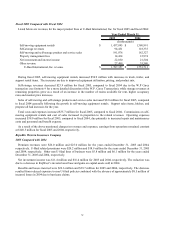

Our financial condition remains strong. At March 31, 2006, cash and short-term investments totaled $155.5

million, compared with $56.0 million at March 31, 2005. Total short-term and long-term debt, were $965.6 million

at March 31, 2006, compared with $780.0 million at March 31, 2005, and represented 1.4 times stockholders’ equity

for both periods.

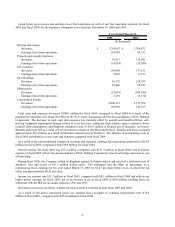

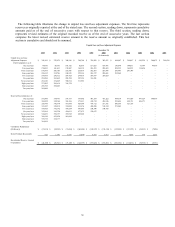

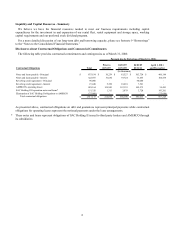

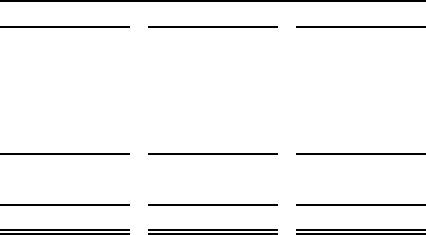

A summary of our cash flows for fiscal 2006, 2005 and 2004 is shown in the table below:

2006 2005 2004

Cash flow from operating activities $ 270,508 $ 220,697 $ (62,818)

Cash flow from investing activities (258,836) 36,176 60,187

Cash flow from financing activities 88,018 (282,497) 17,369

Effects of exchange rate on cash (186) 22 (15)

Net cash flow 99,504 (25,602) 14,723

Cash at the beginning of the period 55,955 81,557 66,834

Cash at the end of the period $ 155,459 $ 55,955 $ 81,557

Year Ended March 31,

(In thousands)

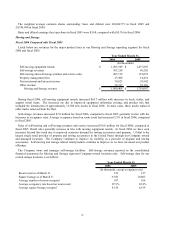

Cash provided by operating activities increased in fiscal 2006, compared with fiscal 2005 due primarily to

improved operating performance. The Moving and Storage segment experienced increased operating cash flows as

collected revenues outpaced increased total costs and expenses. Operating cash flows from the insurance companies

declined from fiscal 2005 as business volume declined.

Net cash used in investing activities increased in fiscal 2006, compared with fiscal 2005 due primarily to higher

capital expenditures in the Moving and Storage segment. Capital expenditures increased in fiscal 2006 due to

planned manufacturing of rental vehicles to replace our older rental fleet; additionally, the Company continued to

buyout trucks and trailers at the expiration of their TRAC lease.

Cash provided by financing activities increased in fiscal 2006, compared with cash used in financing activities in

fiscal 2005 due to higher debt borrowings used to fund increased capital requirements and the absence of capital

lease payments also contributed to the overall increase of cash provided by financing activities.

38