U-Haul 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Insurance Plans

Oxford insures various group life and group disability insurance plans covering employees of the Company. Premiums

earned by Oxford on these policies were $3.5 million, $3.3 million and $4.5 million for the years ended December 31,

2005, 2004, and 2003, respectively. The group life premiums are paid by the Company and those amounts were eliminated

from the Company’ s financial statements in consolidation. The group disability premiums are paid by the covered

employees.

Post Retirement and Post Employment Benefits

The Company provides medical and life insurance benefits to its eligible employees and their dependents upon

retirement from the Company. The retirees must have attained age sixty-five and earned twenty years of full-time service

upon retirement for coverage under the medical plan. The medical benefits are capped at a $20,000 lifetime maximum per

covered person. The benefits are coordinated with Medicare and any other medical policies in force. Retirees who have

attained age sixty-five and earned at least ten years of full-time service upon retirement from the Company are entitled to

group term life insurance benefits. The life insurance benefit is $2,000 plus $100 for each year of employment over ten

years. The plan is not funded and claims are paid as they are incurred. The Company has elected to use a December 31

measurement date for its post retirement benefit disclosures as of March 31.

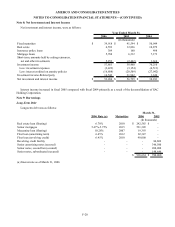

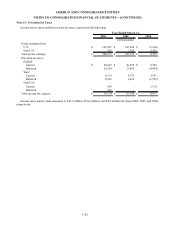

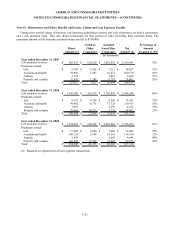

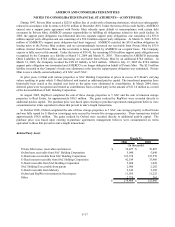

The components of net periodic post retirement benefit cost were as follows:

2006 2005 2004

Service cost for benefits earned during the period $ 373 $ 316 $ 315

Interest cost on accumulated postretirement benefit 306 313 331

Other components (299) (317) (293)

Net periodic postretirement benefit cos

t

$380 $ 312 $ 353

Year Ended March 31,

(In thousands)

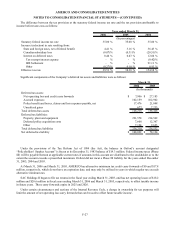

The fiscal 2006 and fiscal 2005 post retirement benefit liability included the following components:

2006 2005

Beginning of year $ 5,376 $ 5,074

Service cost for benefits earned during the period 373 316

Interest cost on accumulated post retirement benefit 306 313

Benefit payments and expense (417) (116)

Actuarial (gain) loss 2,545 (211)

Accumulated postretirement benefit obligation 8,183 5,376

Unrecognized net gain 1,563 4,406

Total post retirement benefit liability $ 9,746 $ 9,782

Year Ended March 31,

(In thousands)

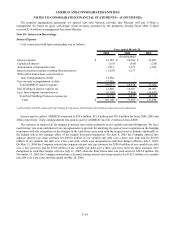

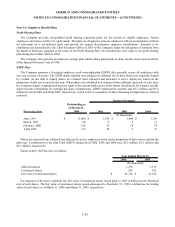

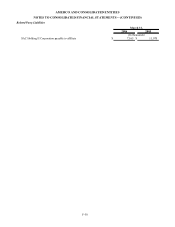

The discount rate assumptions in computing the information above were as follows:

2006 2005 2004

Accumulated postretirement benefit obligation 5.75% 5.75% 6.25%

Year Ended March 31,

(In percentages)

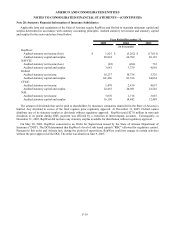

The discount rate represents the expected yield on a portfolio of high grade (AA to AAA rated or equivalent) fixed

income investments with cash flow streams sufficient to satisfy benefit obligations under the plan when due. Fluctuations in

the discount rate assumptions primarily reflect changes in U.S. interest rates. The estimated health care cost inflation rates

used to measure the accumulated post retirement benefit obligation was 5.00% in fiscal 2006, which was projected to

decline annually to an ultimate rate of 4.20% in fiscal 2013.

F-29