U-Haul 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources and Requirements of Our Operating Segments

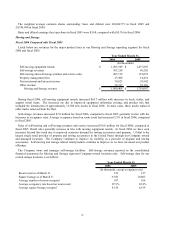

Moving and Self-Storage

To meet the needs of our customers, U-Haul maintains a large fleet of rental equipment. Capital expenditures

have primarily reflected new rental equipment acquisitions and the buyouts of existing fleet from TRAC leases. The

capital to fund these expenditures has historically been obtained internally from operations and the sale of used

equipment, and externally from lease financing. In the future we anticipate that our internally generated funds will

be used to service the existing debt and support operations. U-Haul estimates that during the next three fiscal years,

at least $340.0 million each year will be reinvested in the truck and trailer rental fleet. This investment will be

funded through external lease financing, debt financing and internally from operations and sales of used equipment.

Management considers several factors including cost and tax consequences when selecting a method to fund capital

expenditures. Because the Company has utilized all of its net operating loss carry forwards, there will be more of a

focus on financing the fleet through asset-backed debt. Net capital expenditures were $322.2 million and $40.7

million for fiscal 2006 and 2005, respectively.

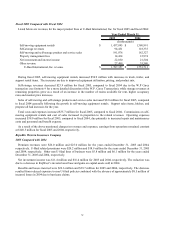

Real Estate has traditionally financed the acquisition of self-storage properties to support U-Haul's growth

through debt financing and funds from operations and sales. U-Haul's growth plan in self-storage is primarily

focused on eMove, which does not require acquisition or construction of self-storage properties by the Company.

This primary focus does not preclude the Company from using debt and internally generated funds to finance

storage acquisitions or construction in the future.

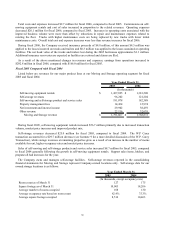

Property and Casualty Insurance

As of December 31, 2005, RepWest had no notes and loans due in less than one year and its accounts payable,

accrued expenses and other policyholders’ funds and liabilities were approximately $5.2 million. RepWest’ s

financial assets (cash, receivables, short-term investments, other investments, fixed maturities and related party

assets) at December 31, 2005, were $456.0 million. State insurance regulations restrict the amount of dividends that

can be paid to stockholders of insurance companies. As a result, RepWest’ s assets are generally not available to

satisfy the claims of AMERCO or its legal subsidiaries.

Stockholder’ s equity was $137.4 million, $154.8 million, and $169.0 million at December 31, 2005, 2004, and

2003 respectively. RepWest paid $27.0 million in dividends to its parent during 2005; payment was effected by a

reduction in intercompany accounts. The decrease was offset by increases from earnings and gains from the sale of

real estate to affiliated entities recorded directly to additional paid in capital. RepWest does not use debt or equity

issues to increase capital and therefore has no exposure to capital market conditions other than through its

investment portfolio.

39