U-Haul 2006 Annual Report Download - page 116

Download and view the complete annual report

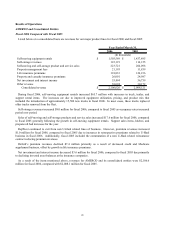

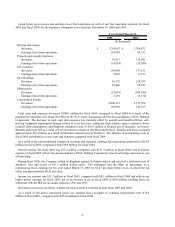

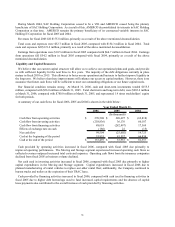

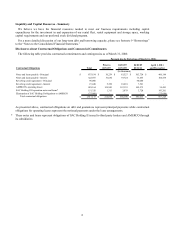

Please find page 116 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amortization of deferred acquisition costs were $2.9 million and $4.7 million for 2005 and 2004, respectively.

The decreases are due to a reduction of in-force business related to the exit of non U-Haul lines of business.

Operating expenses were $10.8 million and $11.8 million for 2005 and 2004, respectively. The decrease was due

to a reduction of general administrative expenses resulting from the exit of the non U-Haul lines of business.

Earnings (loss) from operations were $1.1 million and ($14.8) million for 2005 and 2004, respectively.

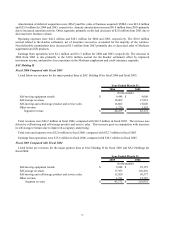

2004 Compared with 2003

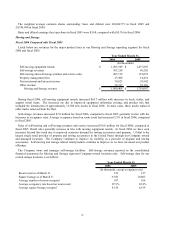

Premium revenues were $25.0 million and $93.2 million for the years ended December 31, 2004 and 2003,

respectively. The overall decrease is due to RepWest exiting non U-Haul lines of business. U-Haul related premiums

were $18.9 million and $23.6 million for 2004 and 2003, respectively. The decrease was a result of RepWest being

under DOI supervision and the “C” rating by A.M. Best. Premium revenues on non U-Haul lines of business were

$6.1 million and $69.6 million for 2004 and 2003, respectively.

Net investment income was $16.4 million and $21.7 million for 2004 and 2003, respectively. The reduction was

due to a decrease in the RepWest’ s invested asset base.

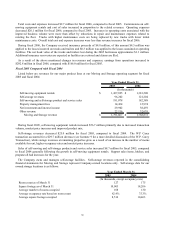

Benefits and losses incurred were $39.7 million and $109.4 million for 2004 and 2003, respectively. The

decreases resulted from reduced exposure resulting from RepWest’ s decision to exit its non U-Haul lines of

business, which was offset by the losses from the Florida hurricanes and additional reserves added to the long-tailed

programs.

Amortization of deferred acquisition costs was $4.7 million and $14.1 million for 2004 and 2003, respectively.

The decrease is due to decreased premium writings.

Operating expenses were $11.8 million and $27.4 million for 2004 and 2003, respectively. The decrease was due

to decreased commissions, as well as, a reduction of general administrative expenses due to the exit of the non U-

Haul lines of business.

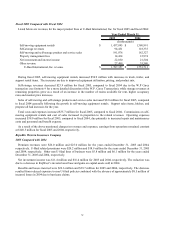

Losses from operations were $14.8 million and $36.0 million for 2004 and 2003, respectively. The loss in 2004

was the result of approximately $8.5 million in incurred losses and related expenses resulting from the hurricanes

that hit the Southeastern United States in the summer and fall of 2004, as well as additional reserves recorded for

RepWest’ s cancelled lines of business.

33