U-Haul 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

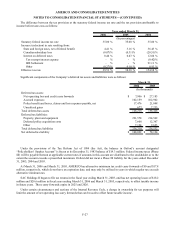

RepWest and Oxford currently hold a 46% limited partnership interest in Securespace Limited Partnership

(“Securespace”), a Nevada limited partnership. A SAC Holdings subsidiary serves as the general partner of Securespace

and owns a 1% interest. Another SAC Holdings subsidiary owns the remaining 53% limited partnership interest in

Securespace. Securespace was formed by SAC Holdings to be the owner of various Canadian self-storage properties.

RepWest’ s and Oxford’ s investment in Securespace is included in Related Party Assets and is accounted for using the

equity method. We do not believe that the carrying amount of their investments in Securespace is in excess of fair value.

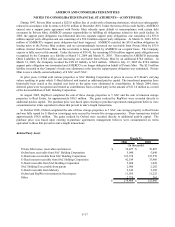

The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from

subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.7 million in both

fiscal 2006 and 2005. The terms of the leases are similar to the terms of leases for other properties owned by unrelated

parties that are leased to the Company.

At March 31, 2006, subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini acted as U-Haul

independent dealers. The financial and other terms of the dealership contracts with the aforementioned companies and their

subsidiaries are substantially identical to the terms of those with the Company’ s other 13,950 independent dealers. During

fiscal 2006 and fiscal 2005, the Company paid the above mentioned entities $36.8 million and $33.1 million, respectively in

commissions pursuant to such dealership contracts.

These agreements with Blackwater entities, excluding dealer agreements, provided revenue of $38.7 million, expenses

of $2.7 million and cash flows of $27.5 million during fiscal 2006. Revenues and commission expenses related to the

Dealer Agreements were $171.5 million and $36.7 million, respectively.

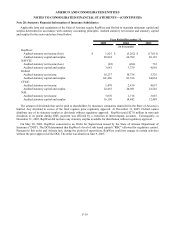

SAC Holdings was established in order to acquire self-storage properties. These properties are being managed by the

Company pursuant to management agreements. The sale of self-storage properties by the Company to SAC Holdings has in

the past provided significant cash flows to the Company and the Company’ s outstanding loans to SAC Holdings entitle the

Company to participate in SAC Holdings’ excess cash flows (after senior debt service).

Management believes that its sales of self-storage properties to SAC Holdings has provided a unique structure for the

Company to earn moving equipment rental revenues and management fee income from the SAC Holdings self-storage

properties the Company manages and to participate in SAC Holdings’ excess cash flows as described above.

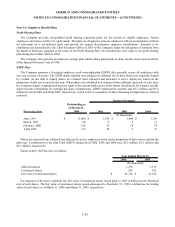

Independent fleet owners own approximately 2.4% of all U-Haul rental trailers. There are approximately 835

independent fleet owners, including certain officers, directors, employees and stockholders of AMERCO. Such AMERCO

officers, directors, employees and stockholders owned less than 1.0% of all U-Haul rental trailers during fiscal 2006, 2005

and 2004, respectively. Payments to these individuals under this program are de minimis (less than one thousand dollars per

quarter, per person). All rental equipment is operated under contract with U-Haul whereby U-Haul administers the

operations and marketing of such equipment and in return receives a percentage of rental fees paid by customers. Based on

the terms of various contracts, rental fees are distributed to U-Haul (for services as operators), to the fleet owners (including

certain subsidiaries and related parties of U-Haul) and to rental dealers (including Company-operated U-Haul Centers).

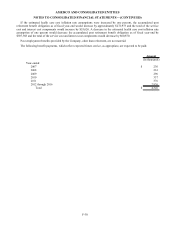

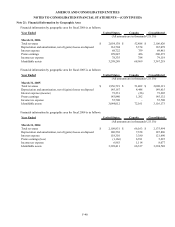

In February 1997, AMERCO, through its insurance subsidiaries, invested in the equity of Private Mini, a Texas-based

self-storage operator. RepWest invested $13.5 million and had a direct 30.6% interest and an indirect 13.2% interest.

Oxford invested $11.0 million and had a direct 24.9% interest and an indirect 10.8% interest. On June 30, 2003, RepWest

and Oxford exchanged their respective interests in Private Mini for certain real property owned by 4 SAC and 5 SAC. The

exchanges were non-monetary and were recorded on the basis of the book values of the assets exchanged.

F-36