U-Haul 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

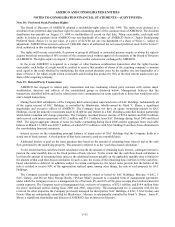

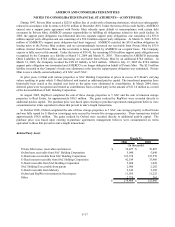

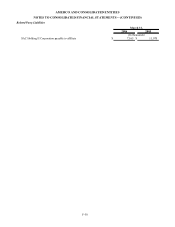

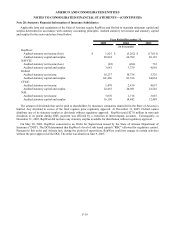

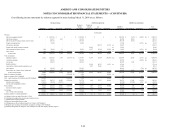

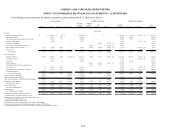

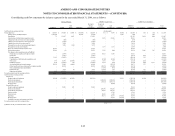

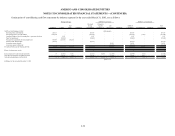

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

F-45

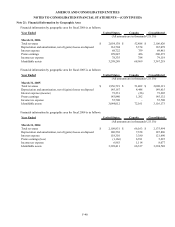

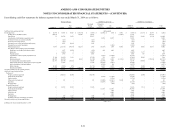

Consolidating balance sheets by industry segment as of March 31, 2005 are as follows:

AMERCO U-Haul Real Estate Eliminations

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a) Eliminations

AMERCO

Consolidated SAC Holding II Eliminations

Total

Consolidated

Liabilities:

Accounts payable and accrued expenses 17,330$ 198,322$ 2,736$ -$ 218,388$ -$ 17,745$ -$ 236,133$ 1,001$ -$ 237,134$

AMERCO's notes and loans payable 780,008 - - - 780,008 - - - 780,008 - - 780,008

SAC Holding II Corporation notes and loans

payable, non-recourse to AMERCO - - - - - - - - - 77,474 - 77,474

Policy benefits and losses,

claims and loss expenses payable - 249,053 - - 249,053 391,383 164,894 - 805,330 - - 805,330

Liabilities from investment contracts - - - - - - 503,838 - 503,838 - - 503,838

Other policyholders' funds and liabilities - - - - - 8,669 2,944 - 11,613 - - 11,613

Deferred income - 11,716 2 - 11,718 12,143 14,279 - 38,140 603 - 38,743

Deferred income taxes 158,415 - - - 158,415 (46,948) (1,121) - 110,346 (4,973) (27,249) (d) 78,124

Related party liabilities 115,499 355,997 249,692 (650,371) (c) 70,817 8,910 12,315 (92,042) (c) - 92,947 (81,877) (c) 11,070

Total liabilities 1,071,252 815,088 252,430 (650,371) 1,488,399 374,157 714,894 (92,042) 2,485,408 167,052 (109,126) 2,543,334

Stockholders' equity:

Series preferred stock:

Series A preferred stock - - - - - - - - - - - -

Series B preferred stock - - - - - - - - - - - -

Series A common stock 929 - - - 929 - - - 929 - - 929

Common stock 9,568 540 1 (541) (b) 9,568 3,300 2,500 (5,800) (b) 9,568 - - 9,568

Additional paid-in capital 396,415 121,230 147,481 (268,711) (b) 396,415 69,922 16,435 (86,357) (b) 396,415 - (46,071) (d) 350,344

Accumulated other comprehensive income (loss) (24,612) (33,344) - 33,344 (b) (24,612) 1,879 6,806 (8,685) (b) (24,612) - - (24,612)

Retained earnings (deficit) 657,434 623,663 106,678 (730,341) (b) 657,434 79,735 89,256 (168,991) (b) 657,434 (14,659) 22,818 (b,d) 665,593

Cost of common shares in treasury, net (418,092) - - - (418,092) - - - (418,092) - - (418,092)

Unearned employee stock

ownership plan shares - (10,891) - - (10,891) - - - (10,891) - - (10,891)

Total stockholders' equity (deficit) 621,642 701,198 254,160 (966,249) 610,751 154,836 114,997 (269,833) 610,751 (14,659) (23,253) 572,839

Total liabilities and stockholders' equity 1,692,894$ 1,516,286$ 506,590$ (1,616,620)$ 2,099,150$ 528,993$ 829,891$ (361,875)$ 3,096,159$ 152,393$ (132,379)$ 3,116,173$

(a) Balances as of December 31, 2004

(b) Eliminate investment in subsidiaries and SAC Holding II

(c) Eliminate intercompany receivables and payables

(d) Eliminate gain on sale of property from U-Haul to SAC Holding II

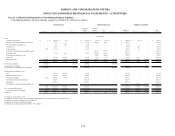

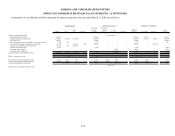

Moving & Storage AMERCO Legal Group AMERCO as Consolidated

(In thousands)