U-Haul 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

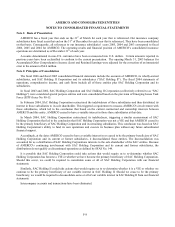

Recent Accounting Pronouncements

On November 3, 2005, the Financial Accounting Standards Board (“FASB”) issued FSP SFAS 115-1 and SFAS 124-1:

The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments. This FSP nullifies certain

requirements of EITF 03-1 and supersedes EITF Topic No. D-44 “Recognition of Other-Than-Temporary Impairment upon

the Planned Sale of a Security Whose Cost Exceeds Fair Value.” This FSP addresses (1) the determination of when an

investment is considered impaired, (2) whether such impairment is other than temporary, and (3) the measurement of an

impairment loss. This FSP also includes accounting considerations subsequent to the recognition of an other-than-

temporary impairment and requires certain disclosures about unrealized losses that have not been recognized as other-than-

temporary impairments. FSP SFAS 115-1 and SFAS 124-1 is effective for periods beginning after December 15, 2005,

with earlier application permitted. We do not believe that the application of this FSP will have a material effect on our

results of operations or financial position.

The AICPA issued Statement of Position SOP 05-1, on September 29, 2005, to provide guidance on accounting by

insurance enterprises for internal policy replacements other than the replacement of traditional life contracts with universal-

life contracts specifically addressed in FASB Statement of Financial Accounting Standards (SFAS) 97. The guidance

applies to both short-duration and long-duration insurance contracts under SFAS 60 and to investment contracts defined in

SFAS 97. SOP 05-1 is effective for internal replacement transactions occurring in fiscal years beginning after December

15, 2006, with earlier application encouraged. Retroactive application to previously issued financial statements is not

permitted. Initial application should be as of the start of the entity's fiscal year. We do not believe that the application of

SOP 05-1 will have a material effect on our results of operations or financial position.

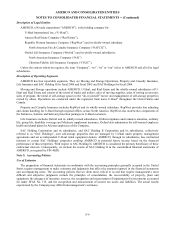

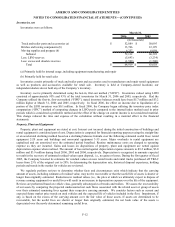

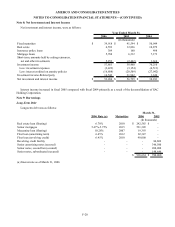

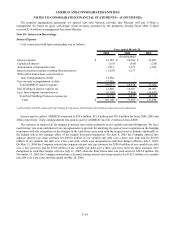

Note 4: Earnings Per Share

Net income for purposes of computing earnings per common share is net income minus preferred stock dividends.

Preferred stock dividends include accrued dividends of AMERCO.

The shares used in the computation of the Company’ s basic and diluted earnings per common share were as follows:

2006 2005 2004

Basic and diluted earnings (loss) per common share $ 5.19 $ 3.68 $ (0.76)

Weighted average common share outstanding:

Basic and diluted 20,857,108 20,804,773 20,749,998

Year Ended March 31,

The weighted average common shares outstanding listed above exclude post-1992 shares of the employee stock

ownership plan that have not been committed to be released. The unreleased shares net of shares committed to be released

were 393,174, 456,254 and 505,453 as of March 31, 2006, 2005, and 2004, respectively.

6,100,000 shares of preferred stock have been excluded from the weighted average shares outstanding calculation

because they are not common stock and they are not convertible into common stock.

F-15