U-Haul 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

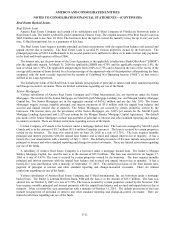

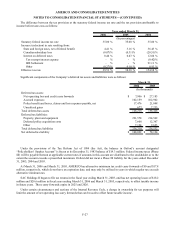

The property management agreement we entered into with Mercury provides that Mercury will pay U-Haul a

management fee based on gross self-storage rental revenues generated by the properties. During fiscal 2006, U-Haul

received $3.4 million in management fees from Mercury.

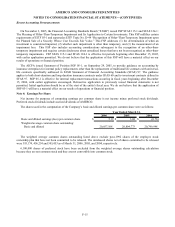

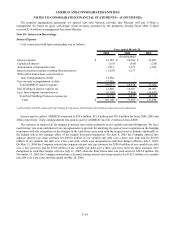

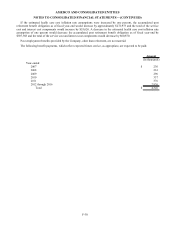

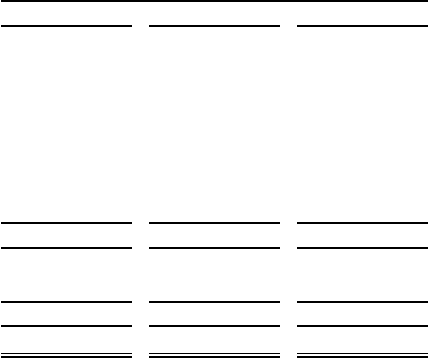

Note 10: Interest on Borrowings

Interest Expense

Cost’ s associated with loans outstanding was as follows:

2006 2005 2004

Interest expense $ 61,285 $ 62,706 $ 76,007

Capitalized interest (151) (186) (270)

Amortization of transaction costs 3,871 3,321 1,825

Interest (income) expense resulting from derivatives (1,655) 1,137 -

Write-off of transactions costs related to

early extinguishment of debt 14,384 - -

Fees on early extinguishment of debt 21,243 - -

Total AMERCO interest expense 98,977 66,978 77,562

SAC Holding II interest expense (a) 12,840 14,187 80,963

Less: Intercompany transactions (a) (6,709) (7,960) (36,835)

Total SAC Holding II interest expense (a) 6,131 6,227 44,128

Total $ 105,108 $ 73,205 $ 121,690

(a) Fiscal 2006 and 2005 contain only SAC Holding II Corporation, 2004 includes SAC Holding Corporation and its subsidiaries

Year ended March 31,

(In thousands)

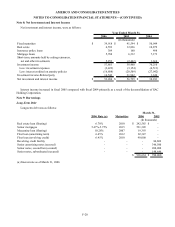

Interest paid in cash by AMERCO amounted to $59.8 million, $57.6 million and $76.6 million for fiscal 2006, 2005 and

2004, respectively. Early extinguishment fees paid in cash by AMERCO was $21.2 million in fiscal 2006.

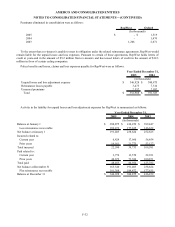

The exposure to market risk for changes in interest rates relates primarily to our variable rate debt obligations. We have

used interest rate swap and interest rate cap agreements to provide for matching the gain or loss recognition on the hedging

instrument with the recognition of the changes in the cash flows associated with the hedged asset or liability attributable to

the hedged risk or the earnings effect of the hedged forecasted transaction. On June 8, 2005 the Company entered into

separate interest rate swap contracts for $100.0 million of our variable rate debt over a three year term and for $100.0

million of our variable rate debt over a five year term, which were designated as cash flow hedges effective July 1, 2005.

On May 13, 2004 the Company entered into separate interest rate cap contracts for $200.0 million of our variable rate debt

over a two year term and for $50.0 million of our variable rate debt over a three year term, however these contracts were

designated as cash flow hedges effective July 11, 2005 when the Real Estate loan was paid down by $222.4 million. On

November 15, 2005 the Company entered into a forward starting interest rate swap contract for $142.3 million of a variable

rate debt over a six year term that started on May 10, 2006.

F-24