U-Haul 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Separately, in March 2004, SAC Holding Corporation restructured its indebtedness, triggering a similar

reassessment of SAC Holding Corporation that led to the conclusion that SAC Holding Corporation was not a VIE

and that AMERCO ceased to be the primary beneficiary of SAC Holding Corporation and its remaining subsidiaries.

This conclusion was based on SAC Holding Corporation’ s ability to fund its own operations and execute its business

plan without any future subordinated financial support.

Accordingly, at the dates AMERCO ceased to have a variable interest and ceased to be the primary beneficiary of

SAC Holding Corporation and its current or former subsidiaries, it deconsolidated those entities. The

deconsolidation was accounted for as a distribution of SAC Holding Corporations interests to the sole shareholder of

the SAC entities. Because of AMERCO’ s continuing involvement with SAC Holding Corporation and its current

and former subsidiaries, the distributions do not qualify as discontinued operations as defined by SFAS No. 144.

It is possible that SAC Holding Corporation could take actions that would require us to re-determine whether SAC

Holding Corporation has become a VIE or whether we have become the primary beneficiary of SAC Holding

Corporation. Should this occur, we could be required to consolidate some or all of SAC Holding Corporation with

our financial statements.

Similarly, SAC Holding II could take actions that would require us to re-determine whether it is a VIE or whether

we continue to be the primary beneficiary of our variable interest in SAC Holding II. Should we cease to be the

primary beneficiary, we would be required to deconsolidate some or all of our variable interest in SAC Holding II

from our financial statements.

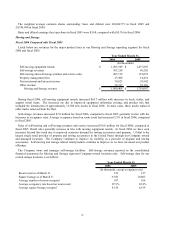

Recoverability of Property, Plant and Equipment

Property, plant and equipment are stated at cost. Interest cost incurred during the initial construction of buildings

and rental equipment is considered part of cost. Depreciation is computed for financial reporting purposes using the

straight-line or an accelerated method based on a declining balance formula over the following estimated useful

lives: rental equipment 2-20 years and buildings and non-rental equipment 3-55 years. Major overhauls to rental

equipment are capitalized and are amortized over the estimated period benefited. Routine maintenance costs are

charged to operating expense as they are incurred. Gains and losses on dispositions of property, plant and equipment

are netted against depreciation expense when realized. Depreciation is recognized in amounts expected to result in

the recovery of estimated residual values upon disposal, i.e., no gains or losses. During the first quarter of fiscal

2005, the Company lowered its estimates for residual values on new rental trucks and rental trucks purchased off

TRAC leases from 25% of the original cost to 20%. In determining the depreciation rate, historical disposal

experience, holding periods and trends in the market for vehicles are reviewed.

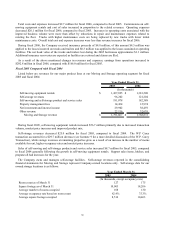

We regularly perform reviews to determine whether facts and circumstances exist which indicate that the carrying

amount of assets, including estimates of residual value, may not be recoverable or that the useful life of assets is

shorter or longer than originally estimated. Reductions in residual values (i.e., the price at which we ultimately

expect to dispose of revenue earning equipment) or useful lives will result in an increase in depreciation expense

over the life of the equipment. Reviews are performed based on vehicle class, generally subcategories of trucks and

trailers. We assess the recoverability of our assets by comparing the projected undiscounted net cash flows

associated with the related asset or group of assets over their estimated remaining lives against their respective

carrying amounts. We consider factors such as current and expected future market price trends on used vehicles and

the expected life of vehicles included in the fleet. Impairment, if any, is based on the excess of the carrying amount

over the fair value of those assets. If assets are determined to be recoverable, but the useful lives are shorter or

longer than originally estimated, the net book value of the assets is depreciated over the newly determined remaining

useful lives.

Fiscal 2006 marked the first time in ten years that the Company has acquired a significant number of new trucks

via purchase rather than lease. Management performed an analysis of the expected economic value of new rental

trucks and determined that additions to the fleet resulting from purchase should be depreciated on an accelerated

method based upon a declining formula. The salvage value and useful life assumptions of the rental truck fleet

remain unchanged.

21