U-Haul 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006

AMERCO

ANNUAL

REPORT

2006

AMERCO

ANNUAL

REPORT

Table of contents

-

Page 1

2006 2006 AMERCO AMERCO ANNUAL ANNUAL REPORT REPORT ® ® -

Page 2

Today, U-Haul has the largest ï¬,eet of moving vans in the industry. $1.5 Billion U-Move rental revenue -

Page 3

Over 11 Million Families Moved 16,000 U-Haul branded moving and storage outlets throughout North America Since 1945 -

Page 4

... part of our business. These increases have been driven by service improvements for our customer base. We continue with our eMove Storage Affiliate Program and at the same time are selectively building, buying and converting more self-storage room capacity. We must progress in service, affiliates... -

Page 5

... U.S. and Canada. Through a network of U-Haul Dealers, that vision became reality and the do-ityourself moving industry was born. Today, approximately 14,000 independent U-Haul Dealers generate 50 percent of the U-Move revenue for our company. U-Haul Dealers increase income and reduce customer cost... -

Page 6

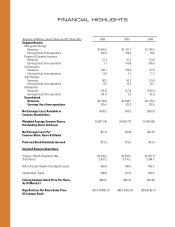

... & Diluted Preferred Stock Dividends Accrued Selected Balance Sheet Data: Property, Plant & Equipment, Net Total Assets Notes & Loans Payable Plus Capital Leases Stockholders' Equity Closing Common Stock Price Per Share As Of March 31 High And Low Per Share Sales Price Of Common Stock 2006 $1,900... -

Page 7

...Haul International, Inc. (A Nevada Corporation) 2727 N. Central Avenue Phoenix, Arizona 85004 Telephone (602) 263-6645 Securities registered pursuant to Section 12(b) of the Act: 86-0663060 Registrant AMERCO U-Haul International, Inc. Title of Class Series A 8 ½% Preferred Stock None Securities... -

Page 8

... REGISTERED PUBLIC ACCOUNTING FIRM Board of Directors and Stockholders AMERCO Reno, Nevada We have audited the accompanying consolidated balance sheets of AMERCO and consolidated entities (the "Company") as of March 31, 2006 and 2005 and the related consolidated statements of operations, changes in... -

Page 9

... balance sheets of SAC Holding II Corporation, a wholly-owned subsidiary of Blackwater Investments, Inc. (the "Company"), as of March 31, 2006 and 2005 and the related consolidated statements of operations, stockholder' s deficit, and cash flows for the years then ended. The financial statements... -

Page 10

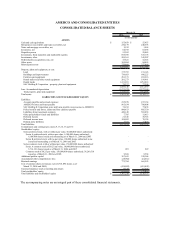

... improvements Furniture and equipment Rental trailers and other rental equipment Rental trucks SAC Holding II Corporation - property, plant and equipment Less: Accumulated depreciation Total property, plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Accounts payable... -

Page 11

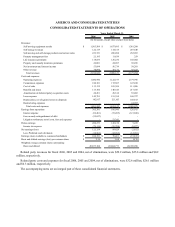

...-moving and self-storage products and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits and losses... -

Page 12

... investments Net loss Preferred stock dividends: Series A ($2.13 per share for fiscal 2004) Contribution from related party SAC Holding Corporation distribution Treasury stock transactions Release of unearned ESOP shares Net activity Balance as of March 31, 2004 Increase in market value of released... -

Page 13

... CONSOLIDATED STATEMENTS OF OTHER COMPREHENSIVE INCOME (LOSS) 2006 Comprehensive income (loss): Net earnings (loss) Other comprehensive income (loss) net of tax: Foreign currency translation Unrealized gain (loss) on investments, net Fair market value of cash flow hedges Total comprehensive income... -

Page 14

... and equipment Short term investments Fixed maturity investments Equity securities Preferred stock Real estate Mortgage loans Payments from notes and mortgage receivables Net cash provided (used) by investing activities Cash flow from financing activities: Borrowings from credit facilities Principal... -

Page 15

... The fiscal 2006 and fiscal 2005 consolidated financial statements include the accounts of AMERCO, its wholly-owned subsidiaries, and SAC Holding II Corporation and its subsidiaries ("SAC Holding II"). The fiscal 2004 statements of operations, comprehensive income, and cash flows include... -

Page 16

... Insurance, Life Insurance and SAC Holding II for fiscal 2006 and fiscal 2005 and SAC Holdings for fiscal 2004. Moving and Storage operations include AMERCO, U-Haul, and Real Estate and the wholly-owned subsidiaries of UHaul and Real Estate and consist of the rental of trucks and trailers, sales... -

Page 17

... available-for-sale, long-term investments, mortgage loans and notes on real estate, and interest rate cap and swap contracts are based on quoted market prices, dealer quotes or discounted cash flows. Fair values of trade receivables approximate their recorded value. Limited credit risk exists on... -

Page 18

... Company entered into a forward starting interest rate swap contract for $142.3 million of a variable rate debt over a six year term, that started on May 10, 2006, in conjunction with the expiration of the $200.0 million interest rate cap. The hedging relationship of the cap agreements is considered... -

Page 19

... held for retail sales Inventories consist primarily of truck and trailer parts and accessories used to manufacture and repair rental equipment as well as products and accessories available for retail sale. Inventory is held at Company-owned locations; our independent dealers do not hold any of the... -

Page 20

... estate, which is lower than market value at the balance sheet date, was $7.9 million and $9.0 million for fiscal 2006 and 2005, respectively, and is included in Investments, other. Receivables Accounts receivable include trade accounts from moving and self-storage customers and dealers, insurance... -

Page 21

... or credited to expense in the periods in which they are made. Self-Insurance Reserves U-Haul retains the risk for certain public liability and property damage programs related to the rental equipment. The consolidated balance sheets include $295.6 million and $249.1 million as of March 31, 2006 and... -

Page 22

...guidance on accounting by insurance enterprises for internal policy replacements other than the replacement of traditional life contracts with universallife contracts specifically addressed in FASB Statement of Financial Accounting Standards (SFAS) 97. The guidance applies to both short-duration and... -

Page 23

AMERCO AND CONSOLIDATED ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 5: Reinsurance Recoverables and Trade Receivables, Net Reinsurance recoverables and trade receivables, net were as follows: March 31, 2006 Reinsurance recoverable Paid losses recoverable Trade accounts ... -

Page 24

AMERCO AND CONSOLIDATED ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 7: Investments Held-to Maturity Investments Held-to maturity investments at December 31, 2005 were as follows: Estimated Gross Gross Market Amortized Unrealized Unrealized Value Losses Gains Cost (In ... -

Page 25

... preferred stocks Common stocks $ Gross Gross Unrealized Unrealized Losses Losses Gross Less than Unrealized More than 12 Months 12 Months Gains (In thousands) 1,840 $ 344 22 20,861 1,752 1,220 46 26,085 $ (28) $ (3,303) (1,931) (5,262) $ (56) $ (1,274) (169) (881) (2,380) $ Estimated Market Value... -

Page 26

... approximated the carrying value. These loans represent first lien mortgages held by the Company' s insurance subsidiaries. Real estate obtained through foreclosures and held for sale and equity investments are carried at the lower of cost or fair market value. Insurance policy loans are carried... -

Page 27

AMERCO AND CONSOLIDATED ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 8: Net Investment and Interest Income Net investment and interest income, were as follows: 2006 Fixed maturities Real estate Insurance policy loans Mortgage loans Short-term, amounts held by ceding ... -

Page 28

... of Combined Net Operating Income ("NOI"), as that term is defined in the Loan Agreement. The default provisions of the Real Estate Loan include non-payment of principal or interest and other standard reporting and change-in-control covenants. There are limited restrictions regarding our use of the... -

Page 29

...31, 2006 the Company had $60.0 million available under this revolving credit facility. The Revolving Credit Agreement requires monthly interest payments, with the unpaid loan balance and accrued unpaid interest due at maturity. The Revolving Credit Agreement is secured by various older rental trucks... -

Page 30

...to UH Storage (DE) Limited Partnership, an affiliate of W. P. Carey. U-Haul entered into a ten year operating lease with W. P. Carey (UH Storage DE) for a portion of each property (the portion of the property that relates to U-Haul' s truck and trailer rental and moving supply sales businesses). The... -

Page 31

... FINANCIAL STATEMENTS -- (CONTINUED) The property management agreement we entered into with Mercury provides that Mercury will pay U-Haul a management fee based on gross self-storage rental revenues generated by the properties. During fiscal 2006, U-Haul received $3.4 million in management fees... -

Page 32

... are not convertible into, or exchangeable for, shares of any other class or classes of stock of AMERCO. Dividends on the Series A preferred stock are payable quarterly in arrears and have priority as to dividends over the common stock of AMERCO. Note 12: Comprehensive Income (Loss) A summary of... -

Page 33

... TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 13: Provision for Taxes Income before taxes and the provision for taxes consisted of the following: 2006 Pretax earnings (loss): U.S. Non-U.S. Total pretax earnings Provision for taxes: Federal: Current Deferred State: Current Deferred Non... -

Page 34

... 31, 2006 and March 31, 2005, AMERCO has alternative minimum tax credit carry forwards of $0 and $17.8 million, respectively, which do not have an expiration date, and may only be utilized in years in which regular tax exceeds alternative minimum tax. SAC Holdings II began to file tax returns in the... -

Page 35

...Board of Directors, pursuant to the terms of the Profit Sharing Plan. No contributions were made to the profit sharing plan during fiscal 2006, 2005 or 2004. The Company also provides an employee savings plan which allows participants to defer income under Section 401(k) of the Internal Revenue Code... -

Page 36

... Retirement and Post Employment Benefits The Company provides medical and life insurance benefits to its eligible employees and their dependents upon retirement from the Company. The retirees must have attained age sixty-five and earned twenty years of full-time service upon retirement for coverage... -

Page 37

... FINANCIAL STATEMENTS -- (CONTINUED) If the estimated health care cost inflation rate assumptions were increased by one percent, the accumulated post retirement benefit obligation as of fiscal year-end would increase by approximately $272,973 and the total of the service cost and interest cost... -

Page 38

...for that portion of risks exceeding their retention limits. The maximum amount of life insurance retained on any one life is $150,000. Direct Amount (a) Year ended December 31, 2005 Life insurance in force $ Premiums earned: Life $ Accident and health Annuity Property and casualty Total $ Year ended... -

Page 39

... of these agreements, RepWest holds letters of credit at years-end in the amount of $5.2 million from re-insurers and has issued letters of credit in the amount of $12.3 million in favor of certain ceding companies. Policy benefits and losses, claims and loss expenses payable for RepWest were as... -

Page 40

... Company leases a portion of its rental equipment and certain of its facilities under operating leases with terms that expire at various dates substantially through 2034 with the exception of one land lease expiring in 2079. At March 31, 2006, AMERCO has guaranteed $193.1 million of residual values... -

Page 41

... storage tanks. Based upon the information currently available to Real Estate, compliance with the environmental laws and its share of the costs of investigation and cleanup of known hazardous waste sites are not expected to have a material adverse effect on AMERCO' s financial position or operating... -

Page 42

... by SAC Holdings. The Company currently manages the self-storage properties owned or leased by SAC Holdings, Mercury, 4 SAC, 5 SAC, Galaxy, and Private Mini Storage Realty ("Private Mini") pursuant to a standard form of management agreement, under which the Company receives a management fee of... -

Page 43

... value. The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.7 million in both fiscal 2006 and 2005. The terms of the leases are similar... -

Page 44

... in the Company' s books was eliminated at the time the support party obligation was terminated. Private Mini is now a wholly-owned subsidiary of 4 SAC and 5 SAC. In prior years, U-Haul sold various properties to SAC Holding Corporation at prices in excess of U-Haul' s carrying values resulting in... -

Page 45

AMERCO AND CONSOLIDATED ENTITIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Related Party Liabilities March 31, 2006 SAC Holding II Corporation payable to affiliate $ (In thousands) 7,165 $ 2005 11,070 F-38 -

Page 46

... shareholders by insurance companies domiciled in the State of Arizona is limited. Any dividend in excess of the limit requires prior regulatory approval. At December 31, 2005, Oxford cannot distribute any of its statutory surplus as dividends without regulatory approval. RepWest paid $27.0 million... -

Page 47

... Geographic Area Financial information by geographic area for fiscal 2006 is as follows: Year Ended March 31, 2006 Total revenues Depreciation and amortization, net of (gains) losses on disposal Interest expense Pretax earnings Income tax expense Identifiable assets United States Canada Consolidated... -

Page 48

... AMERCO has four reportable segments. They are Moving and Storage Operations, Property and Casualty Insurance, Life Insurance and SAC Holding II. Management tracks revenues separately, but does not report any separate measure of the profitability for rental vehicles, rentals of self-storage spaces... -

Page 49

... Storage Moving & Storage Consolidated AMERCO Legal Group Property & Casualty Insurance (a) AMERCO as Consolidated AMERCO U-Haul Real Estate Eliminations Life Insurance (a) Eliminations AMERCO Consolidated SAC Holding II Eliminations Total Consolidated (In thousands) Assets: Cash and cash... -

Page 50

... and loans payable SAC Holding II Corporation notes and loans payable, non-recourse to AMERCO Policy benefits and losses, claims and loss expenses payable Liabilities from investment contracts Other policyholders' funds and liabilities Deferred income Deferred income taxes Related party liabilities... -

Page 51

... Storage Moving & Storage Consolidated AMERCO Legal Group Property & Casualty Insurance (a) AMERCO as Consolidated AMERCO U-Haul Real Estate Eliminations Life Insurance (a) Eliminations AMERCO Consolidated SAC Holding II Eliminations Total Consolidated (In thousands) Assets: Cash and cash... -

Page 52

... and loans payable SAC Holding II Corporation notes and loans payable, non-recourse to AMERCO Policy benefits and losses, claims and loss expenses payable Liabilities from investment contracts Other policyholders' funds and liabilities Deferred income Deferred income taxes Related party liabilities... -

Page 53

... revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits... -

Page 54

... revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits... -

Page 55

... revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits... -

Page 56

... term investments Fixed maturity investments Equity securities Preferred stock Real estate Mortgage loans Payments from notes and mortgage receivables Net cash provided (used) by investing activities (a) Balance for the year ended December 31, 2005 U-Haul Elimination Elimination SAC Holding II... -

Page 57

... 31, 2006, are as follows: Moving & Storage Real Estate Moving & Storage Consolidated AMERCO Legal Group Property & Casualty Insurance (a) Life Insurance (a) AMERCO Consolidated AMERCO as Consolidated Total Consolidated AMERCO Cash flows from financing activities: Borrowings from credit facilities... -

Page 58

... term investments Fixed maturity investments Equity securities Preferred stock Real estate Mortgage loans Payments from notes and mortgage receivables Net cash provided (used) by investing activities (a) Balance for the year ended December 31, 2004 U-Haul Elimination Elimination SAC Holding II... -

Page 59

... on credit facilities Leveraged Employee Stock Ownership Plan - repayments from loan Payoff of capital leases Proceeds from (repayment of) intercompany loans Preferred stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities... -

Page 60

... maturity investments Equity securities Preferred stock Real estate Mortgage loans Payments from notes and mortgage receivables Net cash provided (used) by investing activities (a) Balance for the year ended December 31, 2003 U-Haul Elimination Elimination SAC Holdings Elimination $ (4,047... -

Page 61

... Real Estate Moving & Storage Consolidated AMERCO Legal Group Property & Casualty Insurance (a) Life Insurance (a) AMERCO Consolidated AMERCO as Consolidated Total Consolidated AMERCO Cash flows from financing activities: Borrowings from credit facilities Principal repayments on credit facilities... -

Page 62

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Note 22: Subsequent Events Preferred Stock Dividends On May 3, 2006, the Board of Directors of AMERCO, the holding Company for U-Haul International, Inc., and other companies, declared a regular quarterly cash dividend of $0.53125 per... -

Page 63

... of each month and received by U-Haul International, Inc. by the end of the month and U-Haul Center reports of rentals transacted through the last day of each month. Payments to fleet owners for trailers lost or retired from rental service as a result of damage by accident have not been reflected... -

Page 64

... borne by the Trailer Accident Fund follows: Fleet Owners Subsidiary U-Haul Companies Year ended: March 31, 2006 March 31, 2005 March 31, 2004 March 31, 2003 March 31, 2002 Trailer Accident Retirements Total Trailer Accident Repair Expenses Sub Subsidiary Total Companies Independent (In thousands... -

Page 65

SCHEDULE I CONDENSED FINANCIAL INFORMATION OF AMERCO BALANCE SHEETS March 31, 2006 (In thousands) ASSETS Cash Investment in subsidiaries and SAC Holding II Related party assets Other assets Total assets $ 7 $ (276,552) 1,219,703 4,309 947,467 14 1,221,423 452,350 19,107 1,692,894 2005 LIABILITIES ... -

Page 66

...expenses Other expenses Total expenses Equity in earnings of subsidiaries and SAC Holdings (a) Interest expense Fees on early extinguishment of debt Litigation settlement income, net of costs Pretax earnings (loss) Income tax benefit Net earnings (loss) Less: preferred stock dividends Earnings (loss... -

Page 67

CONDENSED FINANCIAL INFORMATION OF AMERCO STATEMENTS OF CASH FLOWS 2006 Cash flows from operating activities: Net earnings (loss) Change in investments in subsidiaries and SAC Holdings (a) Depreciation Write-off of unamortized debt issuance costs Deferred income taxes Net change in other operating ... -

Page 68

... of Significant Accounting Policies AMERCO, a Nevada corporation, was incorporated in April, 1969, and is the holding Company for U-Haul International, Inc., Amerco Real Estate Company, Republic Western Insurance Company and Oxford Life Insurance Company. The financial statements of the Registrant... -

Page 69

SCHEDULE II AMERCO AND CONSOLIDATED SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS Years Ended March 31, 2006, 2005 and 2004 Balance at Beginning of Year Year ended March 31, 2006 Allowance for doubtful accounts (deducted from trade receivable) Allowance for doubtful accounts (deducted from notes ... -

Page 70

SCHEDULE V AMERCO AND CONSOLIDATED SUBSIDIARIES SUPPLEMENTAL INFORMATION (FOR PROPERTY-CASUALTY INSURANCE UNDERWRITERS) Years Ended December 31, 2005, 2004 AND 2003 Year Reserves for Deferred Policy Unpaid Claims Acquisiton and Adjustment Affiliation with Registrant Cost Expenses Consolidated ... -

Page 71

... any and all capacities, to sign any and all amendments to this Form 10-K Annual Report, and to file the same, with all exhibits thereto and other documents in connection therewith with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to... -

Page 72

Signature Title Date /s/ M. FRANK LYONS Director June 8, 2006 M. Frank Lyons -

Page 73

... any and all capacities, to sign any and all amendments to this Form 10-K Annual Report, and to file the same, with all exhibits thereto and other documents in connection therewith with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to... -

Page 74

Signature Title Date /s/ ROBERT T. PETERSON Chief Financial Officer (U-Haul International, Inc.) June 8, 2006 Robert T. Peterson -

Page 75

... PUBLIC ACCOUNTING FIRM AMERCO Reno, NV We hereby consent to the incorporation by reference in the Registration Statement on Form S-3 (No. 333-10119, 33373357, 333-48396 and 33-56571) of AMERCO and its consolidated entities of our reports dated June 10, 2006, relating to the consolidated financial... -

Page 76

...) of AMERCO and consolidating entities of our report dated May 31, 2006, relating to the consolidated financial statements of SAC Holding II Corporation (a wholly-owned subsidiary of Blackwater Investments, Inc.) and its subsidiaries' consolidated in the Company' s Annual Report on Form 10-K for... -

Page 77

EXHIBIT 31.1 Rule 13a-14(a)/15d-14(a) Certification I, Edward J. Shoen, certify that: 1. 2. I have reviewed this annual report on Form 10-K of AMERCO and U-Haul International, Inc. (together, the "Registrants"); Based on my knowledge, this report does not contain any untrue statement of a material ... -

Page 78

...and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrants internal control over financial reporting. (b) /s/ Jason A. Berg Jason A. Berg Chief Accounting Officer of AMERCO Date: June 12, 2006 -

Page 79

...; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrants internal control over financial reporting. (b) /s/ Robert T. Peterson Robert T. Peterson Chief Financial Officer of U-Haul International, Inc. Date: June 12, 2006 -

Page 80

... ACT OF 2002 In connection with the Form 10-K for the year ended March 31, 2006 of AMERCO and U-Haul International, Inc. (together, the "Company"), as filed with the Securities and Exchange Commission on June 12, 2006 (the "Report"), I, Edward J. Shoen, Chairman of the Board and President of the... -

Page 81

... Securities Exchange Act of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. AMERCO, a Nevada corporation /s/ Jason A. Berg Jason A. Berg Chief Accounting Officer Date: June 12, 2006 -

Page 82

... ACT OF 2002 In connection with the Form 10-K for the year ended March 31, 2006 of U-Haul International, Inc. (the "Company"), as filed with the Securities and Exchange Commission on June 12, 2006 (the "Report"), I, Robert T. Peterson, Chief Financial Officer of the Company, certify, pursuant to... -

Page 83

... the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes 5 No Â... 21,284,604 shares of AMERCO Common Stock, $0.25 par value were outstanding at June 1, 2006. 5,385 shares of U-Haul International, Inc. Common Stock, $0.01 par value, were... -

Page 84

...Directors and Executive Officers of the Registrants ...Executive Compensation...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions ...Principal Accountant Fees and Services ...PART IV Exhibits and Financial... -

Page 85

... retail centers, through which we rent our trucks and trailers and sell moving and self-storage products and services to complement our independent dealer network. AMERCO and U-Haul are each incorporated in Nevada. U-Haul' s Internet address is www.uhaul.com. On AMERCO' s investor relations web site... -

Page 86

...93,000 trucks, 80,675 trailers and 33,500 tow devices. This equipment and our U-Haul brand of self-moving products and services are available through our network of managed retail moving centers and independent U-Haul dealers. Independent U-Haul dealers receive rental equipment from the Company, act... -

Page 87

... needs. Description of Operating Segments AMERCO has four reportable segments. They are Moving and Storage Operations (AMERCO, U-Haul and Real Estate), Property and Casualty Insurance, Life Insurance and SAC Holding II Corporation and its subsidiaries ("SAC Holding II") for fiscal 2006 and fiscal... -

Page 88

...-storage facilities to expand their reach by connecting into a centralized 1-800 and internet reservation system and for a fee, receive an array of services including web-based management software, Secured Online Affiliated Rentals (S.O.A.R®), co-branded rental trucks, savings on insurance, credit... -

Page 89

... eMove web site. A significant driver of U-Haul' s rental transaction volume is our utilization of an online reservation and sales system, through www.uhaul.com, www.eMove.com and our 24-hour 1-800-GO-U-HAUL telephone reservations system. The Company' s 1-800-GO-U-HAUL telephone reservation line is... -

Page 90

... locations, availability of quality rental moving equipment, breadth of essential products and services, and price. Our major competitors in the moving equipment rental market are Budget Car and Truck Rental Company and Penske Truck Leasing. The self-storage market is large and highly fragmented... -

Page 91

... financial information that is provided to stockholders and others, the independence and performance of the Company' s independent registered public accounting firm and internal audit department and the systems of internal control established by management and the Board. The Audit Committee operates... -

Page 92

... Dallas General Life Insurance Company, a Texas-based insurer that primarily distributes Medicare supplement insurance. The purchase price was $4.5 million and was effective February 28, 2006. Mezzanine Loan Various subsidiaries of Amerco Real Estate Company and U-Haul International, Inc. are... -

Page 93

... and strategies; plans for new business; growth rate assumptions, pricing, costs, and access to capital and leasing markets as well as assumptions relating to the foregoing. The words "believe", "expect", "anticipate", "estimate", "project" and similar expressions identify forward-looking statements... -

Page 94

... operations for an indefinite period of time or we may not be able to obtain rental trucks under similar terms, if at all. Our property and casualty insurance business has suffered extensive losses. Between January 1, 2000 and December 31, 2004, RepWest, reported pretax losses totaling approximately... -

Page 95

..., repair and rental of U-Haul equipment and storage space as well as providing office space for the Company. Such facilities exist throughout the United States and Canada. The Company also manages storage facilities owned by others. The Company operates over 1,450 U-Haul retail centers, and operates... -

Page 96

...F. Shoen filed a derivative action in the Second Judicial District Court of the State of Nevada, Washoe County, captioned Paul F. Shoen vs. SAC Holding Corporation et al., CV02-05602, seeking damages and equitable relief on behalf of AMERCO from SAC Holdings and certain current and former members of... -

Page 97

... stock. AMERCO' s common stock is listed on NASDAQ (its principal market) under the trading symbol "UHAL". The number of shareholders' is derived using internal stock ledgers and utilizing Mellon Investor Services Stockholder listings. The following table sets forth the high and the low sales price... -

Page 98

... January 1, 2006, U-Haul paid a non-cash dividend to AMERCO in the form of a reduction in an intercompany payable. See Note 20 of Notes to Consolidated Financial Statements for a discussion of certain statutory restrictions on the ability of the insurance subsidiaries to pay dividends to AMERCO. See... -

Page 99

...and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Operating expenses Commission expenses Cost of sales Benefits and losses Amortization of deferred policy acquisition costs Lease... -

Page 100

... 31, 2006 Summary of Operations: Self-moving equipment rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Net investment and interest income Other revenue Total revenues Operating expenses Commission expenses Cost of sales Lease expense... -

Page 101

... more on its core senior population demographic. Description of Operating Segments AMERCO has four reportable segments. They are Moving and Storage Operations (AMERCO, U-Haul and Real Estate), Property and Casualty Insurance, Life Insurance and SAC Holding II for fiscal 2006 and fiscal 2005 and SAC... -

Page 102

... a fee receive an array of services including web-based management software, Secured Online Affiliated Rentals (S.O.A.R®), co-branded rental trucks, savings on insurance, credit card processing and more. Approximately 2,700 independent self-storage facilities are now registered on the eMove network... -

Page 103

... The fiscal 2006 and fiscal 2005 consolidated financial statements include the accounts of AMERCO, its whollyowned subsidiaries, and SAC Holding II. The 2004 statements of operations, comprehensive income, and cash flows include all of those entities plus SAC Holding Corporation and its subsidiaries... -

Page 104

... residual values (i.e., the price at which we ultimately expect to dispose of revenue earning equipment) or useful lives will result in an increase in depreciation expense over the life of the equipment. Reviews are performed based on vehicle class, generally subcategories of trucks and trailers. We... -

Page 105

... intent to hold the security, quoted market prices, dealer quotes or discounted cash flows, industry factors, financial factors, and issuer specific information. Other-than-temporary impairment in value is recognized in the current period operating results. Income Taxes The Company records deferred... -

Page 106

... for internal policy replacements other than the replacement of traditional life contracts with universal-life contracts specifically addressed in FASB Statement of Financial Accounting Standards (SFAS) 97. The guidance applies to both short-duration and long-duration insurance contracts under... -

Page 107

...service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Consolidated revenue $ $ During fiscal 2006, self-moving equipment rentals increased $65.7 million with increases in truck, trailer, and support... -

Page 108

... sustained at operating facilities. The net book value of the trucks and trailers lost during the 2005 hurricanes approximates $1.1 million. Additional insurance recoveries are expected as facilities are fully restored and claims are filed. As a result of the aforementioned changes in revenues and... -

Page 109

...the third quarter of fiscal 2005, the Company settled our litigation against our former auditor and received a settlement (net of attorneys' fees and costs) of $51.3 million before taxes. The settlement had the effect of increasing, on a nonrecurring basis, earnings for the year ended March 31, 2005... -

Page 110

...-storage revenues Self-moving and self-storage product and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Consolidated revenue $ $ During fiscal 2005, self-moving equipment rentals increased... -

Page 111

... of SAC Holding Corporation, lower borrowings and a lower cost of borrowing. During fiscal 2005, the Company settled its litigation against its former auditor and received a settlement (net of attorneys' fees and costs) of $51.3 million before taxes. The settlement had the effect of increasing, on... -

Page 112

... management fees Net investment and interest income Other revenue Moving and Storage revenue $ $ During fiscal 2006, self-moving equipment rentals increased $65.7 million with increases in truck, trailer, and support rental items. The increases are due to improved equipment utilization, pricing... -

Page 113

... net book value of the trucks and trailers lost during the 2005 hurricanes approximates $1.1 million. Additional insurance recoveries are expected as facilities are restored and claims are filed. As a result of the above mentioned changes in revenues and expenses, earnings from operations increased... -

Page 114

...-storage product and service sales Property management fees Net investment and interest income Other revenue U-Haul International, Inc. revenue $ $ During fiscal 2006, self-moving equipment rentals increased $65.7 million with increases in truck, trailer, and support rental items. The increases... -

Page 115

...-storage product and service sales Property management fees Net investment and interest income Other revenue U-Haul International, Inc. revenue $ $ During fiscal 2005, self-moving equipment rentals increased $56.9 million with increases in truck, trailer, and support rental items. The increases... -

Page 116

... 2003, respectively. The decrease was a result of RepWest being under DOI supervision and the "C" rating by A.M. Best. Premium revenues on non U-Haul lines of business were $6.1 million and $69.6 million for 2004 and 2003, respectively. Net investment income was $16.4 million and $21.7 million for... -

Page 117

...expenses. The first line represents reserves as originally reported at the end of the stated year. The second section, reading down, represents cumulative amounts paid as of the end of successive years with respect to that reserve. The third section, reading down, represents revised estimates of the... -

Page 118

Activity in the liability for unpaid losses and loss adjustment expenses for RepWest is summarized as...balance at January 1 Incurred related to: Current year Prior years Total incurred Paid related to: Current year Prior years Total paid Net balance at December 31 Plus: reinsurance recoverable Balance... -

Page 119

... written on active lines. Credit insurance premiums decreased $6.9 million from 2003 due to fewer accounts resulting from the rating downgrade by A.M. Best. Life, other health, and annuity premiums decreased $5.0 million from 2003 primarily from reduced life insurance sales and fewer annuitizations... -

Page 120

... and credit insurance segments. SAC Holding II Fiscal 2006 Compared with Fiscal 2005 Listed below are revenues for the major product lines at SAC Holding II for fiscal 2006 and fiscal 2005: Self-moving equipment rentals Self-storage revenues Self-moving and self-storage product and service sales... -

Page 121

... and Storage segment experienced increased operating cash flows as collected revenues outpaced increased total costs and expenses. Operating cash flows from the insurance companies declined from fiscal 2005 as business volume declined. Net cash used in investing activities increased in fiscal 2006... -

Page 122

...U-Haul estimates that during the next three fiscal years, at least $340.0 million each year will be reinvested in the truck and trailer rental fleet. This investment will be funded through external lease financing, debt financing and internally from operations and sales of used equipment. Management... -

Page 123

...utilize revolving lines of credit to finance its operations or acquisitions. Certain of SAC Holding II loan agreements contain restrictive covenants and restrictions on incurring additional subsidiary indebtedness. Cash Provided from Operating Activities by Operating Segments Moving and Self-Storage... -

Page 124

... of our rental fleet, rental equipment and storage space, working capital requirements and our preferred stock dividend program. For a more detailed discussion of our long-term debt and borrowing capacity, please see footnote 9 "Borrowings" to the "Notes to the Consolidated Financial Statements... -

Page 125

...contracts. The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.7 million in both fiscal 2006 and 2005. The terms of the leases are similar... -

Page 126

...mid-size rental trucks and expect to produce approximately 15,000 additional vehicles and 4,200 additional trailers during the next year. This investment is expected to increase the number of rentable equipment days available to meet our customer demands and to reduce future spending on repair costs... -

Page 127

... financial statements for the eight quarters beginning April 1, 2004 and ending March 31, 2006. The Company ...accounting principles, such results. Moving and Storage operations are seasonal and proportionally more of the Company' s revenues and net earnings from its Moving and Storage operations... -

Page 128

... investment portfolio' s expose the Company to interest rate risk. This interest rate risk is the price sensitivity of a fixed income security to change in interest rates. As part of our insurance companies' asset and liability management, actuaries estimate the cash flow patterns of our existing... -

Page 129

...fiscal year. We reviewed the results of management's assessment with the Audit Committee of our Board of Directors. Our independent registered public accounting firm, BDO Seidman, LLP, has audited management's assessment of the Company's internal control over financial reporting and has issued their... -

Page 130

... of new rental trucks. The credit facility is secured by a portion of the Company' s new truck rental fleet. The above discussion is merely a description of select terms of the agreements and is qualified in its entirety by reference to our agreements with BTMU Capital Corporation filed as Exhibits... -

Page 131

... is to express an opinion on management's assessment and an opinion on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those... -

Page 132

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of the Company as of March 31, 2006 and 2005 and the related consolidated statements of operations, changes in stockholders' equity, other comprehensive income / (loss), and cash flows for each... -

Page 133

... to all directors, officers and employees of the Company, including the Company' s principal executive officer, principal financial officer and principal accounting officer. A copy of our Code of Ethics has been filed as an exhibit hereto, and is posted on the AMERCO Investor Relations home page at... -

Page 134

..., and Reports on Form 8-K (a) The following documents are filed as part of this Report: Page No. 1. Financial Statements: Report of Independent Registered Public Accounting Firm Independent Auditors' Report Consolidated Balance Sheets - March 31, 2006 and 2005 Consolidated Statements of Operations... -

Page 135

... Holding Corporation, SAC Holding II Corporation, AMERCO, U-Haul International, Inc., and Law Debenture Trust Company of New York U-Haul Dealership Contract 10.1A* 10.3 10.5 Incorporated by reference to AMERCO' s Annual Report on Form 10-K for the year end March 31, 1993, file no. 111255 Rights... -

Page 136

...subsidiaries of AMERCO Management Agreement between Sixteen SAC Self-Storage Corporation and subsidiaries of AMERCO Management Agreement between Seventeen SAC Self-Storage Corporation and subsidiaries of AMERCO Page or Method of Filing Incorporated by reference to AMERCO' s Annual Report on Form 10... -

Page 137

... U-Haul Management Agreement between Twenty-Seven SAC Self-Storage Limited Partnership and U-Haul Promissory Note between SAC Holding Corporation and Oxford Life Insurance Company Amendment and Addendum to Promissory Note between SAC Holding Corporation and Oxford Life Insurance Company Fixed Rate... -

Page 138

... to AMERCO' s Current Report on Form 8-K, filed on May 13, 2005, file no. 1-11255 10.51 Property Management Agreements among ThreeA through Three-D SAC Self-Storage Limited Partnership and the subsidiaries of U-Haul International, Inc. U-Haul Dealership Contract between U-Haul Leasing & Sales Co... -

Page 139

...Inc. in favor of Merrill Lynch Commercial Finance Corporation. Guarantee, dated June 28, 2005, made by U-Haul International, Inc. in favor of Merrill Lynch Commercial Finance Corporation. Page or Method of Filing Incorporated by reference to AMERCO' s Current Report on Form 8-K, filed June 14, 2005... -

Page 140

...., U-Haul Leasing and Sales Co., U-Haul Co. of Arizona, BTMU Capital Corporation, and Orange Truck Trust 2006 Guarantee executed June 7, 2006, made by U-Haul International, Inc. and AMERCO in favor of BTMU Capital Corp. and Orange Truck Trust 2006. First Amendment to Security Agreement (Aged Truck... -

Page 141

... UHaul Leasing and Sales Co., U-Haul Co. of Arizona, and U-Haul International, Inc. in favor of HVB Guarantee dated June 6, 2006, made by U-Haul International, Inc. in favor of HVB Code of Ethics Subsidiaries of AMERCO Consent of BDO Seidman, LLP Consent of Semple & Cooper (re: SAC Holding II) Power... -

Page 142

...under the name "U-Haul Trailer Rental Company." The Company is primarily engaged in the short-term rental of trucks, trailers and related equipment to the do-it-yourself mover. The Company also sells related moving products and services, and rents self-storage facilities and general rental items. In... -

Page 143

... President of Oxford Life Insurance Company Gary B. Horton 62, Treasurer of AMERCO and Assistant Treasurer of U-Haul Robert T. Peterson 55, Chief Financial Officer of U-Haul Mark V. Shoen 55, Chief of U-Haul Phoenix Operations John C. Taylor 48, Director and Executive VP of U-Haul Carlos Vizcarra 59... -

Page 144

Over฀16,000฀U-Haul฀owned,฀managed and฀dealer-afï¬ à¸€liated฀locations฀log฀on to฀the฀U-Haul฀network฀to฀open฀and conduct฀their฀daily฀operations Approximately฀10,000฀customers฀call฀our฀1-800-GO-UHAUL National฀Sales฀and฀Reservations฀Call฀Center -

Page 145

Tens฀of฀thousands฀of฀customers฀access uhaul.com฀to฀make฀equipment฀and฀storage reservations,฀purchase฀boxes฀and฀packing฀ supplies,฀andà¸€ï¬ à¸€nd฀a฀U-Haul฀location Every฀ Day. -

Page 146

® ® ® ® TM ® INTERNATIONAL INTERNATIONAL ® ® ® LIFE INSURANCE COMPANY LIFE INSURANCE COMPANY TM