Tyson Foods 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Tyson Foods, Inc.

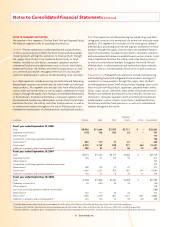

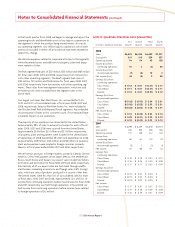

Notes to Consolidated Financial Statements (continued)

We currently have pending eleven separate wage and hour actions

involving TFM’s plants located in Lexington, Nebraska (Lopez, et al.

v. Tyson Foods, Inc., District of Nebraska, June 30, 2006), Garden City

and Emporia, Kansas (Garcia, et al. v. Tyson Foods, Inc., Tyson Fresh

Meats, Inc., District of Kansas, May 15, 2006), Storm Lake, Iowa (Sharp,

et al. v. Tyson Foods, Inc., N.D. Iowa, February 6, 2007), Columbus

Junction, Iowa (Robinson, et al. v. Tyson Foods, Inc., d/b/a Tyson Fresh

Meats, Inc., S.D. Iowa, September 12, 2007), Joslin, Illinois (Murray,

et al. v. Tyson Foods, Inc., C.D. Illinois, January 2, 2008), Dakota City,

Nebraska (Gomez, et al. v. Tyson Foods, Inc., District of Nebraska,

January 16, 2008), Madison, Nebraska (Acosta, et al. v Tyson Foods, Inc.

d.b.a. Tyson Fresh Meats, Inc., District of Nebraska, February 29, 2008),

Perry and Waterloo, Iowa (Edwards, et al. v. Tyson Foods, Inc. d.b.a.

Tyson Fresh Meats, Inc., S.D. Iowa, March 20, 2008); Council Bluffs,

Iowa (Salazar, et al. v. Tyson Foods, Inc. d.b.a. Tyson Fresh Meats, Inc.,

S.D. Iowa, April 29, 2008); and Logansport, Indiana (Carter, et al. v.

Tyson Foods, Inc. and Tyson Fresh Meats, Inc., N.D. Indiana, April 29,

2008); and Goodlettsville, Tennessee (Cunningham v. Tyson Fresh

Meats, Inc., M.D. Tennessee, May 22, 2008). With the exception of

Cunningham, the actions allege TFM failed to pay employees for

all hours worked, including overtime compensation for the time it

takes to change into protective work uniforms, safety equipment and

other sanitary and protective clothing worn by employees, and for

walking to and from the changing area, work areas and break areas in

violation of the Fair Labor Standards Act and analogous state laws.

The plaintiffs seek back wages, liquidated damages, pre- and post-

judgment interest, attorneys’ fees and costs. Cunningham alleges TFM

failed to pay quality assurance technicians overtime compensation

for all hours worked in excess of forty hours in each work week. TFM

fi led a motion for partial summary judgment in Garcia, based upon

an injunction entered in Reich v. IBP, which outlined the types of

activities at issue here that are compensable. The District Court of

Kansas denied the motion, and TFM appealed to the Tenth Circuit

Court of Appeals, arguing that the District Court’s ruling had the

effect of improperly modifying the injunction. On July 23, 2008,

Tyson fi led a motion to transfer the eleven actions to the District of

Kansas for consolidated pretrial proceedings. On October 9, 2008,

the motion to transfer was denied by the Judicial Panel on Multi-

district Litigation. The effect of this order will be that the stays

previously entered in the individual actions will be lifted and each

case will resume.

On November 21, 2002, 10 current and former hourly employees of

a TFM case-ready facility in Goodlettsville, Tennessee, fi led a puta-

tive class action lawsuit styled Emily D. Jordan, et al. v. IBP, inc. and

Tyson Foods, Inc. in the U.S. District Court for the Middle District of

Tennessee against us claiming violations of the overtime provisions

of the Fair Labor Standards Act by failing to pay employees for all

hours worked. The suit further alleges employees should be paid for

the time it takes to collect, assemble and put on, take off and wash

their health, safety and production gear at the beginning and end of

their shifts and during their meal period. Finally, the suit alleges we

deduct 30 minutes per day from employees’ paychecks regardless of

whether employees use a full 30-minute period for their meal. The

plaintiffs seek a declaration that the defendants did not comply with

the Fair Labor Standards Act, and an award for an unspecifi ed amount

of back pay compensation and benefi ts, unpaid entitlements, liqui-

dated damages, prejudgment and post-judgment interest, attorney

fees and costs. On November 17, 2003, the District Court condition-

ally certifi ed a collective action based on clothes changing and

washing activities and unpaid production work during meal periods,

since the plant operations began in April 2001. Approximately 650

current and former employees have opted into the class. On

August 20, 2007, both parties fi led motions for summary judgment.

The court granted in part and denied in part the parties’ motions

for partial summary judgment on March 13, 2008. A jury trial was set

to begin on September 16, 2008, but the parties resolved the litiga-

tion. On September 25, 2008, the court entered an agreed order of

dismissal with prejudice and approved the confi dential settlement

agreement of the parties.

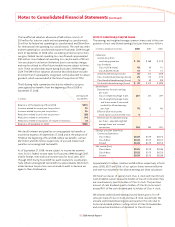

NOTE 22: SUBSEQUENT EVENTS

In October 2008, Dynamic Fuels received $100 million in Gulf

Opportunity Zone tax-exempt bonds made available by the Federal

government to the regions affected by Hurricanes Katrina and Rita

in 2005. These fl oating rate bonds are due October 1, 2033, and have

an initial interest rate of 1.3%. We issued a letter of credit as a guar-

antee for the entire bond issuance. In exchange for our guarantee,

Syntroleum Corporation, the other 50 percent investor in Dynamic

Fuels, issued to us eight million Syntroleum stock warrants with an

exercise price of $0.01 per share.

In October 2008, we completed the acquisition of three vertically

integrated poultry companies in southern Brazil. The purchase price

was $80 million, as well as up to an additional $15 million of contin-

gent purchase price based on production volumes payable through

fi scal 2010. These transactions include the acquisitions of Macedo

Agroindustrial, Avicola Itaiopolis and Frangobras. Combined, we

expect these companies will have sales of $150 – $175 million in

fi scal 2009.