Tyson Foods 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Tyson Foods, Inc.

Notes to Consolidated Financial Statements (continued)

Cash fl ow hedges: Derivative products, such as futures and options,

are designated as hedges against changes in the amount of future

cash fl ows related to commodities procurement. We do not purchase

derivative products related to grain procurement in excess of our

physical grain consumption requirements. Related to our grain hedges,

there were $5 million of net losses recorded in accumulated other

comprehensive income at September 27, 2008. These losses will be

recognized within the next 12 months. Of these losses, the portion

resulting from our open hedge positions was a net loss of $4 million

as of September 27, 2008. Ineffectiveness related to our cash fl ow

hedges was not signifi cant during fi scal 2008, 2007 or 2006.

Fair value hedges: We designate certain futures contracts as fair value

hedges of fi rm commitments to purchase livestock for slaughter.

Changes in the fair value of a derivative that is designated and quali-

fi es as a fair value hedge, along with changes in fair value of the

hedged asset or liability attributable to the hedged risk (including

gains or losses on fi rm commitments), are recorded in current period

earnings. Ineffectiveness results when the change in the fair value

of the hedge instrument differs from the change in fair value of the

hedged item. Ineffectiveness related to fair value hedges was not

signifi cant during fi scal 2008, 2007 and 2006.

During fi scal 2006, we discontinued the use of hedge accounting

for certain fi nancial instruments to hedge forward cattle purchases.

Hedge accounting was discontinued to provide a natural offset to the

gains and losses resulting from our derivatives tied to forward fi xed

price sales of boxed beef, as this activity does not qualify for hedge

accounting. The contracts for which hedge accounting was discontin-

ued had a fair value of approximately $28 million at the discontinued

date, and was primarily recognized as a component of cost of sales

in fi scal 2006. However, due to changes in our beef market strategies

and business conditions, we now have more forward cattle purchase

derivatives relative to fi xed forward boxed beef sales derivatives which

can and have caused mark-to-market earnings volatility. Accordingly,

effective in the fourth quarter fi scal 2008, we began designating

certain futures contracts as fair value hedges of forward cattle

purchases. We anticipate this change will help reduce volatility

of quarterly reported beef earnings.

Undesignated positions: We hold positions as part of our risk

management activities, primarily futures and options for grains

and livestock, for which we do not apply hedge accounting, but

instead mark these positions to fair value through earnings at each

reporting date. We generally do not enter into undesignated posi-

tions beyond 18 months. Related to grain positions for which we

did not apply hedge accounting, we recognized pretax net gains of

approximately $169 million, $50 million and $8 million, respectively,

in cost of sales for fi scal 2008, 2007 and 2006, which included an

unrealized pretax loss on open mark-to-market futures positions

of $4 million as of September 27, 2008.

We enter into certain forward sales of boxed beef and boxed pork

and forward purchases of cattle at fi xed prices. The fi xed price sales

contracts lock in the proceeds from a sale in the future and the fi xed

cattle purchases lock in the cost. However, the cost of the livestock

and the related boxed beef and boxed pork market prices at the time

of the sale or purchase could vary from this fi xed price. As we enter

into fi xed forward sales of boxed beef and boxed pork and forward

purchases of cattle, we also enter into the appropriate number of

livestock futures positions to mitigate a portion of this risk. Changes

in market value of the open livestock futures positions are marked to

market and reported in earnings at each reporting date, even though

the economic impact of our fi xed prices being above or below the

market price is only realized at the time of sale or purchase. In con-

nection with these livestock futures, we recorded realized and

unrealized net gains of $83 million in fi scal 2008, which included

an unrealized pretax gain on open mark-to-market futures positions

of approximately $3 million as of September 27, 2008. We recorded

realized and unrealized net gains of $14 million and realized and

unrealized net losses of $39 million in fi scal 2007 and 2006, respec-

tively, related to livestock futures positions.

Additionally, we enter into grain derivatives to manage the risk of

costs associated with forward sales to certain customers for which

sales prices are determined under cost-plus arrangements. These

unrealized positions, which do not qualify for hedge treatment,

totaled a loss of $24 million and a gain of $9 million at September 27,

2008, and September 29, 2007, respectively. When these positions

are liquidated, we expect any realized gains or losses will be refl ected

in the prices of the poultry products sold. Since these derivative

positions do not qualify for hedge treatment, they initially create

volatility in our income statement associated with mark-to-market

changes. However, once the positions are liquidated and included

in the sales price to the customer, there is ultimately no income

statement impact as any previous mark-to-market gains or losses

are included in the prices of the poultry products.

Foreign currency positions: We enter into foreign currency forward

contracts to manage the risk from changes in the fair value or future

cash fl ows of receivables, payables and purchase commitments arising

from changes in the exchange rates of foreign currencies. We have

not applied hedge accounting to these contracts. The fair value

of the foreign exchange contracts was not signifi cant as of

September 27, 2008, and September 29, 2007.

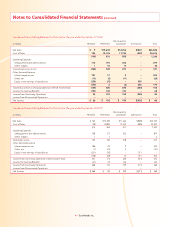

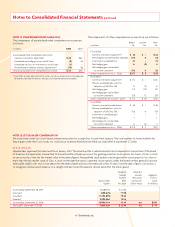

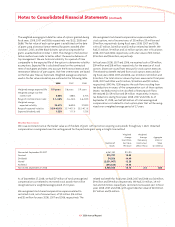

Fair Values of Financial Instruments:

in millions 2008 2007

Commodity derivative positions, net liability $ 16 $ 32

Total debt 2,659 2,927