Tyson Foods 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21 2008 Annual Report

Management’s Discussion and Analysis (continued)

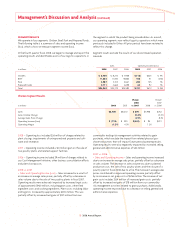

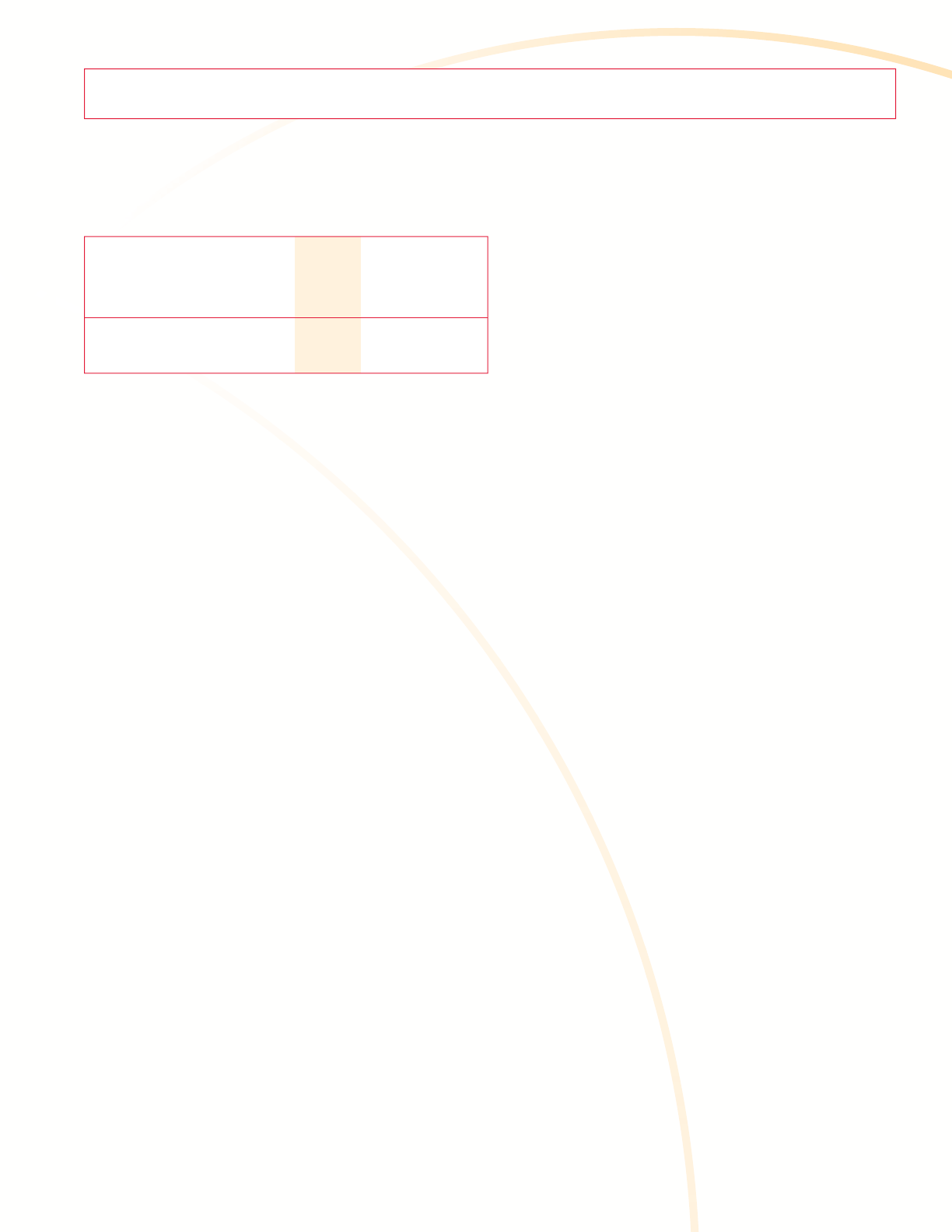

Capitalization

in millions 2008 2007 2006

Senior notes $2,400 $2,475 $3,388

3.25% Convertible senior notes 458 – –

Lakeside term loan – 25 345

Other indebtedness 38 279 246

Total Debt $2,896 $2,779 $3,979

Total Equity $5,014 $4,731 $4,440

Debt to Capitalization Ratio 36.6% 37.0% 47.3%

• In fi scal 2008, we issued $458 million of 3.25% Convertible Senior

Notes due October 15, 2013. Net proceeds were used for the net cost

of the Convertible Note Hedge and Warrant Transactions, toward the

repayment of our borrowings under the accounts receivable securiti-

zation facility, and for other general corporate purposes.

• In fi scal 2008, we issued 22.4 million shares of Class A stock in a

public offering. Net proceeds were used toward repayment of our

borrowings under the accounts receivable securitization facility and

for other general corporate purposes.

• At September 30, 2006, we had $750 million in a short-term invest-

ment held on deposit with a trustee. Proceeds from sale of short-

term investment were used to repay the $750 million 7.25% Notes

due October 1, 2006. This repayment was made in fi scal 2007. When

adjusted for the $750 million short-term investment held on deposit,

total debt would have been $3.2 billion, with a debt to capitalization

ratio of 42.1%.

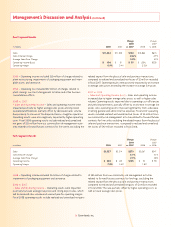

Credit Ratings

2016 Notes On July 24, 2006, Moody’s Investors Services, Inc.

(Moody’s) downgraded the credit rating from “Baa3” to “Ba1.” This

downgrade increased the interest rate on the 2016 Notes from

6.60% to 6.85%, effective on the fi rst day of the interest period

during which the rating change required an adjustment to the

interest rate (i.e., the issuance of the 2016 Notes). Additionally, on

July 31, 2006, Standard & Poor’s (S&P) downgraded the credit rating

from “BBB” to “BBB–.” This downgrade did not change the interest

rate on the 2016 Notes.

On September 4, 2008, S&P downgraded the credit rating from

“BBB–” to “BB.” This downgrade increased the interest rate on the

2016 Notes from 6.85% to 7.35%, effective beginning with the six

month interest payment due October 1, 2008.

On November 13, 2008, Moody’s downgraded the credit rating from

“Ba1” to “Ba3.” This downgrade increased the interest rate on the 2016

Notes from 7.35% to 7.85%, effective beginning with the six month

interest payment due April 1, 2009.

S&P currently rates the 2016 Notes “BB.” Moody’s currently rates this

debt “Ba3.” A further one-notch downgrade by either ratings agency

would increase the interest rates on the 2016 Notes by an additional

0.25% per ratings agency.

Revolving Credit Facility Rating After an upgrade on October 1, 2008,

S&P’s credit rating for the revolving credit facility is “BBB–.” After a

downgrade on November 13, 2008, Moody’s credit rating is “Ba2.”

The pretax impact to earnings of another downgrade would not be

material to annual interest expense. However, if Moody’s were to

downgrade this facility to “Ba3” or below, or if S&P were to down-

grade this facility to “BB–” or below, then the banks participating in

our accounts receivable securitization facility could refuse to pur-

chase any additional receivables from us and the accounts receivable

securitization facility could unwind with any amounts outstand-

ing under the facility repaid as the receivables owned by Tyson

Receivables Company, our wholly-owned consolidated special

purpose entity, are collected.

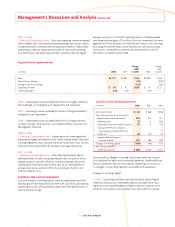

Debt Covenants

Our debt agreements contain various covenants, the most restrictive

of which contain maximum allowed leverage ratios and a minimum

required interest coverage ratio. On September 10, 2008, we amended

our revolving credit facility agreement to provide a less restrictive

maximum allowed leverage ratio, which takes effect in fi rst quarter

of fi scal 2009. All trademarks of our domestic subsidiaries are

pledged as collateral under the revolving credit facility. Additionally,

certain domestic subsidiaries guaranteed this facility and pledged

inventory as collateral. We were in compliance with all covenants

at September 27, 2008.

Based on the current industry outlook and our internal forecasts,

we anticipate we will be in compliance with our debt covenants

throughout fi scal 2009. However, our Chicken segment in the fi rst

part of fi scal 2009 will be negatively impacted by diffi cult export

markets and long grain positions that could negatively impact our

covenant compliance.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements material to

our fi nancial position or results of operations. The off-balance sheet

arrangements we have are guarantees of debt of outside third parties,

including a lease and grower loans, and residual value guarantees

covering certain operating leases for various types of equipment.

See Note 9, “Commitments” of the Notes to Consolidated Financial

Statements for further discussion.