Tyson Foods 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Tyson Foods, Inc.

Notes to Consolidated Financial Statements (continued)

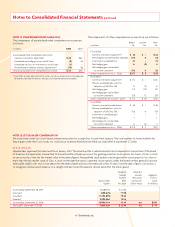

associated with the retirement of a tangible long-lived asset that

resulted from the acquisition, construction, development and/or

the normal operation of a long-lived asset. The associated asset costs

are capitalized as part of the carrying amount of the long-lived asset.

FIN 47 clarifi es the term “conditional asset retirement obligation” as

used in SFAS No. 143, which refers to a legal obligation to perform

an asset retirement activity in which the timing and/or method of

settlement are conditional on a future event that may or may not be

within the control of the entity. FIN 47 requires an entity to recog-

nize a liability for the fair value of a conditional asset retirement

obligation if the fair value of the liability can be estimated reason-

ably. Uncertainty about the timing and/or method of settlement of

a conditional asset retirement obligation should be factored into

the measurement of the liability when suffi cient information exists.

SFAS No. 143 acknowledges in some cases, suffi cient information

may not be available to reasonably estimate the fair value of an asset

retirement obligation (ARO). We adopted FIN 47 in the fourth quarter

of fi scal 2006. In connection with the adoption, an ARO liability of

$12 million, a related ARO asset of $3 million and a cumulative adjust-

ment due to change in accounting principle, net of tax of $5 million

were recorded. The ARO liability is included in Other Liabilities and

the ARO asset is included in Property, Plant and Equipment on the

Consolidated Balance Sheets. The principal conditional asset retire-

ment obligations relate to the potential future closure, sale or other

disposal of certain production facilities. In connection with any such

activity, we are legally obligated under various federal, state and local

laws to properly retire the related wastewater treatment facility.

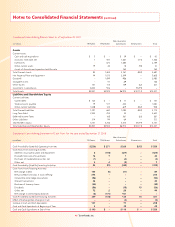

NOTE 3: DISCONTINUED OPERATION

On June 25, 2008, we executed a letter of intent with XL Foods Inc.

to sell the beef processing, cattle feed yard and fertilizer assets of

Lakeside for $104 million. Lakeside was part of our Beef segment.

XL Foods will pay an additional amount for cattle inventory, fertilizer

inventory and packaging assets, estimated to approximate $82 mil-

lion. This transaction is denominated in Canadian Dollars, thus

conversion at the closing date to US Dollars could result in amounts

in US Dollars different than noted. We will retain certain working

capital items, including fi nished product inventory, accounts receiv-

able and accounts payable, of the Lakeside operation as of the

closing date, which totaled $89 million at September 27, 2008.

Once the transaction is complete, we expect retained working

capital, including inventory, at Lakeside will be liquidated and

settled over a two-month period.

Approximately $60 million of Beef segment goodwill relates to

Lakeside. In addition, at September 27, 2008, we had $60 million of

currency translation adjustment gain in accumulated comprehensive

income related to the Lakeside Canadian dollar translation. Subse-

quent to September 27, 2008, the Canadian dollar weakened versus

the US dollar, which may result in a decrease in the currency trans-

lation adjustment gain.

The transaction remains subject to government approvals and execu-

tion of a defi nitive agreement between Tyson and XL Foods. Subject

to receipt of such approvals, we anticipate being ready to complete

the sale by the end of the fi rst quarter fi scal 2009 and are reporting

the Lakeside results as a discontinued operation.

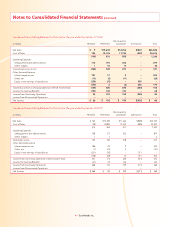

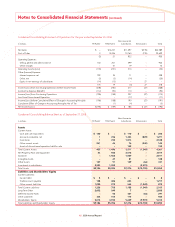

The following is a summary of Lakeside’s operating results (in millions):

2008 2007 2006

Sales $1,268 $1,171 $970

Pretax loss – – 25

The carrying amounts of Lakeside’s assets held for sale include the

following (in millions):

2008 2007

Assets of discontinued operation held for sale:

Inventories $ 82 $ 79

Net property, plant and equipment 77 85

Total assets of discontinued operation held for sale $159 $164

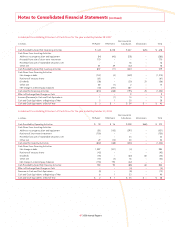

NOTE 4: DISPOSITIONS AND OTHER CHARGES

In fi scal 2008, we recorded charges of $10 million related to intan-

gible asset impairments. Of this amount, $8 million is refl ected in

the Beef segment’s Operating Income and $2 million in the Prepared

Foods segment’s Operating Income, and both are recorded in the

Consolidated Statements of Operations in Cost of Sales. We recorded

estimated charges of $7 million related to fl ood damage at our

Jefferson, Wisconsin, plant. This amount is refl ected in the Prepared

Foods segment’s Operating Income and included in the Consolidated

Statements of Operations in Cost of Sales. We also recorded a charge

of $6 million related to the impairment of unimproved real property

in Memphis, Tennessee. This amount is refl ected in the Chicken seg-

ment’s Operating Income (Loss) and included in the Consolidated

Statements of Operations in Cost of Sales. Additionally, we recorded

an $18 million non-operating gain as the result of a private equity

fi rm’s purchase of a technology company in which we held a minority

interest. This gain was recorded in Other Income in the Consolidated

Statements of Operations.

In February 2008, we announced discontinuation of an existing prod-

uct line and closing of one of our three poultry plants in Wilkesboro,

North Carolina. The Wilkesboro Cooked Products plant ceased oper-

ations during the second quarter of fi scal 2008. The closure resulted

in elimination of approximately 400 jobs. In fi scal 2008, we recorded

charges of $13 million for estimated impairment charges. This amount

is refl ected in the Chicken segment’s Operating Income (Loss) and

included in the Consolidated Statements of Operations in Other

Charges. No material adjustments to the accrual are anticipated.