Tyson Foods 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19 2008 Annual Report

Management’s Discussion and Analysis (continued)

• In fi scal 2007, we used proceeds from sale of the short-term

investment to repay our outstanding $750 million 7.25% Notes

due October 1, 2006. In addition, we used cash from operations

to reduce the amount outstanding under the Lakeside term loan

by $320 million, repay the outstanding $125 million 7.45% Notes

due June 1, 2007, and reduce other borrowings.

• In fi scal 2006, we repaid the $87 million 6.125% Senior Notes due

February 1, 2006, and reduced other borrowings.

• Net proceeds from borrowings include –

• In fi scal 2008, we issued $458 million of 3.25% Convertible

Senior Notes due October 15, 2013. Net proceeds were used for

the net cost of the related Convertible Note Hedge and Warrant

Transactions, toward the repayment of our borrowings under the

accounts receivable securitization facility, and for other general

corporate purposes.

• In fi scal 2006, we issued $1.0 billion of 2016 Notes. We used

proceeds to purchase a short-term investment, as well as for other

general corporate purposes. The short-term investment was later

sold and used in fi scal 2007 to repay our outstanding $750 million

7.25% Notes due October 1, 2006.

• In fi scal 2008, we issued 22.4 million shares of Class A stock in a

public offering. Net proceeds were used toward repayment of our

borrowings under the accounts receivable securitization facility and

for other general corporate purposes.

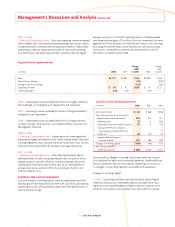

Liquidity

Outstanding

Letters of

Commitments Facility Credit (no Amount Amount

in millions Expiration Date Amount draw downs) Borrowed Available

Cash $ 250

Revolving credit facility September 2010 $1,000 $291 $ – $ 709

Accounts receivable securitization facility Aug. 2009, Aug. 2010 750 – – 750

Total liquidity $1,709

• The revolving credit facility supports our short-term funding needs

and letters of credit. Letters of credit are issued primarily in support

of workers’ compensation insurance programs and derivative activities.

• The accounts receivable securitization facility is with three

co-purchasers and allows us to sell up to $750 million of trade

receivables, consisting of $375 million expiring in August 2009 and

a $375 million 364-day facility with an additional one-year option,

which commits funding through August 2010. At September 27,

2008, we had access to the full $750 million borrowing capacity.

Our borrowing capacity could be reduced in the future if our

eligible receivables balance falls below $750 million.

• In conjunction with the $100 million of Gulf Opportunity Zone tax-

exempt bond issuance in October 2008, we agreed to issue a guarantee

for the full amount of the bond issuance, which was issued in the form

of a letter of credit, in exchange for eight million Syntroleum stock

warrants valued at $0.01 each. Both the issuance of the letter of

credit and the receipt of Syntroleum warrants occurred subsequent

to fi scal 2008. The letter of credit will reduce the unused borrowing

capacity available under the revolving credit facility.

• In October 2008, we completed the acquisition of three vertically

integrated poultry companies in southern Brazil. The purchase price

was $80 million, as well as up to an additional $15 million of contin-

gent purchase price based on production volumes payable through

fi scal 2010. Additionally, once the joint venture agreement with

Shandong Xinchang Group receives the necessary government

approvals, we expect to spend $110 – $115 million to acquire a

60% ownership. We expect this to be fi nalized during fi scal 2009.

• Subject to receipt of applicable government approvals, we anticipate

being ready to complete the sale of Lakeside by the end of the fi rst

quarter fi scal 2009, with plans to use available proceeds to pay down

debt and other general corporate purposes. Inclusive of working capital

of Lakeside initially retained by us at closing, as well as consideration

received from XL Foods, we expect the following future cash fl ows

based on the September 27, 2008, currency exchange rate: $55 million

received at closing; approximately $136 million in calendar 2009;

$49 million in notes receivable, plus interest, to be paid over two years

by XL Foods; and $29 million of XL Foods preferred stock redeemable

over fi ve years. The discontinuance of Lakeside’s operation will not

have a material effect on our future operating cash fl ows.

• Our current ratio at September 27, 2008, and September 29, 2007,

was 2.07 to 1 and 1.74 to 1, respectively.