Tyson Foods 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

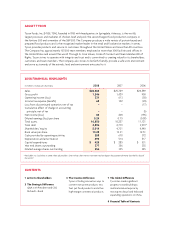

THE STRATEGIC DIFFERENCE

Q&A with the CEO

Q: Why did you raise capital in September?

A: We raised more than $740 million in capital by issuing

22.4 million shares and $457.5 million in convertible

debt. We had (and still have) a strong balance sheet,

so it wasn’t something we had to do, but we believed

it was in the Company’s long-term best interest.

It enabled us to be comfortable in making several

international acquisitions, which is where much of the

Company’s growth will occur. As for the timing, we

thought credit markets would tighten and that it would

be a long time before we could generate this amount

of capital; however, we thought things would tighten

up in the next few months or weeks, not the next few

days, as was the case.

Q: How has the U.S. economy affected your business?

A: We have a diversifi ed business model, and that

means diversity in the proteins we sell and the

channels in which we sell them. The economic

downturn has caused many people to re-evaluate

how they spend their food dollars. Our research

indicates many consumers are opting for the value

offered by quick service restaurants (QSRs) rather

than mid-scale or family restaurant chains. QSRs

are actually doing well, and we are a large supplier

to the major national chains. They are promoting

chicken on their menus – including their breakfast

menus – and putting advertising dollars behind

those promotions. Also, there are many consumers

who are eating at home more often and taking

their lunches to work to save money. We serve that

segment as well through our fresh chicken, beef

and pork, our value-added chicken products and

our deli meats sold at retail. Wherever consumers

choose to eat, and no matter what the current

economic conditions are, Tyson is there to meet

consumers’ needs.

Q: The world economy isn’t doing well either. With

the stronger U.S. dollar, how concerned are you

about exports in 2009?

A: We benefi ted tremendously from exports in 2008,

especially pork. As we begin the 2009 fi scal year,

liquidity is a problem for some importers of our

products. We think this is a short-term problem, and

underlying demand will remain strong in the long

term. We’re not immune from the overall economic

conditions, but countries import protein because they

can’t produce enough to feed their own people, and

that hasn’t changed.

Q: What can you tell us about your expectations

for 2009?

A: We anticipate sales to be $28-$29 billion.

Capital spending should be approximately

$600-$650 million, with $425-$450 million going

to our core business, $100-$120 million on post-

acquisition spending related to our Brazil and

China operations and $75-$80 million for the

Dynamic Fuels plant. It will be a transition year

for us as we integrate our international

acquisitions, get our renewable products

initiatives rolling and turn our chicken

segment around.

2 Tyson Foods, Inc.