Tyson Foods 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 Tyson Foods, Inc.

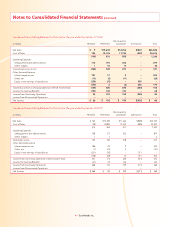

Notes to Consolidated Financial Statements (continued)

Financial Instruments: We purchase certain commodities, such as

grains and livestock in the course of normal operations. As part of

our commodity risk management activities, we use derivative fi nan-

cial instruments, primarily futures and options, to reduce our exposure

to various market risks related to these purchases, as well as to changes

in foreign currency exchange rates. Contract terms of a fi nancial

instrument qualifying as a hedge instrument closely mirror those of

the hedged item, providing a high degree of risk reduction and cor-

relation. Contracts designated and highly effective at meeting risk

reduction and correlation criteria are recorded using hedge account-

ing. If a derivative instrument is accounted for as a hedge, changes

in the fair value of the instrument will be offset either against the

change in fair value of the hedged assets, liabilities or fi rm commit-

ments through earnings or recognized in other comprehensive income

(loss) until the hedged item is recognized in earnings. The ineffective

portion of an instrument’s change in fair value is immediately recog-

nized in earnings as a component of cost of sales. Instruments we

hold as part of our risk management activities that do not meet the

criteria for hedge accounting are marked to fair value with unreal-

ized gains or losses reported currently in earnings. Changes in market

value of derivatives used in our risk management activities relating to

forward sales contracts are recorded in sales. Changes in market value

of derivatives used in our risk management activities surrounding

inventories on hand or anticipated purchases of inventories or

supplies are recorded in cost of sales. We generally do not hedge

anticipated transactions beyond 12 months.

Revenue Recognition: We recognize revenue when title and risk of

loss are transferred to customers, which is generally on delivery

based on terms of sale. Revenue is recognized as the net amount

estimated to be received after deducting estimated amounts for

discounts, trade allowances and product terms.

Litigation Reserves: There are a variety of legal proceedings pending

or threatened against us. Accruals are recorded when it is probable

a liability has been incurred and the amount of the liability can be

reasonably estimated based on current law, progress of each case,

opinions and views of legal counsel and other advisers, our experi-

ence in similar matters and intended response to the litigation. These

amounts, which are not discounted and are exclusive of claims against

third parties, are adjusted periodically as assessment efforts progress

or additional information becomes available. We expense amounts

for administering or litigating claims as incurred. Accruals for legal

proceedings are included in Other current liabilities in the Consoli-

dated Balance Sheets.

Freight Expense: Freight expense associated with products shipped to

customers is recognized in cost of sales.

Advertising and Promotion Expenses: Advertising and promotion

expenses are charged to operations in the period incurred. Customer

incentive and trade promotion activities are recorded as a reduction

to sales based on amounts estimated as being due to customers,

based primarily on historical utilization and redemption rates, while

other advertising and promotional activities are recorded as selling,

general and administrative expenses. Advertising and promotion

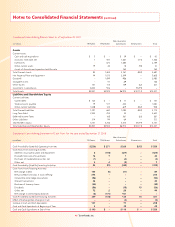

expenses for fi scal years 2008, 2007 and 2006 were $495 million,

$467 million and $493 million, respectively.

Use of Estimates: The consolidated fi nancial statements are prepared

in conformity with accounting principles generally accepted in the

United States, which require us to make estimates and assumptions

that affect the amounts reported in the consolidated fi nancial state-

ments and accompanying notes. Actual results could differ from

those estimates.

Recently Issued Accounting Pronouncements: In September 2006,

the FASB issued Statement of Financial Accounting Standards No. 157,

“Fair Value Measurements” (SFAS No. 157). SFAS No. 157 provides

guidance for using fair value to measure assets and liabilities. This

standard also responds to investors’ requests for expanded infor-

mation about the extent to which companies measure assets and

liabilities at fair value, the information used to measure fair value and

the effect of fair value measurements on earnings. SFAS No. 157 applies

whenever other standards require (or permit) assets or liabilities to

be measured at fair value. Beginning September 28, 2008, we partially

applied SFAS No. 157 as allowed by FASB Staff Position (FSP) 157-2,

which delayed the effective date of SFAS No. 157 for nonfi nancial

assets and liabilities. As of September 28, 2008, we have applied

the provisions of SFAS No. 157 to our fi nancial instruments and the

impact was not material. Under FSP 157-2, we will be required to

apply SFAS No. 157 to our nonfi nancial assets and liabilities at the

beginning of fi scal 2010. We are currently reviewing the applicability

of SFAS No. 157 to our nonfi nancial assets and liabilities as well as

the potential impact on our consolidated fi nancial statements.

In February 2007, the FASB issued Statement of Financial Accounting

Standards No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities, including an amendment of FASB Statement

No. 115” (SFAS No. 159). This statement provides companies with an

option to report selected fi nancial assets and liabilities fi rm commit-

ments, and nonfi nancial warranty and insurance contracts at fair value

on a contract-by-contract basis, with changes in fair value recognized

in earnings each reporting period. At September 28, 2008, we did not

elect the fair value option under SFAS No. 159 and therefore there

was no impact to our consolidated fi nancial statements.

In December 2007, the FASB issued Statement of Financial Accounting

Standards No. 160, “Noncontrolling Interests in Consolidated Finan-

cial Statements” (SFAS No. 160). SFAS No. 160 amends Accounting

Research Bulletin No. 51, “Consolidated Financial Statements” to

establish accounting and reporting standards for a noncontrolling

interest in a subsidiary and for the deconsolidation of a subsidiary.

This statement clarifi es that a noncontrolling interest in a subsidiary

is an ownership interest in the consolidated entity and should be

reported as equity in the consolidated fi nancial statements, rather