Tyson Foods 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Tyson Foods, Inc.

Management’s Discussion and Analysis (continued)

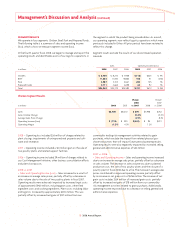

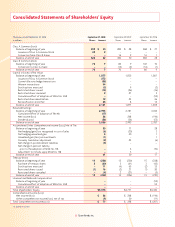

CONTRACTUAL OBLIGATIONS

The following table summarizes our contractual obligations as of

September 27, 2008:

Payments Due by Period

2010– 2012– 2014 and

in millions 2009 2011 2013 thereafter Total

Debt and capital

lease obligations:

Principal payments(1) $ 8 $1,245 $ 5 $1,638 $2,896

Interest payments(2) 289 339 207 329 1,164

Guarantees(3) 25 29 33 34 121

Operating lease

obligations(4) 80 102 48 23 253

Purchase obligations(5) 710 73 20 24 827

Capital expenditures(6) 308 58 – – 366

Other long-term

liabilities(7) 8 5 5 32 50

Total contractual

commitments $1,428 $1,851 $318 $2,080 $5,677

(1) In the event of a default on payment or violation of debt covenants, acceleration of

the principal payments could occur. At September 27, 2008, we were in compliance

with all of our debt covenants.

(2) Interest payments included interest on all outstanding debt. Payments are estimated

for variable rate and variable term debt based on effective rates at September 27, 2008,

and expected payment dates.

(3) Amounts included guarantees of debt of outside third parties, which consist of a

lease and grower loans, all of which are substantially collateralized by the underlying

assets, as well as residual value guarantees covering certain operating leases for various

types of equipment. The amounts included are the maximum potential amount of

future payments.

(4) Amounts included in operating lease obligations are minimum lease payments under

lease agreements.

(5) Amounts included in purchase obligations are agreements to purchase goods or

services that are enforceable and legally binding and specify all signifi cant terms,

including: fi xed or minimum quantities to be purchased; fi xed, minimum or variable

price provisions; and the approximate timing of the transaction. The purchase obliga-

tions amount included items, such as future purchase commitments for grains, live-

stock contracts and fi xed grower fees that provide terms that meet the above criteria.

We have excluded future purchase commitments for contracts that do not meet these

criteria. Purchase orders have not been included in the table, as a purchase order is an

authorization to purchase and may not be considered an enforceable and legally bind-

ing contract. Contracts for goods or services that contain termination clauses without

penalty have also been excluded.

(6) Amounts included in capital expenditures are estimated amounts to complete build-

ings and equipment under construction as of September 27, 2008, as well as costs to

construct Dynamic’s facility.

(7) Amounts included in other long-term liabilities are items that meet the defi nition of

a purchase obligation and are recorded in the Consolidated Balance Sheets.

In addition to the amounts shown above in the table, we have unrec-

ognized tax benefi ts of $220 million and related interest and penal-

ties of $67 million at September 27, 2008, recorded as liabilities in

accordance with Interpretation No. 48, “Accounting for Uncertainty

in Income Taxes,” an interpretation of FASB Statement No. 109

(FIN 48). During fi scal 2009, tax audit resolutions could potentially

reduce these amounts by approximately $38 million, either because

tax positions are sustained on audit or because we agree to their dis-

allowance. For the remaining liability, due to the uncertainties related

to these income tax matters, we are unable to make a reasonably

reliable estimate of the amounts or timing of potential reductions.

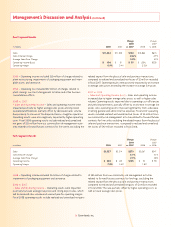

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

In June 2006, the FASB issued FIN 48. FIN 48 prescribes a recognition

threshold and measurement attribute for the fi nancial statement

recognition and measurement of a tax position taken or expected

to be taken in a tax return. FIN 48 also provides guidance on derecog-

nition, classifi cation, interest and penalties, accounting in interim

periods, disclosure and transition. We adopted FIN 48 at the begin-

ning of fi scal 2008. The adoption of FIN 48 resulted in a change

to the opening Consolidated Balance Sheet as follows: $32 million

increase to Other Current Assets, $17 million decrease to Other

Current Liabilities, $106 million increase to Other Liabilities, $40 mil-

lion decrease to Deferred Income Taxes and $17 million decrease

to Retained Earnings. Included in these changes we recognized a

$120 million increase in the liability for unrecognized tax benefi ts

and a $21 million increase in the related liability for interest and

penalties for a total of $141 million.

In September 2006, the FASB issued Statement of Financial

Accounting Standards No. 158, “Employers’ Accounting for Defi ned

Benefi t Pension and Other Postretirement Plans, an amendment

of FASB Statements No. 87, 88, 106, and 132(R)” (SFAS No. 158).

SFAS No. 158 requires companies to recognize the funded status

of a defi ned benefi t postretirement plan as an asset or liability in

its consolidated balance sheet and to recognize changes in funded

status in the year in which the changes occur through other com-

prehensive income. We adopted SFAS No. 158 at the end of fi scal

2007 except for the requirement to measure the funded status of

a plan as of the date of its annual consolidated balance sheet,

which we adopted in fi scal 2008 and which had an immaterial

impact. See Note 13, “Pensions and Other Postretirement Benefi ts”

in the Notes to Consolidated Financial Statements for the impact

of the adoption of SFAS No. 158.

In March 2005, the FASB issued FIN 47. Statement of Financial

Accounting Standards No. 143, “Accounting for Asset Retirement

Obligations” (SFAS No. 143), was issued in June 2001 and requires an

entity to recognize the fair value of a liability for an asset retirement

obligation in the period in which it is incurred if a reasonable estimate

of fair value can be made. SFAS No. 143 applies to legal obligations

associated with the retirement of a tangible long-lived asset that

resulted from the acquisition, construction, development and/or

the normal operation of a long-lived asset. The associated asset costs

are capitalized as part of the carrying amount of the long-lived asset.

FIN 47 clarifi es the term “conditional asset retirement obligation” as

used in SFAS No. 143, which refers to a legal obligation to perform

an asset retirement activity in which the timing and/or method of

settlement are conditional on a future event that may or may not