Tyson Foods 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Tyson Foods, Inc.

Notes to Consolidated Financial Statements (continued)

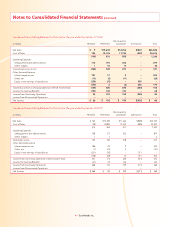

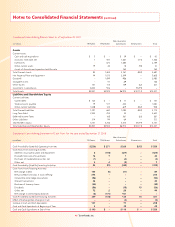

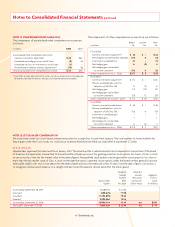

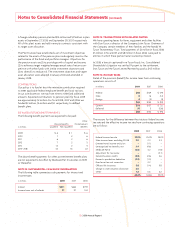

Condensed Consolidating Balance Sheet as of September 29, 2007

Non-Guarantor

in millions TFI Parent TFM Parent Subsidiaries Eliminations Total

Assets

Current Assets:

Cash and cash equivalents $ 3 $ – $ 39 $ – $ 42

Accounts receivable, net 1 557 1,461 (773) 1,246

Inventories – 674 1,485 – 2,159

Other current assets 79 32 18 (59) 70

Assets of discontinued operation held for sale – – 164 – 164

Total Current Assets 83 1,263 3,167 (832) 3,681

Net Property, Plant and Equipment 44 1,015 2,549 – 3,608

Goodwill – 1,499 986 – 2,485

Intangible Assets – 57 69 – 126

Other Assets 137 113 139 (62) 327

Investment in subsidiaries 8,243 976 – (9,219) –

Total Assets $8,507 $4,923 $6,910 $(10,113) $10,227

Liabilities and Shareholders’ Equity

Current Liabilities:

Current debt $ 120 $ – $ 17 $ – $ 137

Trade accounts payable 79 517 454 – 1,050

Other current liabilities 1,008 143 609 (832) 928

Total Current Liabilities 1,207 660 1,080 (832) 2,115

Long-Term Debt 2,355 255 32 – 2,642

Deferred Income Taxes – 168 261 (62) 367

Other Liabilities 214 94 64 – 372

Shareholders’ Equity 4,731 3,746 5,473 (9,219) 4,731

Total Liabilities and Shareholders’ Equity $8,507 $4,923 $6,910 $(10,113) $10,227

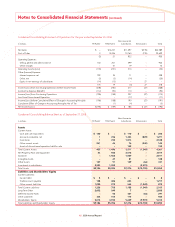

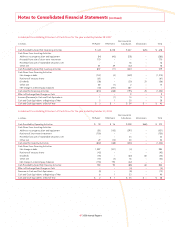

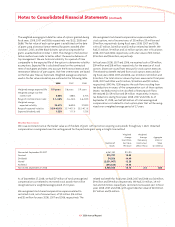

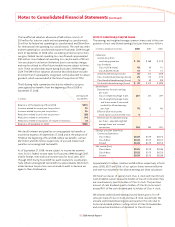

Condensed Consolidating Statement of Cash Flows for the year ended September 27, 2008

Non-Guarantor

in millions TFI Parent TFM Parent Subsidiaries Eliminations Total

Cash Provided by (Used for) Operating Activities $(236) $ 271 $ 268 $(15) $ 288

Cash Flows From Investing Activities:

Additions to property, plant and equipment 6 (104) (327) – (425)

Proceeds from sale of investments 14 7 1 – 22

Purchases of marketable securities, net (1) – (2) – (3)

Other, net 5 4 (2) – 7

Cash Provided by (Used for) Investing Activities 24 (93) (330) – (399)

Cash Flows From Financing Activities:

Net change in debt 145 (5) (51) – 89

Net proceeds from Class A stock offering 274 – – – 274

Convertible note hedge transactions (94) – – – (94)

Warrant transactions 44 – – – 44

Purchase of treasury shares (30) – – – (30)

Dividends (56) – (15) 15 (56)

Other, net 72 2 20 – 94

Net change in intercompany balances (6) (175) 181 – –

Cash Provided by (Used for) Financing Activities 349 (178) 135 15 321

Effect of Exchange Rate Change on Cash – – (2) – (2)

Increase in Cash and Cash Equivalents 137 – 71 – 208

Cash and Cash Equivalents at Beginning of Year 3 – 39 – 42

Cash and Cash Equivalents at End of Year $ 140 $ – $ 110 $ – $ 250