Tyson Foods 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 Tyson Foods, Inc.

Notes to Consolidated Financial Statements (continued)

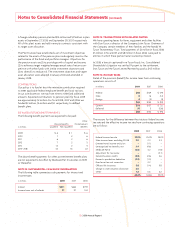

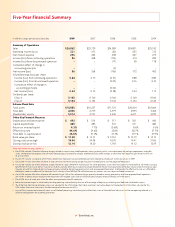

In June 2008, we executed a letter of intent to sell the beef process-

ing, cattle feed yard and fertilizer assets of Lakeside Farm Industries

Ltd. We are reporting Lakeside as a discontinued operation and have

restated the quarterly fi nancial data accordingly.

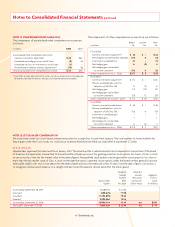

First quarter fi scal 2008 income from continuing operations before

income taxes includes an $18 million non-operating gain related to

sale of an investment and a $6 million severance charge related to the

FAST initiative. Second quarter fi scal 2008 income from continuing

operations before income taxes includes $47 million in charges related

to restructuring a beef plant operation, closing a poultry plant, impair-

ment of packaging equipment and software impairments. Third

quarter fi scal 2008 loss from continuing operations before income

taxes includes $13 million in charges related to fl ood damage and

impairment of unimproved real property. Fourth quarter fi scal 2008

income from continuing operations before income taxes includes a

$10 million charge related to intangible asset impairments.

Fourth quarter fi scal 2007 income from continuing operations includes

tax expense of $17 million related to a fi xed asset tax cost correction.

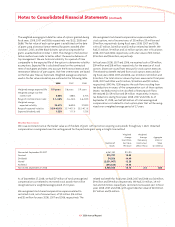

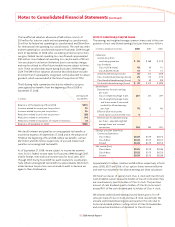

NOTE 20: CAPITAL STRUCTURE

In September 2008, we issued 22.4 million shares of Class A stock

as part of a public offering. The shares were offered at $12.75. Net

proceeds, after underwriting discounts and commissions, of approxi-

mately $274 million were used toward the repayment of our borrow-

ings under the accounts receivable securitization facility and for

other general corporate purposes. An entity controlled by Don Tyson

purchased three million shares of Class A stock in this offering.

During fi scal 2007, Tyson Limited Partnership converted 15.9 million

shares of Class B stock to Class A stock on a one-for-one basis.

During fi scal 2006, Tyson Limited Partnership converted 15 million

shares of Class B stock to Class A stock on a one-for-one basis.

Additionally, Don Tyson, a director, converted 750,000 shares of

Class B stock to Class A stock on a one-for-one basis.

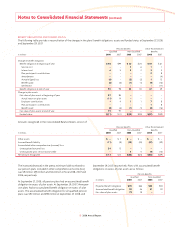

NOTE 21: CONTINGENCIES

Listed below are certain claims made against the Company and our

subsidiaries. In our opinion, we have made appropriate and adequate

reserves, accruals and disclosures where necessary, and believe the

probability of a material loss beyond the amounts accrued to be

remote; however, the ultimate liability for these matters is uncertain,

and if accruals and reserves are not adequate, an adverse outcome

could have a material effect on the consolidated fi nancial condition

or results of operations. We believe we have substantial defenses to

the claims made and intend to vigorously defend these cases.

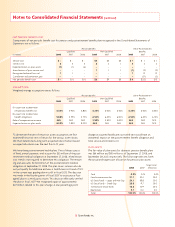

In 2000, the Wage and Hour Division of the U.S. Department of Labor

(DOL) conducted an industry-wide investigation of poultry producers,

including us, to ascertain compliance with various wage and hour

issues. As part of this investigation, the DOL inspected 14 of our

processing facilities. On May 9, 2002, the DOL fi led a civil complaint

styled Elaine L. Chao, Secretary of Labor, United States Department

of Labor v. Tyson Foods, Inc. against us in the U.S. District Court for

the Northern District of Alabama. The plaintiffs allege in the com-

plaint that we violated the overtime provisions of the federal Fair

Labor Standards Act at our chicken-processing facility in Blountsville,

Alabama. The complaint does not contain a defi nite statement of

what acts constituted alleged violations of the statute, although the

Secretary of Labor indicated in discovery the case seeks to require

us to compensate all hourly chicken processing workers for pre- and

post-shift clothes changing, washing and related activities and for

one of two unpaid 30-minute meal periods. The Secretary of Labor

seeks unspecifi ed back wages for all employees at the Blountsville

facility for a period of two years prior to the date of the fi ling of the

complaint, and an additional amount in unspecifi ed liquidated dam-

ages and an injunction against future violations at that facility and

all other chicken processing facilities we operate. The District Court

granted the Company’s motion for partial summary judgment in part,

ruling that the second meal period is appropriately characterized as

non-compensable, and reserving the remaining issues for trial. The

trial is presently set for January 5, 2009.

Several private lawsuits are pending against us alleging that we failed

to compensate poultry plant employees for all hours worked, includ-

ing overtime compensation, in violation of the Fair Labor Standards

Act. These lawsuits include M.H. Fox, et al. v. Tyson Foods, Inc. (Fox),

fi led on June 22, 1999, in the U.S. District Court for the Northern

District of Alabama, and DeAsencio v. Tyson Foods, Inc. (DeAsencio),

fi led on August 22, 2000, in the U.S. District Court for the Eastern

District of Pennsylvania. Each of these matters involves similar allega-

tions that employees should be paid for the time it takes to engage

in pre- and post-shift activities such as changing into and out of

protective and sanitary clothing, obtaining clothing and walking to

and from the changing area, work areas and break areas. The plaintiffs

in these lawsuits seek or have sought to act as class representatives

on behalf of all current and former employees who were allegedly

not paid for time worked and seek back wages, liquidated damages,

pre- and post-judgment interest, and attorneys’ fees. In Fox, the

District Court denied class certifi cation on November 16, 2006, and

ordered the cases of the 10 named plaintiffs in the matter to proceed

individually in the home jurisdictions of the named plaintiffs. Two

of these cases (Brothers and Hatchett) were tried in November 2007

in Alabama with jury verdicts in favor of the plaintiffs. The District

Court recently entered judgment in the fi nal of these cases (Fox) after

the Company made an offer of judgment to Fox, thereby avoiding

trial. However, the District Court must now determine the amount of