Tyson Foods 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Tyson Foods, Inc.

Notes to Consolidated Financial Statements (continued)

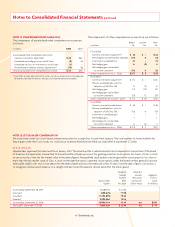

PERFORMANCE-BASED SHARES

In July 2003, our Compensation Committee authorized us to award

performance-based shares of our Class A stock to certain senior

executive offi cers on the fi rst business day of each of the Company’s

2004, 2005 and 2006 fi scal years. The Compensation Committee later

authorized the expansion of the awards to include additional senior

offi cers and to extend out to fi scal year 2008. The vesting of the

performance-based shares for the 2006 award is over two and one-

half to three years and the vesting for the 2007 and 2008 awards is

over three years (the Vesting Period), each award being subject to the

attainment of goals determined by the Compensation Committee

prior to the date of the award. We review progress toward the attain-

ment of goals each quarter during the Vesting Period. However, the

attainment of goals can be determined only at the end of the Vest-

ing Period. If the shares vest, the ultimate cost will be equal to the

Class A stock price on the date the shares vest times the number of

shares awarded for all performance grants with other than market

criteria. For grants with market performance criteria, the ultimate cost

will be the fair value of the probable shares to vest regardless if the

shares actually vest. Total expense recorded related to performance-

based shares was not material for fi scal years 2008, 2007 and 2006.

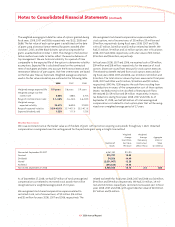

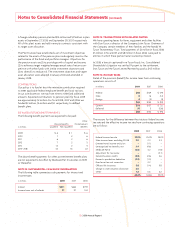

NOTE 13: PENSIONS AND OTHER POSTRETIREMENT BENEFITS

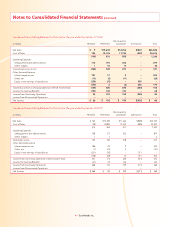

Effective September 29, 2007, we adopted SFAS No. 158, which

requires the recognition in pension obligations and accumulated

other comprehensive income of actuarial gains or losses, prior

service costs or credits and transition assets or obligations previ-

ously deferred under the reporting requirements of SFAS No. 87,

SFAS No. 106 and SFAS No. 132(R). The following table refl ects the

effects of adoption of SFAS No. 158 on the Consolidated Balance

Sheet as of September 29, 2007.

Before After

Application of Application of

in millions SFAS No. 158 Adjustments SFAS No. 158

Other assets $ 332 $(5) $ 327

Total assets 10,232 (5) 10,227

Deferred income taxes 366 1 367

Other liabilities 381 (9) 372

Accumulated other

comprehensive income 47 3 50

Total shareholders’ equity 4,728 3 4,731

Total liabilities and

shareholders’ equity 10,232 (5) 10,227

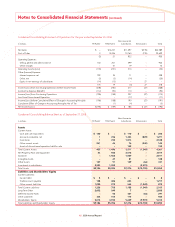

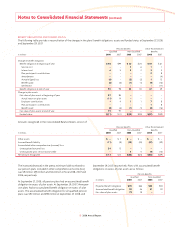

At September 27, 2008, we had four noncontributory defi ned benefi t

pension plans consisting of three funded qualifi ed plans and one

unfunded non-qualifi ed plan. All three of our qualifi ed plans are

frozen and provide benefi ts based on a formula using years of ser-

vice and a specifi ed benefi t rate. Effective January 1, 2004, we imple-

mented a non-qualifi ed defi ned benefi t plan for certain contracted

offi cers that uses a formula based on years of service and fi nal average

salary. We also have other postretirement benefi t plans for which

substantially all of our employees may receive benefi ts if they satisfy

applicable eligibility criteria. The postretirement healthcare plans

are contributory with participants’ contributions adjusted when

deemed necessary.

We have defi ned contribution retirement and incentive benefi t

programs for various groups of employees. We recognized expenses

of $48 million, $46 million and $55 million in fi scal 2008, 2007 and

2006, respectively.

We use a fi scal year end measurement date for our defi ned benefi t

plans and other postretirement plans. We generally recognize the

effect of actuarial gains and losses into earnings immediately for

other postretirement plans rather than amortizing the effect over

future periods.

Other postretirement benefi ts include postretirement medical costs

and life insurance.