Tyson Foods 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43 2008 Annual Report

Notes to Consolidated Financial Statements (continued)

• during the fi ve business days after any 10 consecutive trading

days (measurement period) in which the trading price per $1,000

principal amount of notes for each trading day of the measure-

ment period was less than 98% of the product of the last reported

sale price of our Class A stock and the applicable conversion rate

on each such day; or

• upon the occurrence of specifi ed corporate events as defi ned in

the supplemental indenture.

On and after July 15, 2013, until the close of business on the second

scheduled trading day immediately preceding the maturity date,

holders may convert their notes at any time, regardless of the fore-

going circumstances. Upon conversion, we will deliver cash up to

the aggregate principal amount of the Convertible Notes to be con-

verted and shares of our Class A stock in respect of the remainder, if

any, of our conversion obligation in excess of the aggregate principal

amount of the Convertible Notes being converted.

The Convertible Notes were accounted for as a combined instrument

pursuant to EITF Issue 90-19, “Convertible Bonds with Issuer Option

to Settle for Cash upon Conversion.” Accordingly, we accounted for

the entire agreement as one debt instrument because the conver-

sion feature does not meet the requirements to be accounted for

separately as a derivative fi nancial instrument.

Convertible Note Hedge and Warrant Transactions In connection

with the issuance of the Convertible Notes, we entered into separate

convertible note hedge transactions with respect to our common

stock to minimize the potential economic dilution upon conversion

of the Convertible Notes. We also entered into separate warrant

transactions. We recorded the purchase of the note hedge trans-

actions as a reduction to capital in excess of par value, net of $36 mil-

lion pertaining to the related deferred tax asset, and we recorded

the proceeds of the warrant transactions as an increase to capital in

excess of par value. Subsequent changes in fair value of these instru-

ments are not recognized in the fi nancial statements as long as the

instruments continue to meet the criteria for equity classifi cation.

We purchased call options in private transactions for $94 million

that permit us to acquire up to approximately 27 million shares of

our Class A stock at an initial strike price of $16.89 per share, subject

to adjustment. The call options allow us to acquire a number of shares

of our Class A stock initially equal to the number of shares of Class A

stock issuable to the holders of the Convertible Notes upon conver-

sion. These call options will terminate upon the maturity of the

Convertible Notes.

We sold warrants in private transactions for total proceeds of

$44 million. The warrants permit the purchasers to acquire up to

approximately 27 million shares of our Class A stock at an initial

exercise price of $22.31 per share, subject to adjustment. The war-

rants are exercisable on various dates from January 2014 through

March 2014.

These transactions, in effect, increase the initial conversion price

of the Convertible Notes from $16.89 per share to $22.31 per share,

thus reducing the potential future economic dilution associated

with conversion of the Convertible Notes. The Convertible Notes

and the warrants could have a dilutive effect on our earnings per

share to the extent the price of our Class A stock during a given

measurement period exceeds the respective exercise prices of those

instruments. The call options are excluded from the calculation of

diluted earnings per share as their impact is anti-dilutive.

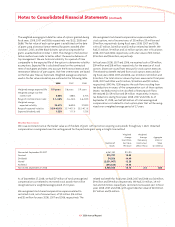

Credit Ratings On September 4, 2008, S&P downgraded the credit

rating applicable to the senior notes due April 1, 2016 (2016 Notes)

from “BBB–” to “BB.” This downgrade increased the interest rate on

the 2016 Notes from 6.85% to 7.35%, effective beginning with the

six month interest payment due October 1, 2008.

On November 13, 2008, Moody’s downgraded the credit rating from

“Ba1” to “Ba3.” This downgrade increased the interest rate on the 2016

Notes from 7.35% to 7.85%, effective beginning with the six month

interest payment due April 1, 2009.

Debt Covenants Our debt agreements contain various covenants, the

most restrictive of which contain maximum allowed leverage ratios and

a minimum required interest coverage ratio. On September 10, 2008,

we amended our revolving credit facility agreement to provide a less

restrictive maximum allowed leverage ratio, which takes effect in fi rst

quarter of fi scal 2009. We were in compliance with all covenants at

September 27, 2008.

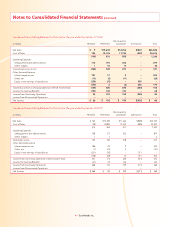

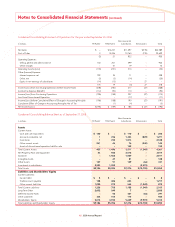

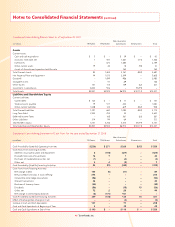

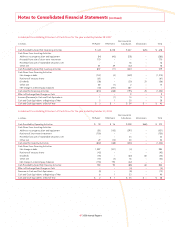

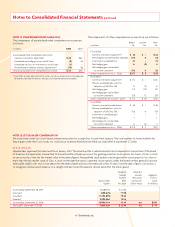

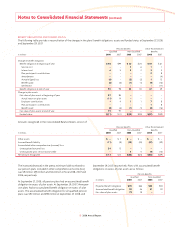

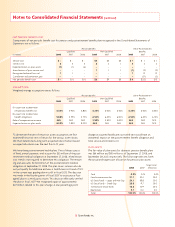

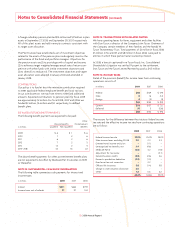

Tyson Fresh Meats, Inc. (TFM), a wholly-owned subsidiary of the

Company, has fully and unconditionally guaranteed $960 million

of our 2016 Notes. The following fi nancial information presents

condensed consolidating fi nancial statements, which include Tyson

Foods, Inc. (TFI Parent); Tyson Fresh Meats, Inc. (TFM Parent); the

Non-Guarantor Subsidiaries on a combined basis; the elimination

entries necessary to consolidate the TFI Parent, TFM Parent and the

Non-Guarantor Subsidiaries; and Tyson Foods, Inc. on a consolidated

basis, is provided as an alternative to providing separate fi nancial

statements for the guarantor.