Tyson Foods 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Tyson Foods, Inc.

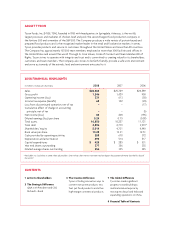

DESCRIPTION OF THE COMPANY

We are the world’s largest meat company and the second-largest

food production company in the Fortune 500 with one of the most

recognized brand names in the food industry. We produce, distribute

and market chicken, beef, pork, prepared foods and related allied

products. Our operations are conducted in four segments: Chicken,

Beef, Pork and Prepared Foods. Some of the key factors that infl uence

our business are customer demand for our products, ability to main-

tain and grow relationships with customers and introduce new and

innovative products to the marketplace, accessibility of international

markets, market prices for our chicken, beef and pork products, cost

of live cattle and hogs, raw materials and grain and operating effi cien-

cies of our facilities.

OVERVIEW

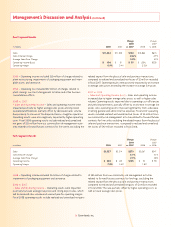

• Chicken Segment – Fiscal 2008 operating results declined as

compared to fi scal 2007 due largely to increased input costs of

approximately $900 million, including increased grain costs, other

feed ingredient costs and cooking ingredients. These increases were

partially offset by increased average sales prices, as well as increased

net gains of $127 million from our commodity risk management

activities related to grain purchases, which exclude the impact from

related physical purchase transactions that will impact future period

operating results.

• Beef Segment – Fiscal 2008 operating results improved com-

pared to fi scal 2007 as operating margins signifi cantly improved

in the latter half of the year, with an operating margin of 2.8% in

the last six months of fi scal 2008. While sales volume was down

with the closure of our Emporia, Kansas, slaughter operation,

operating margins improved due to improved average sales prices

and operational effi ciencies.

• Pork Segment – We achieved record operating income of

$280 million, an increase of $135 million as compared to fi scal

2007, due to adequate hog supplies and strong domestic and

export demand.

• Prepared Foods Segment – Declines in operating income for fi scal

2008 compared to fi scal 2007 for our Prepared Foods segment were

primarily due to increased raw material costs, partially offset by

increased average sales prices.

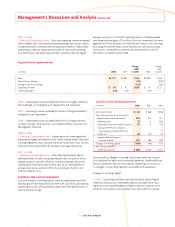

• Acquisitions – In fi scal 2008, we announced the following transactions:

• In December 2007, Cobb-Vantress, Inc. (Cobb), our wholly-owned

poultry breeding subsidiary, formed an alliance with Hendrix Genetics

B.V. (Hendrix). This alliance will strengthen Cobb’s position in the

broiler breeding industry, Hendrix’ position in egg layer, turkey and

swine genetics, and enable Cobb and Hendrix to explore other

joint venture opportunities. In July 2008, Cobb acquired the Hybro

poultry breeding and genetics business from Hendrix. The acquisi-

tion included genetic lines and facilities. At the same time, Cobb

and Hendrix signed a Joint Development Agreement involving their

respective Research & Development in livestock genetics.

• In February 2008, we signed an agreement with the Jiangsu

Jinghai Poultry Industry Group Co., Ltd., a Chinese poultry breeding

company, to build a fully integrated poultry operation in Haimen

City near Shanghai. The joint venture, Jiangsu Tyson Foods, will

produce fresh, packaged chicken products that will be sold under

the Tyson name. Jiangsu Tyson will become the fi rst producer to

deliver brand name, high quality fresh chicken to consumers in

the eastern China market. We own 70 percent of the business and

production is expected to begin in 2009.

• In June 2008, we announced the acquisition of 51% ownership

of Godrej Foods, Ltd., a poultry processing business in India. The

joint venture is called Godrej Tyson Foods. We anticipate annual

sales of approximately $50 million initially, and expect operations

will expand later. Godrej Foods currently sells retail fresh and

further processed chicken.

• In September 2008, we announced a joint venture agreement

was fi nalized with Shandong Xinchang Group, a vertically inte-

grated poultry operation in eastern China. Once the agreement

receives the necessary government approvals, which is expected

in fi scal 2009, Tyson will have a 60% ownership. The joint venture

will be called Shandong Tyson Xinchang Foods Company.

• In September 2008, we signed purchase agreements with three

poultry companies in southern Brazil, each vertically integrated.

These companies include Macedo Agroindustrial, Avicola Itaiopolis

and Frangobras. We closed on each of these transactions subse-

quent to fi scal 2008.

• In June 2008, we executed a letter of intent to sell Lakeside Farm

Industries (Lakeside), our Canadian beef operation, to XL Foods, Inc.,

a Canadian-owned beef processing business. Under the terms of the

letter of intent, Tyson will sell Lakeside for $104 million and retain

the fi nished product inventory, accounts receivable and accounts

payable of Lakeside as of the closing date. XL Foods will pay an

additional amount for cattle inventory, fertilizer inventory and

packaging assets, estimated to approximate $82 million. The trans-

action remains subject to government approvals and execution of

a defi nitive agreement by the parties. The results of Lakeside are

reported as a discontinued operation.

• See Liquidity and Capital Resources for a summary of the impact of

recent deterioration of credit and capital markets on our business.

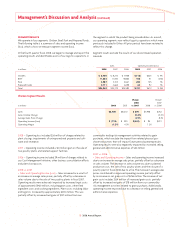

Management’s Discussion and Analysis