Tyson Foods 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Tyson Foods, Inc.

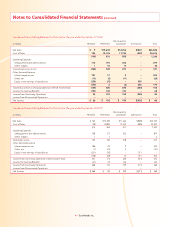

Notes to Consolidated Financial Statements (continued)

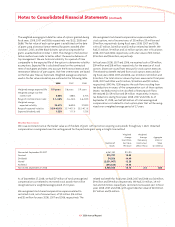

We guarantee debt of outside third parties, which consist of a lease

and grower loans, all of which are substantially collateralized by the

underlying assets. Terms of the underlying debt cover periods up to

nine years, and the maximum potential amount of future payments as

of September 27, 2008, was $66 million. We also maintain operating

leases for various types of equipment, some of which contain residual

value guarantees for the market value of assets at the end of the term

of the lease. The terms of the lease maturities cover periods up to

seven years. The maximum potential amount of the residual value

guarantees is approximately $55 million, of which approximately

$21 million would be recoverable through various recourse provisions

and an undeterminable recoverable amount based on the fair market

value of the underlying leased assets. The likelihood of material

payments under these guarantees is not considered probable. At

September 27, 2008, and September 29, 2007, no material liabilities

for guarantees were recorded.

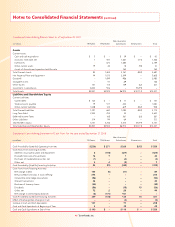

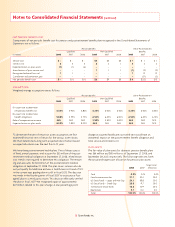

Additionally, we enter into future purchase commitments for various

items, such as grains, livestock contracts and fi xed grower fees. At

September 27, 2008, these commitments totaled:

in millions

2009 $710

2010 42

2011 31

2012 13

2013 7

2014 and beyond 24

Total $827

NOTE 10: LONG-TERM DEBT

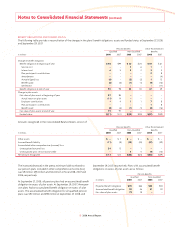

in millions Maturity 2008 2007

Revolving credit facility 2010 $ – $ –

Accounts receivable

securitization facility 2009, 2010 – 213

Senior notes (rates ranging from

7.00% to 8.25%) 2010–2028 2,400 2,475

3.25% Convertible senior notes 2013 458 –

Lakeside term loan – – 25

Other Various 38 66

Total debt 2,896 2,779

Less current debt 8 137

Total long-term debt $2,888 $2,642

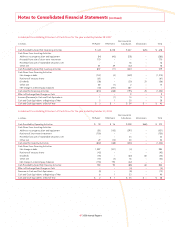

Annual maturities of long-term debt for the fi ve fi scal years subse-

quent to September 27, 2008, are: 2009 – $8 million; 2010 – $240 mil-

lion; 2011 – $1.0 billion; 2012 – $3 million; 2013 – $2 million.

Revolving Credit Facility We have a revolving credit facility totaling

$1.0 billion that supports short-term funding needs and letters of

credit. The facility expires in September 2010. At September 27, 2008,

we had outstanding letters of credit totaling approximately $291 mil-

lion, none of which were drawn upon, issued primarily in support

of workers’ compensation insurance programs and derivative activ-

ities. The amount available for borrowings under this facility as of

September 27, 2008, was $709 million. All trademarks of our domestic

subsidiaries are pledged as collateral under this facility. Additionally,

certain domestic subsidiaries guaranteed this facility and pledged

their inventory as collateral, which had a book value of $2.0 billion

at September 27, 2008.

Accounts Receivable Securitization Facility We have a receivables

purchase agreement with three co-purchasers to sell up to $750 million

of trade receivables. The agreement includes a $375 million 364-day

facility expiring in August 2009 and a $375 million 364-day facility

with an additional one-year option, which commits funding through

August 2010. The receivables purchase agreement has been accounted

for as a borrowing and has an interest rate based on commercial

paper issued by the co-purchasers. Under this agreement, substan-

tially all of our accounts receivable may be sold to a special purpose

entity, Tyson Receivables Corporation (TRC), which is a wholly-owned

consolidated subsidiary of the Company. TRC has its own creditors

who are entitled to be satisfi ed out of all of the assets of TRC prior

to any value becoming available to the Company as TRC’s equity

holder. At September 27, 2008, there were no amounts borrowed

under the receivables purchase agreement.

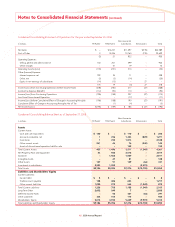

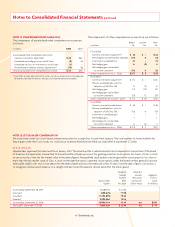

3.25% Convertible Senior Notes due 2013 In September 2008,

we issued $458 million principal amount 3.25% convertible senior

unsecured notes due October 15, 2013 (Convertible Notes), with

interest paid semi-annually in arrears on April 15 and October 15.

The conversion rate initially is 59.1935 shares of Class A stock per

$1,000 principal amount of notes, which is equivalent to an initial

conversion price of $16.89 per share of Class A stock. The Convertible

Notes may be converted before the close of business on July 12, 2013,

only under the following circumstances:

• during any fi scal quarter after December 27, 2008, if the last

reported sale price of our Class A stock for at least 20 trading days

during a period of 30 consecutive trading days ending on the last

trading day of the preceding fi scal quarter is at least 130% of the

applicable conversion price on each applicable trading day (which

would currently require our shares to trade at or above $21.96); or