Tyson Foods 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 2008 Annual Report

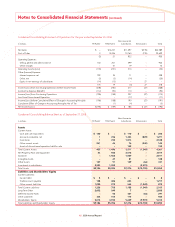

Notes to Consolidated Financial Statements (continued)

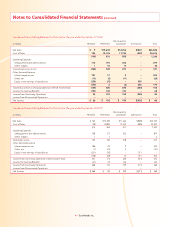

Goodwill and Other Intangible Assets: Goodwill and indefi nite life

intangible assets are initially recorded at fair value and not amortized,

but are reviewed for impairment at least annually or more frequently

if impairment indicators arise. Our goodwill is allocated by report-

ing unit, and we follow a two-step process to evaluate if a potential

impairment exists. We have estimated the fair value of our reporting

units using a discounted cash fl ow analysis. This analysis requires

us to make various judgmental estimates and assumptions about

sales, operating margins, growth rates and discount factors. While

estimating the fair value of our Beef and Chicken reporting units, we

assumed operating margins in future years in excess of the margins

realized in the most recent year. The fair value estimates for these

reporting units assume normalized operating margin assumptions and

improved operating effi ciencies based on long-term expectations

and operating margins historically realized in the beef and chicken

industries. As a result of the fi rst step of our goodwill impairment

review, a potential impairment did not exist; therefore, the second

step was not considered necessary. While we believe we have made

reasonable estimates and assumptions to determine the fair value of

our reporting units, it is possible a material change could occur. If our

actual results are not consistent with our estimates and assumptions

used to calculate the fair value of our reporting units, we may be

required to perform the second step which could result in a material

impairment of our goodwill.

During the latter part of the fourth quarter of fi scal 2008 and con-

tinuing into November 2008, our market capitalization was below

book value. While we considered the market capitalization decline

in our evaluation of fair value of goodwill, we determined it did not

impact the overall goodwill impairment analysis as we believe the

decline to be primarily attributed to the negative market conditions

as a result of the credit crisis, indications of a possible recession

and current issues within the poultry industry. We will continue to

monitor our market capitalization as a potential impairment indicator

considering overall market conditions and poultry industry events.

The fair value of trademarks is determined using a royalty rate method

based on expected revenues by trademark, and the fair value of our

in-process patents is determined using the present value of estimated

future cash fl ows.

Investments: We have investments in joint ventures and other entities.

We use the cost method of accounting where our voting interests

are less than 20 percent and the equity method of accounting where

our voting interests are in excess of 20 percent, but we do not have

a controlling interest or a variable interest in which we are the pri-

mary benefi ciary. Investments in joint ventures and other entities

are reported in the Consolidated Balance Sheets in Other Assets.

We have investments in marketable debt securities. As of

September 27, 2008, and September 29, 2007, $94 million, were

classifi ed in Other Assets in the Consolidated Balance Sheets,

with maturities ranging up to 48 years. We have determined all

our marketable debt securities are available-for-sale investments.

These investments are reported at fair value based on quoted

market prices as of the balance sheet date, with unrealized gains

and losses, net of tax, recorded in other comprehensive income.

The amortized cost of debt securities is adjusted for amortization of

premiums and accretion of discounts to maturity. Such amortization

is recorded in interest income. The cost of securities sold is based on

the specifi c identifi cation method. Realized gains and losses on the

sale of debt securities and declines in value judged to be other than

temporary are recorded on a net basis in other income. Interest and

dividends on securities classifi ed as available-for-sale are recorded

in interest income.

Accrued Self Insurance: We use a combination of insurance and

self-insurance mechanisms to provide for the potential liabilities

for health and welfare, workers’ compensation, auto liability and

general liability risks. Liabilities associated with our risks retained are

estimated, in part, by considering claims experience, demographic

factors, severity factors and other actuarial assumptions.

Capital Stock: We have two classes of capital stock, Class A Common

Stock, $0.10 par value (Class A stock) and Class B Common Stock,

$0.10 par value (Class B stock). Holders of Class B stock may convert

such stock into Class A stock on a share-for-share basis. Holders of

Class B stock are entitled to 10 votes per share, while holders of

Class A stock are entitled to one vote per share on matters sub-

mitted to shareholders for approval. As of September 27, 2008,

members of the Tyson family benefi cially own, in the aggregate,

99.97% of the outstanding shares of Class B stock and 2.31% of the

outstanding shares of Class A stock, giving the Tyson family control

of approximately 70% of the total voting power of the outstanding

voting stock. Cash dividends cannot be paid to holders of Class B

stock unless they are simultaneously paid to holders of Class A stock.

The per share amount of the cash dividend paid to holders of Class B

stock cannot exceed 90% of the cash dividend simultaneously paid

to holders of Class A stock. We pay quarterly cash dividends to Class A

and Class B shareholders. We paid Class A dividends per share of

$0.16 and Class B dividends per share of $0.144 in each of fi scal years

2008, 2007 and 2006.

The Class B stock is considered a participating security requiring the

use of the two-class method for the computation of basic earnings

per share. The two-class computation method for each period refl ects

the cash dividends paid for each class of stock, plus the amount of

allocated undistributed earnings (losses) computed using the partici-

pation percentage, which refl ects the dividend rights of each class

of stock. Basic earnings per share were computed using the two-

class method for all periods presented. The shares of Class B stock

are considered to be participating convertible securities since the

shares of Class B stock are convertible on a share-for-share basis into

shares of Class A stock. Diluted earnings per share were computed

assuming the conversion of the Class B shares into Class A shares as

of the beginning of each period.