Tyson Foods 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Tyson Foods, Inc.

Notes to Consolidated Financial Statements (continued)

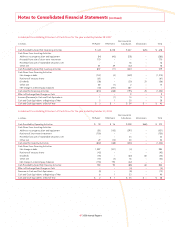

An increase in the state valuation allowance increased the fi scal 2008

tax expense by $8 million, while non-deductible activity relating to

company-owned life insurance increased the fi scal 2008 tax expense

by $6 million. The addition of FIN 48 unrecognized tax benefi ts in

fi scal 2008 caused a net increase to income tax expense of approxi-

mately $7 million. Additionally, estimated general business credits

decreased fi scal 2008 tax expense by $6 million.

During fi scal 2007, we discovered a certain population of our tax cost

and accumulated depreciation values were not accurately recorded,

primarily related to a property, plant and equipment system conver-

sion in 1999. This system conversion did not impact the recorded

book value of the property, plant and equipment. As a result, the net

tax basis of property, plant and equipment was overstated, which

caused the deferred tax liability in our fi nancial statements to be

understated. In fi scal 2007, we increased our deferred tax liabilities

$17 million and recognized additional tax expense of $17 million.

The fi scal 2007 effective tax rate was reduced by 4.6% due to the

reduction of income tax reserves management deemed were no

longer required. The net reduction to current income tax expense

of approximately $20 million related to Internal Revenue Service

examinations, appeals and United States Tax Court settlement activ-

ity, as well as state income tax examination settlements. Additional

related adjustments resulted in a $28 million reduction of goodwill.

During fi scal 2006, we completed a review of our tax account bal-

ances, and as a result, reduced our income tax benefi t by $15 million.

This included $12 million related to additional tax reserves for our

foreign operations and $3 million related to a cumulative adjustment

to our recorded tax balances attributable to book to tax differences

associated with property, plant and equipment (including synthetic

leases) and certain acquired deferred tax liabilities. Additional adjust-

ments resulted in an increase to goodwill of $12 million, deferred tax

liabilities of $3 million and a reduction of property, plant and equip-

ment of $9 million.

Deferred income taxes are recognized for the future tax consequences

attributable to differences between the fi nancial statement carrying

amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled.

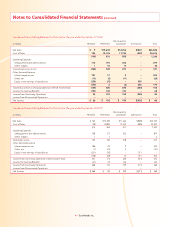

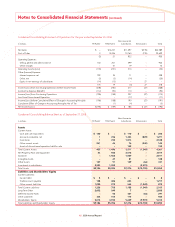

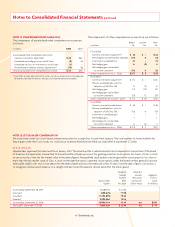

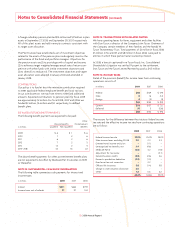

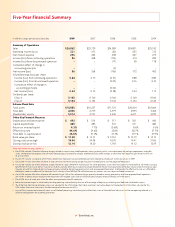

The tax effects of major items recorded as deferred tax assets and

liabilities are:

2008 2007

Deferred Tax Deferred Tax

in millions Assets Liabilities Assets Liabilities

Property, plant and equipment $ – $365 $ – $399

Suspended taxes from

conversion to

accrual method – 96 – 104

Intangible assets – 30 7 32

Inventory 13 89 13 74

Accrued expenses 167 – 165 –

Net operating loss and

other carryforwards 124 – 133 –

Note hedge transactions 36 – – –

Insurance reserves 22 – 22 –

Prepaids – 23 – 40

Other 58 48 53 71

$420 $651 $393 $720

Valuation allowance $ (49) $ (55)

Net deferred tax liability $280 $382

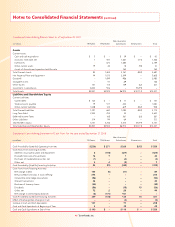

Net deferred tax liabilities are included in Other Current Assets,

Other Current Liabilities and Deferred Income Taxes on the Consoli-

dated Balance Sheets.

The deferred tax liability for suspended taxes from conversion to

accrual method represents the 1987 change from the cash to accrual

method of accounting and will be recognized by 2027.

We have accumulated undistributed earnings of foreign subsidi-

aries aggregating approximately $219 million and $215 million at

September 27, 2008 and September 29, 2007, respectively. These

earnings are expected to be indefi nitely reinvested outside of the

United States. If those earnings were distributed in the form of

dividends or otherwise, we would be subject to federal income taxes

(subject to an adjustment for foreign tax credits), state income

taxes and withholding taxes payable to the various foreign countries.

It is not currently practicable to estimate the tax liability that might

be payable on the repatriation of these foreign earnings.