Tyson Foods 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 2008 Annual Report

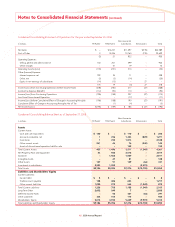

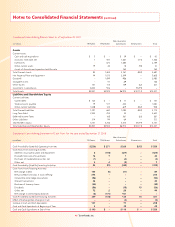

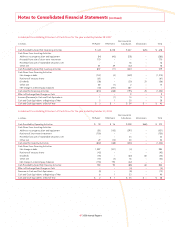

Notes to Consolidated Financial Statements (continued)

than in the liability or mezzanine section between liabilities and

equity. SFAS No. 160 also requires consolidated net income be reported

at amounts that include the amounts attributable to both the parent

and the noncontrolling interest. The impact of SFAS No. 160 will not

have a material impact on our current Consolidated Financial State-

ments. SFAS No. 160 is effective for fi scal years, and interim periods

within those fi scal years, beginning on or after December 15, 2008;

therefore, we expect to adopt SFAS No. 160 at the beginning

of fi scal 2010.

In December 2007, the FASB issued Statement of Financial Account-

ing Standards No. 141R, “Business Combinations” (SFAS No. 141R). SFAS

No. 141R establishes principles and requirements for how an acquirer

in a business combination: 1) recognizes and measures in its fi nancial

statements identifi able assets acquired, liabilities assumed, and any

noncontrolling interest in the acquiree; 2) recognizes and measures

goodwill acquired in a business combination or a gain from a bargain

purchase; and 3) determines what information to disclose to enable

users of the fi nancial statements to evaluate the nature and fi nancial

effects of a business combination. SFAS No. 141R is effective for busi-

ness combinations for which the acquisition date is on or after the

beginning of the fi rst annual reporting period beginning on or after

December 15, 2008; therefore, we expect to adopt SFAS No. 141R for

any business combinations entered into beginning in fi scal 2010.

In March 2008, the FASB issued Statement of Financial Accounting

Standards No. 161, “Disclosures about Derivative Instruments and

Hedging Activities – an amendment of FASB Statement No. 133” (SFAS

No. 161). SFAS No. 161 establishes enhanced disclosure requirements

about: 1) how and why an entity uses derivative instruments; 2) how

derivative instruments and related hedged items are accounted for

under Statement 133 and its related interpretations; and 3) how deriva-

tive instruments and related hedged items affect an entity’s fi nancial

position, fi nancial performance and cash fl ows. SFAS No. 161 is effec-

tive for fi nancial statements issued for fi scal years and interim periods

beginning after November 15, 2008; therefore, we expect to adopt

SFAS No. 161 in the second quarter of fi scal 2009.

In May 2008, the FASB issued FASB Staff Position No. APB 14-1,

“Accounting for Convertible Debt Instruments That May Be Settled

in Cash upon Conversion (Including Partial Cash Settlement)” (FSP

APB 14-1). FSP APB 14-1 specifi es that issuers of convertible debt

instruments that may be settled in cash upon conversion (including

partial cash settlement) should separately account for the liability

and equity components in a manner that will refl ect the entity’s non-

convertible debt borrowing rate when interest cost is recognized in

subsequent periods. The amount allocated to the equity component

represents a discount to the debt, which is amortized into interest

expense using the effective interest method over the life of the debt.

FSP APB 14-1 is effective for fi nancial statements issued for fi scal

years beginning after December 15, 2008, and interim periods within

those fi scal years. Early adoption is not permitted. Therefore, we

expect to adopt the provisions of FSP APB 14-1 beginning in the fi rst

quarter of fi scal 2010. The provisions of FSP APB 14-1 are required to

be applied retrospectively to all periods presented. Upon retrospec-

tive adoption, we anticipate our effective interest rate on our 3.25%

Convertible Senior Notes due 2013 will range from 8.0% to 8.50%,

which would result in the recognition of an approximate $90 million

to $100 million discount to these notes with the offsetting after tax

amount recorded to capital in excess of par value. This discount will

be accreted until the maturity date at the effective interest rate, which

will not materially impact fi scal 2008 interest expense, but will result

in an estimated $15 million to $20 million increase to our fi scal 2009

interest expense.

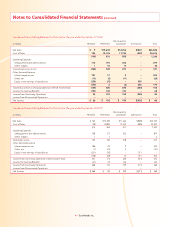

NOTE 2: CHANGE IN ACCOUNTING PRINCIPLES

In June 2006, the Financial Accounting Standards Board (FASB) issued

Interpretation No. 48, “Accounting for Uncertainty in Income Taxes,”

an interpretation of FASB Statement No. 109 (FIN 48). FIN 48 pre-

scribes a recognition threshold and measurement attribute for the

fi nancial statement recognition and measurement of a tax position

taken or expected to be taken in a tax return. FIN 48 also provides

guidance on derecognition, classifi cation, interest and penalties,

accounting in interim periods, disclosure and transition. We adopted

FIN 48 at the beginning of fi scal 2008. The adoption of FIN 48

resulted in a change to the opening Consolidated Balance Sheet as

follows: $32 million increase to Other Current Assets, $17 million

decrease to Other Current Liabilities, $106 million increase to Other

Liabilities, $40 million decrease to Deferred Income Taxes and $17 mil-

lion decrease to Retained Earnings. Included in these changes we

recognized a $120 million increase in the liability for unrecognized

tax benefi ts and a $21 million increase in the related liability for

interest and penalties for a total of $141 million.

In September 2006, the FASB issued Statement of Financial Account-

ing Standards No. 158, “Employers’ Accounting for Defi ned Benefi t

Pension and Other Postretirement Plans, an amendment of FASB

Statements No. 87, 88, 106, and 132(R)” (SFAS No. 158). SFAS No. 158

requires companies to recognize the funded status of a defi ned

benefi t postretirement plan as an asset or liability in its consolidated

balance sheet and to recognize changes in funded status in the year

in which the changes occur through other comprehensive income.

We adopted SFAS No. 158 at the end of fi scal 2007 except for the

requirement to measure the funded status of a plan as of the date

of its annual consolidated balance sheet, which we adopted in fi scal

2008 and which had an immaterial impact. See Note 13, “Pensions and

Other Postretirement Benefi ts” in the Notes to Consolidated Finan-

cial Statements for the impact of the adoption of SFAS No. 158.

In March 2005, the FASB issued FIN 47, an interpretation of SFAS

No. 143. SFAS No. 143 was issued in June 2001 and requires an entity

to recognize the fair value of a liability for an asset retirement obliga-

tion in the period in which it is incurred if a reasonable estimate of

fair value can be made. SFAS No. 143 applies to legal obligations