Tyson Foods 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 Tyson Foods, Inc.

Management’s Discussion and Analysis (continued)

Senior Notes due 2013 will range from 8.0% to 8.50%, which would

result in the recognition of an approximate $90 million to $100 mil-

lion discount to these notes with the offsetting after tax amount

recorded to capital in excess of par value. This discount will be

accreted until the maturity date at the effective interest rate, which

will not materially impact fi scal 2008 interest expense, but will result

in an estimated $15 million to $20 million increase to our fi scal 2009

interest expense.

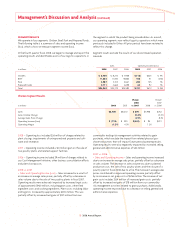

CRITICAL ACCOUNTING ESTIMATES

The preparation of consolidated fi nancial statements requires us to

make estimates and assumptions. These estimates and assumptions

affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the consolidated

fi nancial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ

from those estimates. The following is a summary of certain

accounting estimates we consider critical.

Description Judgments and Uncertainties

Effect if Actual Results Differ

from Assumptions

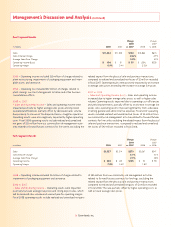

Contingent liabilities

We are subject to lawsuits, investigations

and other claims related to wage and hour/

labor, livestock procurement, securities, envi-

ronmental, product, taxing authorities and

other matters, and are required to assess the

likelihood of any adverse judgments or out-

comes to these matters, as well as potential

ranges of probable losses.

A determination of the amount of reserves

and disclosures required, if any, for these

contingencies are made after considerable

analysis of each individual issue. We accrue

for contingent liabilities when an assessment

of the risk of loss is probable and can be rea-

sonably estimated. We disclose contingent

liabilities when the risk of loss is reasonably

possible or probable.

Our contingent liabilities contain uncertain-

ties because the eventual outcome will

result from future events, and determination

of current reserves requires estimates and

judgments related to future changes in facts

and circumstances, differing interpretations

of the law and assessments of the amount of

damages, and the effectiveness of strategies

or other factors beyond our control.

We have not made any material changes in

the accounting methodology used to estab-

lish our contingent liabilities during the past

three fi scal years.

We do not believe there is a reasonable like-

lihood there will be a material change in the

estimates or assumptions used to calculate

our contingent liabilities. However, if actual

results are not consistent with our estimates

or assumptions, we may be exposed to gains

or losses that could be material.

Marketing and advertising costs

We incur advertising, retailer incentive

and consumer incentive costs to promote

products through marketing programs. These

programs include cooperative advertising,

volume discounts, in-store display incentives,

coupons and other programs.

Marketing and advertising costs are charged

in the period incurred. We accrue costs based

on the estimated performance, historical

utilization and redemption of each program.

Cash consideration given to customers is

considered a reduction in the price of our

products, thus recorded as a reduction to

sales. The remainder of marketing and adver-

tising costs is recorded as a selling, general

and administrative expense.

Recognition of the costs related to these

programs contains uncertainties due to

judgment required in estimating the

potential performance and redemption

of each program.

These estimates are based on many

factors, including experience of similar

promotional programs.

We have not made any material changes in

the accounting methodology used to estab-

lish our marketing accruals during the past

three fi scal years.

We do not believe there is a reasonable like-

lihood there will be a material change in the

estimates or assumptions used to calculate

our marketing accruals. However, if actual

results are not consistent with our estimates

or assumptions, we may be exposed to gains

or losses that could be material.

A 10% change in our marketing accruals at

September 27, 2008, would impact pretax

earnings by approximately $10 million.