Tyson Foods 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39 2008 Annual Report

Notes to Consolidated Financial Statements (continued)

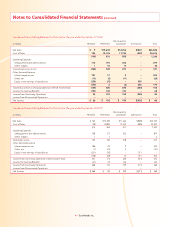

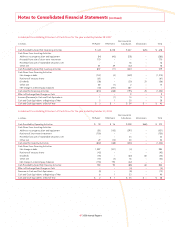

In January 2008, we announced the decision to restructure opera-

tions at our Emporia, Kansas, beef plant. Beef slaughter operations

ceased during the second quarter of fi scal 2008. However, the facility

will still be used to process certain commodity, specialty cuts and

ground beef, as well as a cold storage and distribution warehouse.

This restructuring resulted in elimination of approximately 1,700 jobs

at the Emporia plant. In fi scal 2008, we recorded charges of $10 mil-

lion for estimated impairment charges and $7 million of other closing

costs, consisting of $6 million for employee termination benefi ts and

$1 million in other plant-closing related liabilities. These amounts

were refl ected in the Beef segment’s Operating Income (Loss) and

included in the Consolidated Statements of Operations in Other

Charges. We have fully paid the employee termination benefi ts and

other plant-closing related liabilities. No material adjustments to the

accrual are anticipated.

In fi scal 2008, management approved plans for implementation of

certain recommendations resulting from the previously announced

FAST initiative, which was focused on process improvement and

effi ciency creation. As a result, in fi scal 2008, we recorded charges

of $6 million related to employee termination benefi ts resulting

from termination of approximately 200 employees. Of these charges,

$2 million, $2 million, $1 million and $1 million, respectively, were

recorded in the Chicken, Beef, Pork and Prepared Foods segments’

Operating Income (Loss) and included in the Consolidated State-

ments of Operations in Other Charges. We have fully paid the

employee termination benefi ts. No material adjustments to

the accrual are anticipated.

In May 2007, we announced the completion of the sale of two of

our Alabama poultry plants and related support facilities. As part

of strategic efforts to reduce the production of commodity chicken,

we sold our processing plants in Ashland and Gadsden, which also

included a nearby feed mill and two hatcheries. These facilities

employed approximately 1,200 employees, of which approximately

800 were hired by the acquiring company, while the remaining

employees were offered the opportunity to transfer to our other

operations in Alabama. We recorded a gain of $10 million on the

sale in fi scal 2007. The gain was recorded in the Chicken segment’s

Operating Income (Loss) and included in the Consolidated State-

ments of Operations in Cost of Sales.

In July 2006, we announced our decision to implement a Cost Man-

agement Initiative as part of a strategy to return to profi tability. The

cost reductions include staffi ng costs, consulting and professional

fees, sales and marketing costs and other expenses. In fi scal 2006, we

recorded charges of approximately $9 million for employee termina-

tion benefi ts resulting from the termination of approximately 400

employees. Of these charges, $4 million, $3 million, $1 million and

$1 million, respectively, were included in the Chicken, Beef, Pork and

Prepared Foods segments’ Operating Income (Loss) and included in

the Consolidated Statements of Operations in Other charges in

the period ending September 30, 2006. In fi scal 2007, there were no

material adjustments to amounts accrued. We have fully paid the

estimated employee termination benefi ts. No material adjustments

to the accrual are anticipated.

In August 2006, we announced our decision to close the Boise, Idaho,

beef slaughter plant and to scale back processing operations at our

Pasco, Washington, complex. This decision resulted in the elimination

of approximately 770 positions. The closure and processing change

occurred in October 2006 and did not result in a signifi cant charge.

In February 2006, we announced our decision to close the Norfolk,

Nebraska, beef processing plant and the West Point, Nebraska, beef

slaughter plant. These facilities closed in February 2006. Production

from these facilities was shifted primarily to our beef complex in

Dakota City, Nebraska. Combined, these two facilities employed

approximately 1,665 employees. We sold the West Point plant in fi scal

2007, while the Norfolk plant and related property are currently

offered for sale. In fi scal 2006, we recorded charges of $38 million

for estimated impairment charges and $9 million of other closing

costs, consisting of $5 million for employee termination benefi ts and

$4 million in other plant closing related liabilities. These amounts

were refl ected in the Beef segment’s Operating Income (Loss) and

included in the Consolidated Statements of Operations in Other

charges. We have fully paid the estimated employee termination

benefi ts and other plant closing related liabilities. No material

adjustments to the accrual are anticipated.

In January 2006, we announced our decision to close two processed

meats facilities in northeast Iowa. The Independence and Oelwein

plants, which produced chopped ham and sliced luncheon meats,

closed in March 2006. Combined, these two facilities employed

approximately 400 employees. Equipment from these facilities was

removed and either sold or transferred to our other locations, while

the plants and related property are currently offered for sale. In fi scal

2006, we recorded charges of $12 million for estimated impairment

charges and $1 million for employee termination benefi ts. These

amounts were refl ected in the Prepared Foods segment’s Operat-

ing Income (Loss) and included in the Consolidated Statements

of Operations in Other charges. We have fully paid the estimated

employee termination benefi ts. No material adjustments to the

accrual are anticipated.

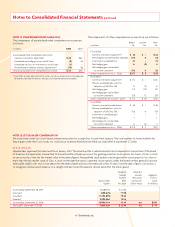

NOTE 5: FINANCIAL INSTRUMENTS

We had derivative related balances of $29 million and $16 million

recorded in other current assets at September 27, 2008, and

September 29, 2007, respectively, and $45 million and $48 million in

other current liabilities at September 27, 2008, and September 29,

2007, respectively.