Tyson Foods 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13 2008 Annual Report

Management’s Discussion and Analysis (continued)

2007 vs. 2006

• Decrease in cost of sales as a percentage of sales primarily was due

to the increase in average sales prices, while average live prices and

production costs did not increase at the same rate.

• Cost of sales increased by $661 million, with an increase in cost per

pound contributing to an $853 million increase, offset by a decrease

in sales volume reducing cost of sales by $192 million.

• Increase in net grain costs of $256 million, which included $334 mil-

lion of increased grain costs, partially offset by increased net gains

of $78 million from our commodity risk management activities

related to grain purchases.

• Increase in average domestic live cattle and hog costs, as well as

an increase in domestic pork sales volume, increased cost of sales

by approximately $682 million.

• Decrease in Chicken segment sales volume decreased cost of

sales by approximately $346 million, primarily due to planned

production cuts, the sale of two poultry plants and the closure

of a poultry plant in fi scal 2006 due to a fi re.

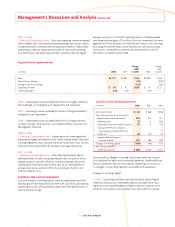

Selling, General and Administrative

in millions 2008 2007 2006

Selling, general and administrative $879 $814 $930

As a percentage of sales 3.3% 3.2% 3.8%

2008 vs. 2007

• Increase of $29 million related to unfavorable investment returns

on company-owned life insurance, which is used to fund non-qualifi ed

retirement plans.

• Increase of $16 million related to advertising and sales promotions.

• Increase of $14 million due to a favorable actuarial adjustment

related to retiree healthcare plan recorded in fi scal 2007.

• Increase of $9 million due to a gain recorded in fi scal 2007 on the

disposition of an aircraft.

2007 vs. 2006

• Decrease of $39 million in advertising and sales promotion expenses.

• Decrease of $27 million due to a favorable actuarial adjustment

related to retiree healthcare plan recorded in fi scal 2007 compared

to an unfavorable adjustment recorded in fi scal 2006.

• Decrease of $15 million in other professional fees.

• Decrease of $18 million due to a gain recorded in fi scal 2007 on the

disposition of an aircraft, as well as favorable investment returns on

company-owned life insurance.

• We had various other savings recognized as part of our Cost

Management Initiative. These savings are in addition to some of the

decreases above and include management salaries, travel, relocation

and recruiting, personnel awards, as well as other various savings.

• Increase of $18 million in earnings-based incentive compensation.

Other Charges

in millions 2008 2007 2006

$36 $2 $70

2008

• Included $17 million charge related to restructuring our Emporia,

Kansas, beef operation.

• Included $13 million charge related to closing our Wilkesboro,

North Carolina, Cooked Products poultry plant.

• Included $6 million of severance charges related to the FAST initiative.

2006

• Included $47 million of charges related to closing our Norfolk and

West Point, Nebraska, operations.

• Included $14 million of charges related to closing our Independence

and Oelwein, Iowa, operations.

• Included $9 million of severance accruals related to our Cost

Management Initiative announced in July 2006.