Tyson Foods 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41 2008 Annual Report

Notes to Consolidated Financial Statements (continued)

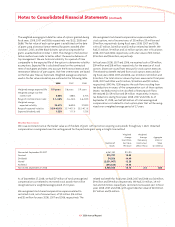

Fair values are based on quoted market prices or published forward

interest rate curves. Carrying values for derivative positions equal

the fair values as of September 27, 2008, and September 29, 2007,

and the carrying value of total debt was $2.9 billion and $2.8 billion,

respectively. All other fi nancial instruments’ fair values approximate

recorded values at September 27, 2008, and September 29, 2007.

Concentrations of Credit Risk: Our fi nancial instruments exposed to

concentrations of credit risk consist primarily of cash equivalents

and trade receivables. Cash equivalents are in high quality securities

placed with major banks and fi nancial institutions. Concentrations

of credit risk with respect to receivables are limited due to the large

number of customers and their dispersion across geographic areas.

We perform periodic credit evaluations of our customers’ fi nancial

condition and generally do not require collateral. At September 27,

2008, and September 29, 2007, 12.2% and 12.1%, respectively, of our

net accounts receivable balance was due from Wal-Mart Stores, Inc.

No other single customer or customer group represents greater than

10% of net accounts receivable.

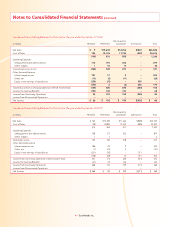

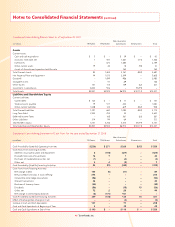

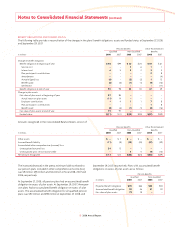

NOTE 6: PROPERTY, PLANT AND EQUIPMENT

Major categories of property, plant and equipment and accumulated

depreciation at cost, at September 27, 2008, and September 29, 2007:

in millions 2008 2007

Land $ 89 $ 99

Building and leasehold improvements 2,440 2,423

Machinery and equipment 4,382 4,255

Land improvements and other 210 200

Buildings and equipment under construction 352 245

7,473 7,222

Less accumulated depreciation 3,954 3,614

Net property, plant and equipment $3,519 $3,608

Approximately $228 million will be required to complete buildings

and equipment under construction at September 27, 2008.

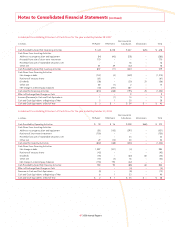

NOTE 7: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill by segment, net of $286 million of accumulated amortiza-

tion at September 27, 2008, and September 29, 2007:

in millions 2008 2007

Chicken $ 945 $ 921

Beef 1,185 1,182

Pork 317 317

Prepared Foods 64 65

Total Goodwill $2,511 $2,485

Other intangible assets by type at September 27, 2008, and

September 29, 2007:

in millions 2008 2007

Gross Carrying Value:

Trademarks $ 62 $ 66

Patents 50 50

In-process patents 27 35

Intellectual property 17 –

Less Accumulated Amortization:

Patents and intellectual property 28 25

Total Intangible Assets $128 $126

Amortization expense on patents and intellectual property of

$3 million was recognized during each of fi scal years 2008, 2007

and 2006. We estimate amortization expense on intangible assets

will be $5 million in each of the next fi ve years. Patents and intellec-

tual property are amortized using the straight-line method over their

estimated period of benefi t of fi ve to 15 years and 30 years, respectively,

beginning with the date benefi ts from intangible items are realized.

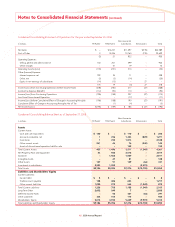

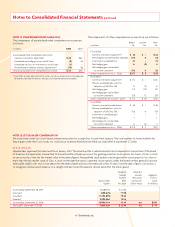

NOTE 8: OTHER CURRENT LIABILITIES

Other current liabilities at September 27, 2008, and September 29,

2007, include:

in millions 2008 2007

Accrued salaries, wages and benefi ts $259 $249

Self-insurance reserves 236 259

Other 383 420

Total other current liabilities $878 $928

NOTE 9: COMMITMENTS

We lease equipment, properties and certain farms for which total

rentals approximated $163 million, $133 million and $146 million,

respectively, in fi scal years 2008, 2007 and 2006. Most leases have

terms up to seven years with varying renewal periods. The most

signifi cant obligations assumed under the terms of the leases

are the upkeep of the facilities and payments of insurance and

property taxes.

Minimum lease commitments under non-cancelable leases at

September 27, 2008:

in millions

2009 $ 80

2010 61

2011 41

2012 30

2013 18

2014 and beyond 23

Total $253