Tyson Foods 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 Tyson Foods, Inc.

Management’s Discussion and Analysis (continued)

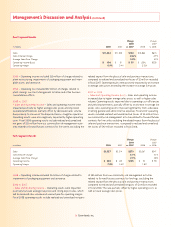

Beef Segment Results

Change Change

2008 2007

in millions 2008 2007 vs. 2007 2006 vs. 2006

Sales $11,664 $11,540 $124 $10,866 $674

Sales Volume Change (4.6)% 0.9%

Average Sales Price Change 5.9% 5.3%

Operating Income (Loss) $ 106 $ 51 $ 55 $ (254) $305

Operating Margin 0.9% 0.4% (2.3)%

2008 – Operating income included $35 million of charges related to:

plant restructuring; impairments of packaging equipment and intan-

gible assets; and severance.

2006 – Operating loss included $52 million of charges related to

plant closings, our Cost Management Initiative and other business

consolidation efforts.

2008 vs. 2007

• Sales and Operating Income – Sales and operating income were

impacted positively by higher average sales prices and improved

operational effi ciencies, partially offset by decreased sales volume

due primarily to closure of the Emporia, Kansas, slaughter operation.

Operating results were also negatively impacted by higher operating

costs. Fiscal 2008 operating results include realized and unrealized

net gains of $53 million from our commodity risk management activ-

ities related to forward futures contracts for live cattle, excluding the

related impact from the physical sale and purchase transactions,

compared to realized and unrealized net losses of $2 million recorded

in fi scal 2007. Operating results were positively impacted by an increase

in average sales prices exceeding the increase in average live prices.

2007 vs. 2006

• Sales and Operating Income (Loss) – Sales and operating income

increased due to higher average sales prices, as well as higher sales

volume. Operating results improved due to operating cost effi ciencies

and yield improvements, partially offset by an increase in average live

prices. Also, operating results improved signifi cantly from a decrease

in selling, general and administrative expenses. Fiscal 2007 operating

results included realized and unrealized net losses of $2 million from

our commodity risk management activities related to forward futures

contracts for live cattle, excluding the related impact from the physical

sale and purchase transactions, compared to realized and unrealized

net losses of $40 million recorded in fi scal 2006.

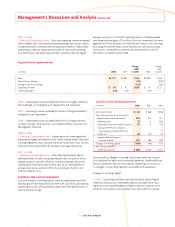

Pork Segment Results

Change Change

2008 2007

in millions 2008 2007 vs. 2007 2006 vs. 2006

Sales $3,587 $3,314 $273 $3,067 $247

Sales Volume Change 6.1% 5.1%

Average Sales Price Change 2.1% 2.8%

Operating Income $ 280 $ 145 $135 $ 55 $ 90

Operating Margin 7.8% 4.4% 1.8%

2008 – Operating income included $5 million of charges related to

impairment of packaging equipment and severance.

2008 vs. 2007

• Sales and Operating Income – Operating results were impacted

positively by lower average live prices and strong export sales, which

led to increased sales volume and a record year for operating margins.

Fiscal 2008 operating results include realized and unrealized net gains

of $95 million from our commodity risk management activities

related to forward futures contracts for live hogs, excluding the

related impact from the physical sale and purchase transactions,

compared to realized and unrealized net gains of $3 million recorded

in fi scal 2006. This was partially offset by higher operating costs, as

well as lower average sales prices.