Tyson Foods 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11 2008 Annual Report

Management’s Discussion and Analysis (continued)

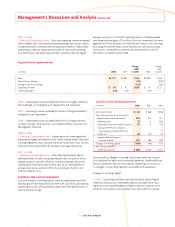

in millions, except per share data 2008 2007 2006

Net income (loss) $ 86 $ 268 $ (196)

Net income (loss) per diluted share 0.24 0.75 (0.58)

2008

Net income includes the following items:

• $33 million of charges related to asset impairments, including

packaging equipment, intangible assets, unimproved real property

and software;

• $17 million charge related to restructuring our Emporia, Kansas,

beef operation;

• $13 million charge related to closing our Wilkesboro, North

Carolina, Cooked Products poultry plant;

• $13 million of charges related to fl ood damage at our Jefferson,

Wisconsin, plant and severance charges related to the FAST

initiative; and

• $18 million non-operating gain related to sale of an investment.

2007

Net income includes the following item:

• $17 million of tax expense related to a fi xed asset tax cost correc-

tion, primarily related to a fi xed asset system conversion in 1999.

2006

Net loss includes the following items:

• $63 million of costs related to beef, prepared foods and poultry

plant closings;

• $19 million of charges related to our Cost Management Initiative

and other business consolidation efforts which included severance

expense, product rationalization costs and related intangible asset

impairment expenses;

• $15 million tax expense resulting from a review of our tax account

balances; and

• $5 million charge related to the cumulative effect of a change

in accounting principle due to adoption of Financial Accounting

Standards Board Interpretation No. 47, “Accounting for Conditional

Asset Retirement Obligations,” an interpretation of FASB Statement

No. 143 (FIN 47).

OUTLOOK

The following elements comprise our long-term strategic plan:

• Create innovative and insight-driven food solutions: Discover and

sell market-leading products and services to grow Tyson’s brand

equity and help our customers succeed through our commitment

to joint value creation.

• Optimize commodity business models: Emphasize cost focus in

operations, manage margins and maximize revenue by capitalizing

on scale, yield, pricing, product mix and services.

• Build a multi-national enterprise: Accelerate expansion in cost

competitive regions and markets with the greatest growth potential

as well as increase and diversify United States exports.

• Revolutionize conversion of raw materials and by-products into

high-margin initiatives: Commercialize opportunities outside the core

business, such as renewable energy from fat and developing other

technologically-advanced platforms from materials such as feathers,

viscera, blood and animal waste.

Our outlook for segments in fi scal 2009 includes:

• Chicken – Export markets, credit availability and the recent

strengthening dollar have negatively impacted leg quarter pricing.

International leg quarter sales will be diffi cult at least through the

beginning of fi scal 2009. We have seen grain prices drop signifi cantly

from all-time highs this past summer that if sustained, will benefi t us

in the long run. However, we have some grain positions that could

negatively impact us depending on corn and soybean meal closing

prices at the end of the fi rst quarter fi scal 2009.

• Beef – We expect cattle supplies will be down 1 – 2% in fi scal

2009, but there should be ample supply to run our plants effi ciently.

We will continue to focus on the operational effi ciencies from fi scal

2008 and expect a successful fi scal 2009.

• Pork – While we anticipate fewer hog supplies in fi scal 2009, we

expect we will have an adequate supply to achieve good operating

results. This segment should continue to do well in fi scal 2009, but

likely not at the record amounts we had in fi scal 2008.

• Prepared Foods – High input costs will likely continue in fi scal

2009. Demand for our products remains strong, which should provide

for sales volume growth in fi scal 2009.