Tyson Foods 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25 2008 Annual Report

Management’s Discussion and Analysis (continued)

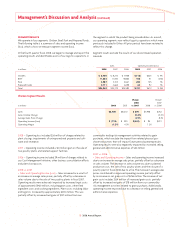

Description Judgments and Uncertainties

Effect if Actual Results Differ

from Assumptions

Accrued self insurance

We are self insured for certain losses related

to health and welfare, workers’ compensa-

tion, auto liability and general liability claims.

We use an independent third-party actuary

to assist in determining our self-insurance

liability. We and the actuary consider a

number of factors when estimating our

self-insurance liability, including claims

experience, demographic factors, severity

factors and other actuarial assumptions.

We periodically review our estimates and

assumptions with our third-party actuary

to assist us in determining the adequacy of

our self-insurance liability. Our policy is to

maintain an accrual within the central to

high point of the actuarial range.

Our self-insurance liability contains uncer-

tainties due to assumptions required and

judgment used.

Costs to settle our obligations, including

legal and healthcare costs, could increase

or decrease causing estimates of our self-

insurance liability to change.

Incident rates, including frequency and

severity, could increase or decrease causing

estimates in our self-insurance liability

to change.

We have not made any material changes

in the accounting methodology used to

establish our self-insurance liability during

the past three fi scal years.

We do not believe there is a reasonable like-

lihood there will be a material change in the

estimates or assumptions used to calculate

our self-insurance liability. However, if actual

results are not consistent with our estimates

or assumptions, we may be exposed to gains

or losses that could be material.

A 10% increase in the actuarial range at

September 27, 2008, would not impact the

amount we recorded for our self-insurance

liability. A 10% decrease in the actuarial

range at September 27, 2008, would result

in a gain in the amount we recorded for

our self-insurance liability of approximately

$23 million.

Impairment of long-lived assets

Long-lived assets are evaluated for

impairment whenever events or changes

in circumstances indicate the carrying value

may not be recoverable. Examples include a

signifi cant adverse change in the extent or

manner in which we use a long-lived asset

or a change in its physical condition.

When evaluating long-lived assets for

impairment, we compare the carrying value

of the asset to the asset’s estimated undis-

counted future cash fl ows. An impairment

is indicated if the estimated future cash

fl ows are less than the carrying value of the

asset. The impairment is the excess of the

carrying value over the fair value of the

long-lived asset.

We recorded impairment charges related to

long-lived assets of $52 million, $6 million

and $67 million, respectively, in fi scal years

2008, 2007 and 2006.

Our impairment analysis contains uncertain-

ties due to judgment in assumptions and

estimates surrounding undiscounted future

cash fl ows of the long-lived asset, including

forecasting useful lives of assets and select-

ing the discount rate that refl ects the risk

inherent in future cash fl ows to determine

fair value.

We have not made any material changes

in the accounting methodology used to

evaluate the impairment of long-lived

assets during the last three fi scal years.

We do not believe there is a reasonable like-

lihood there will be a material change in the

estimates or assumptions used to calculate

impairments of long-lived assets. However,

if actual results are not consistent with our

estimates and assumptions used to calcu-

late estimated future cash fl ows, we may be

exposed to impairment losses that could

be material.