Sara Lee 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 7

This Financial Review discusses the company’s results of operations,

financial condition and liquidity, risk management activities, and

significant accounting policies and critical estimates. This discussion

should be read in conjunction with the Consolidated Financial

Statements and related notes thereto contained elsewhere in this

annual report. The company’s fiscal year ends on the Saturday closest

to June 30. Fiscal years 2013, 2012 and 2011 were 52-week years.

Unless otherwise stated, references to years relate to fiscal years.

The following is an outline of the analysis included herein:

• Business Overview

• Summary of Results/Outlook

• Review of Consolidated Results

• Operating Results by Business Segment

• Financial Condition

• Liquidity

• Risk Management

• Non-GAAP Financial Measures

• Critical Accounting Estimates

• Issued But Not Yet Effective Accounting Standards

• Forward-Looking Information

BUSINESS OVERVIEW

OUR BUSINESS

Hillshire Brands is a manufacturer and marketer of high-quality,

brand name food products. Sales are principally in the United States,

where it is one of the leaders in meat-centric food solutions for the

retail and foodservice markets. In the retail channel, the company

sells a variety of packaged meat products that include hot dogs, corn

dogs, breakfast sandwiches, sausages and lunchmeats as well as a

variety of frozen baked products and specialty items including cakes

and cheesecakes. These products are sold primarily to supermarkets,

warehouse clubs and national chains. The company also sells a variety

of meat and bakery products to foodservice customers.

The company’s portfolio of brands includes Jimmy Dean,

Ball Park, Hillshire Farm, State Fair, Sara Lee frozen bakery and

Chef Pierre, as well as artisanal brands Aidells and Gallo.

STRATEGY

The company is focused on delivering long-term value creation

through strengthening the core of its business through brand building

and innovation; leveraging its heritage brand equities to extend

into new adjacent categories; fueling growth by driving operating

efficiencies; and evaluating opportunities to acquire on-trend

brands that align with its strategy for value creation.

SPIN-OFF

On June 28, 2012, Sara Lee Corporation successfully completed the

spin-off of its international coffee and tea business (“spin-off”) into

an independent new public company named D.E. MASTER BLENDERS

1753 N.V. (“DEMB”). Immediately after the spin-off, Sara Lee

Corporation changed its name to The Hillshire Brands Company.

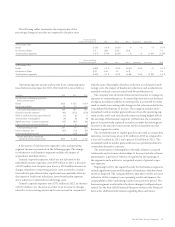

SUMMARY OF RESULTS/OUTLOOK

The business highlights for 2013 include the following:

• Net sales for the year were $3.9 billion, a decrease of $38 million,

or 1% versus the prior year. Adjusted net sales, which excludes the

results of businesses that have been exited or disposed of, increased

0.4%. The favorable impact of volume increases were offset by an

unfavorable shift in sales mix and pricing actions in response to

lower commodity costs.

• Reported operating income for the year was $297 million, an

increase of $221 million, which resulted from a decrease in charges

related to significant items. Adjusted operating income was $363 mil-

lion, an increase of $40 million, or 12.5% over the prior year as a

result of lower commodity costs net of pricing actions, lower general

corporate expenses, and higher volumes, partially offset by increased

investments in media, advertising and promotion (“MAP”).

• Operating segment income, which excludes the impact of

significant items and business dispositions, was favorably impacted

by a year-over-year decrease in commodity costs net of pricing actions

and volume increases primarily related to Jimmy Dean products,

partially offset by higher investments in MAP and higher bakery

manufacturing costs.

• Net income from continuing operations attributable to Hillshire

Brands in 2013 was $184 million, or $1.49 per share on a diluted basis,

versus a loss of $20 million, or $0.16 per share on a diluted basis in

2012. The year-over-year improvement was due to a $165 million

decrease in after tax charges related to significant items, which

includes charges for restructuring actions, spin-off related costs and

significant reductions in interest expense. On an as adjusted basis,

net income from continuing operations attributable to Hillshire

Brands in 2013 was $212 million or $1.72 per share on a diluted

basis, versus $173 million, or $1.45 per share of income in 2012.

• Cash from operating activities was $253 million in 2013,

an increase of $4 million due to a decrease in cash payments for

restructuring actions, lower contributions to pension plans, lower

cash payments for taxes and improved operating results on an adjusted

basis which were offset by the impact of the completion of the dis-

position of several discontinued operations as well as an increase in

cash used to fund working capital related to operating activities.

FINANCIAL REVIEW