Sara Lee 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 41

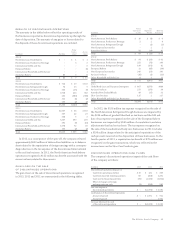

The company currently tests goodwill and intangible assets

not subject to amortization for impairment in the fourth quarter

of its fiscal year and whenever a significant event occurs or circum-

stances change that would more likely than not reduce the fair value

of these intangible assets. Other long-lived assets are tested for

recoverability whenever events or changes in circumstances indicate

that its carrying value may not be recoverable. The following is a

discussion of each impairment charge:

2013

Retail Property The company recognized a $1 million impairment

charge related to machinery and equipment within the Retail

segment which was determined to no longer have any future use

by the company.

2012

Capitalized Computer Software The company recognized a $14 million

impairment charge related to the write-down of capitalized computer

software which was determined to no longer have any future use by

the company. These charges were recognized as part of general

corporate expenses.

2011

Foodservice/Other Property The company recognized a $15 million

impairment charge related to the write-down of manufacturing

equipment associated with the foodservice bakery operations of

the Foodservice/Other segment.

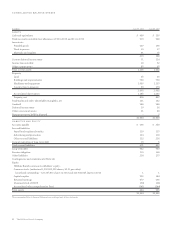

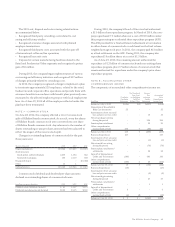

NOTE 5 – DISCONTINUED OPERATIONS

The results of the fresh bakery, refrigerated dough and foodservice

beverage operations in North America and the international coffee

and tea, household and body care, European bakery and Australian

bakery businesses are classified as discontinued operations and are

presented as discontinued operations in the condensed consolidated

statements of income for all periods presented. The assets and liabili-

ties for these businesses met the accounting criteria to be classified

as held for sale and have been aggregated and reported on a separate

line of the Condensed Consolidated Balance Sheet prior to disposition.

NORTH AMERICAN OPERATIONS

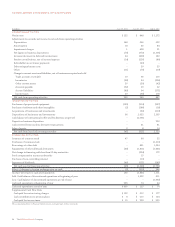

North American Fresh Bakery On October 21, 2011, the company

announced an agreement with Grupo Bimbo that allowed the parties

to complete the previously announced sale of its North American

Fresh Bakery business for a purchase price of $709 million. The sale

also included a small portion of business that was part of the North

American Foodservice/Other segment which is not reflected as

discontinued operations as it did not meet the definition of a com-

ponent pursuant to the accounting rules. The transaction closed

on November 4, 2011 and Hillshire Brands received $717 million,

which included working capital and other purchase price adjustments.

The company entered into a customary transition services agreement

with the purchaser of this business to provide for the orderly separation

of the business and transition of various administrative functions

and processes which ended in the fourth quarter of 2013.

The buyer of the North American Fresh Bakery business assumed

all the pension and postretirement medical liabilities associated with

these businesses, including any multi-employer pension liabilities.

An actuarial analysis under ERISA guidelines was performed to deter-

mine the final plan assets that should be transferred to support the

pension liabilities assumed by the buyer. The transfer of the benefit

plan liabilities to the buyer resulted in the recognition of a $36 million

settlement loss related to the defined benefit pension plans and

a $71 million settlement gain and a $44 million curtailment gain

related to the postretirement benefit plans. These amounts have

been included in the gain on disposition of this business.

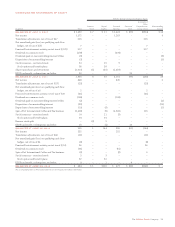

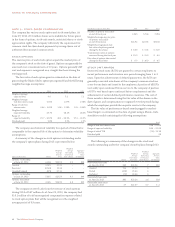

North American Foodservice Beverage On October 24, 2011, the

company announced that it had entered into an agreement to sell

the majority of its North American Foodservice Beverage operations

to the J.M. Smucker Company (Smuckers) for $350 million. The

transaction closed on December 31, 2011, resulting in the recogni-

tion of a pretax gain of $222 million in the second quarter of 2012.

The company received $376 million of proceeds, which included a

working capital adjustment. The company entered into a customary

transition services agreement with Smuckers to provide for the orderly

separation of the business and the transition of various administrative

functions and processes which ended in the fourth quarter of 2012.

The company also entered into a 10 year partnership to collaborate

on liquid coffee innovation that will pay the company approximately

$50 million plus growth-related royalties over the 10 year period.

While this arrangement provided a continuation of cash flows subse-

quent to the divestiture, it did not represent significant continuing

cash flows or significant continuing involvement that would have

precluded classification of the North American Foodservice Beverage

component as a discontinued operation. This partnership agreement

was subsequently transferred to the international coffee and tea

business as part of the spin-off. The company performed an updated

impairment analysis for the remaining assets for sale in North

American foodservice beverage and recognized a pretax impairment

charge of $6 million in 2012 which has been recognized in the oper-

ating results for discontinued operations. The company has also

recognized exit related costs for this business which is included in

the operating results for discontinued operations.

North American Foodservice Refrigerated Dough On August 9,

2011, the company announced it had entered into an agreement

to sell its North American Foodservice Refrigerated Dough business

to Ralcorp for $545 million. The company received $552 million of

proceeds, which included working capital adjustments. The company

entered into a customary transitional services agreement with the

purchaser of this business to provide for the orderly separation of

the business and the orderly transition of various functions and

processes which ended in the fourth quarter of 2012.