Sara Lee 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

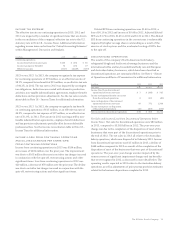

Changes in the company’s credit ratings result in changes in

the company’s borrowing costs. The company’s current short-term

credit rating allows it to participate in a commercial paper market

that has a number of potential investors and a historically high

degree of liquidity. A downgrade of the company’s short-term credit

rating would place the company in a commercial paper market that

would contain significantly less market liquidity than it currently

operates in with a rating of A-2, P-2 and F-2. This would reduce the

amount of commercial paper the company could issue and raise its

commercial paper borrowing cost. The facility does not mature or

terminate upon a credit rating downgrade. See Note 15 – Financial

Instruments for more information. To the extent that the company’s

operating requirements were to exceed its ability to issue commer-

cial paper following a downgrade of its short-term credit rating, the

company has the ability to use available credit facilities to satisfy

operating requirements, if necessary.

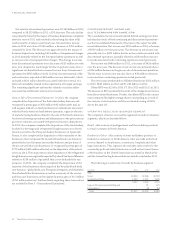

OFF-BALANCE SHEET ARRANGEMENTS

The off-balance sheet arrangements that are reasonably likely to

have a current or future effect on the company’s financial condition

are lease transactions for facilities, warehouses, office space, vehi-

cles and machinery and equipment.

LEASES

The company has numerous operating leases for manufacturing

facilities, warehouses, office space, vehicles and machinery and

equipment. Operating lease obligations are scheduled to be paid

as follows: $19 million in 2014, $15 million in 2015, $11 million

in 2016, $10 million in 2017, $9 million in 2018 and $77 million

thereafter. The company is also contingently liable for certain

long-term leases on property operated by others. These leased

properties relate to certain businesses that have been sold. The

company continues to be liable for the remaining terms of the

leases on these properties in the event that the owners of the

businesses are unable to satisfy the lease liability. The minimum

annual rentals under these leases are as follows: $9 million in

2014, $8 million in 2015, and $1 million in 2016.

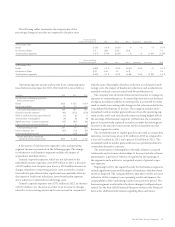

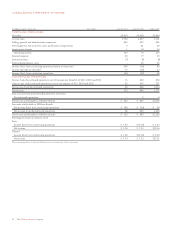

FUTURE CONTRACTUAL OBLIGATIONS

AND COMMITMENTS

The company has no material unconditional purchase

obligations as defined by the accounting principles associated

with the Disclosure of Long-Term Purchase Obligations. The

following table aggregates information on the company’s

contractual obligations and commitments:

20 The Hillshire Brands Company

FINANCIAL REVIEW

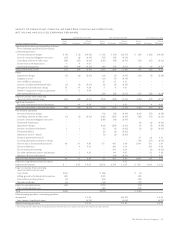

Payments Due by Fiscal Year

In millions Total 2014 2015 2016 2017 2018 Thereafter

Long-term debt $÷«951 $÷19 $÷93 $400 $÷÷– $÷÷– $439

Interest on debt obligations1310 45 33 24 21 21 166

Operating lease obligations 141 19 15 11 10 9 77

Purchase obligations21,684 622 433 204 175 161 89

Other long-term liabilities3398174226

Subtotal 3,125 713 591 643 208 193 777

Contingent lease obligations418981–––

Total5$3,143 $722 $599 $644 $208 $193 $777

1 Interest obligations on fixed rate debt instruments are calculated for future periods using stated interest rates as per the debt terms. See Note 12 – Debt Instruments for further details on the company’s long-term debt.

2 Purchase obligations include expenditures to purchase goods and services in the ordinary course of business for production and inventory needs (such as raw materials, supplies, packaging, manufacturing arrangements,

storage, distribution and union wage agreements); capital expenditures; marketing services; information technology services; and maintenance and other professional services where, as of the end of 2013, the company has

agreed upon a fixed or minimum quantity to purchase, a fixed, minimum or variable pricing arrangement and the approximate delivery date. Future cash expenditures will vary from the amounts shown in the table above.

The company enters into purchase obligations when terms or conditions are favorable or when a long-term commitment is necessary. Many of these arrangements are cancelable after a notice period without a significant

penalty. Additionally, certain costs of the company are not included in the table since at the end of 2013 an obligation did not exist. An example of these includes situations where purchasing decisions for these future periods

have not been made at the end of 2013. Ultimately, the company’s decisions and cash expenditures to purchase these various items will be based upon the company’s sales of products, which are driven by consumer demand.

The company’s obligations for accounts payable and accrued liabilities recorded on the balance sheet are also excluded from the table.

3 Represents the projected payment for long-term liabilities recorded on the balance sheet for deferred compensation, restructuring costs, deferred income, sales and other incentives. The company has employee benefit obligations

consisting of pensions and other postretirement benefits, including medical; pension and postretirement obligations, including any contingent amounts that may be due related to multi-employer pension plans, have been excluded

from the table. A discussion of the company’s pension and postretirement plans, including funding matters, is included in Notes 16 – Defined Benefit Pension Plans and 17 – Postretirement Healthcare and Life Insurance

Plans. The company’s obligations for employee health and property and casualty losses are also excluded from the table. Finally, the amount does not include any reserves for income taxes because we are unable to reasonably

predict the ultimate amount or timing of settlement of our reserves for income taxes. See Note 18 – Income Taxes regarding income taxes for further details.

4 Contingent lease obligations represent leases on property operated by others that only become an obligation of the company in the event that the owners of the businesses are unable to satisfy the lease liability. A significant

portion of these amounts relates to leases operated by Coach, Inc. At June 29, 2013, the company has not recognized a contingent lease liability on the Consolidated Balance Sheets.

5 Contractual commitments and obligations identified under the accounting rules associated with accounting for contingencies are reflected and disclosed on the Consolidated Balance Sheets and in the related notes. Amounts

exclude any tax impact. See Note 18 – Income Taxes regarding income taxes for further details.