Sara Lee 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 53

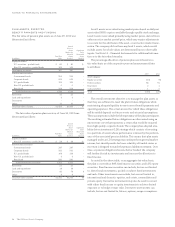

NET PERIODIC BENEFIT COST AND FUNDED STATUS

The components of the net periodic benefit cost for continuing

operations were as follows:

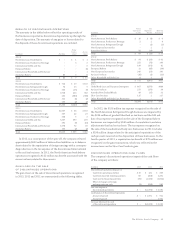

In millions 2013 2012 2011

Components of defined benefit

net periodic benefit cost

Service cost $«11 $÷«9 $÷«7

Interest cost 70 73 73

Expected return on assets (92) (86) (81)

Amortization of:

Prior service cost 111

Net actuarial loss 4313

Settlement loss 61–

Net periodic benefit cost $÷«– $÷«1 $«13

In 2013, the company recognized $1 million of settlement losses

associated with settlement of two of the company’s defined benefit

pension plans in Canada. The losses resulted from recognition of the

unamortized actuarial losses associated with these two plans. The

company also recognized a $4 million loss related to the payout of

the surplus assets associated with these plans, which were in an

overfunded position. The remaining $1 million of settlement losses

were associated with plan settlements resulting from the payment

of lump-sum benefits to plan participants.

In 2012, the company recognized $1 million of settlement losses

associated with plan settlements resulting from the payment of lump-

sum benefits to plan participants. In 2012, the disposition of the

North American fresh bakery business resulted in the recognition

of a $36 million net settlement loss as a result of the assumption

of the related plan liabilities by the buyer. The settlement loss was

recognized as part of the gain on disposition of this business.

In 2011, the company recognized a curtailment loss of $5 million

associated with the fresh bakery businesses as a result of the expected

decline in expected years of future service associated with the planned

disposition of this business. The amounts recognized in 2011 were

reported as part of the results of discontinued operations.

The net periodic benefit cost of the defined benefit pension plans

in 2013 was virtually unchanged from 2012 as an increase settlement

losses and amortization expense was offset by an increase in asset

returns and lower interest expense.

The net periodic benefit cost of the defined benefit pension plans

in 2012 was $12 million lower than in 2011. The decrease was pri-

marily due to a reduction in the amortization of net actuarial losses

due to actuarial gains recognized during 2011, which reduced the

amount of actuarial losses to be amortized as of the end of 2011.

The amount of prior service cost and net actuarial loss that is

expected to be amortized from accumulated other comprehensive

income and reported as a component of net periodic benefit cost

in continuing operations during 2014 is $1 million and $4 million,

respectively.

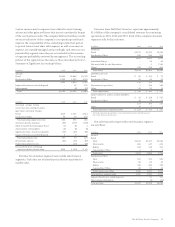

The funded status of defined benefit pension plans at the

respective year-ends was as follows:

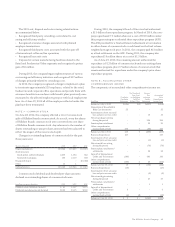

In millions 2013 2012

Projected benefit obligation

Beginning of year $1,680 $1,377

Service cost 11 9

Interest cost 70 73

Plan amendments/other 11

Benefits paid (81) (73)

Actuarial (gain) loss (123) 294

Settlements 4–

Foreign exchange – (1)

End of year $1,562 $1,680

Fair value of plan assets

Beginning of year $1,515 $1,259

Actual return on plan assets (3) 321

Employer contributions 89

Benefits paid (81) (73)

Foreign exchange – (1)

End of year 1,439 1,515

Funded status $÷(123) $÷(165)

Amounts recognized on the

consolidated balance sheets

Noncurrent asset $÷÷÷«1 $÷÷÷«5

Accrued liabilities (5) (4)

Pension obligation (119) (166)

Net asset (liability) recognized $÷(123) $÷(165)

Amounts recognized in accumulated

other comprehensive income

Unamortized prior service cost $÷÷÷«7 $÷÷÷«7

Unamortized actuarial loss, net 228 263

Total $÷«235 $÷«270

The underfunded status of the plans decreased from $165 million

in 2012 to $123 million in 2013, due to a $118 million decrease in

plan obligations resulting from $123 million of actuarial gains driven

by an increase in the discount rate which was only partially offset by

a $76 million decrease in plan assets. The decrease in plan assets was

the result of a decline in investment performance during the year.

The accumulated benefit obligation is the present value of pension

benefits (whether vested or unvested) attributed to employee service

rendered before the measurement date and based on employee service

and compensation prior to that date. The accumulated benefit obliga-

tion differs from the projected benefit obligation in that it includes no

assumption about future compensation levels. The accumulated benefit

obligations of the company’s pension plans as of the measurement dates

in 2013 and 2012 were $1.562 billion and $1.680 billion, respectively.

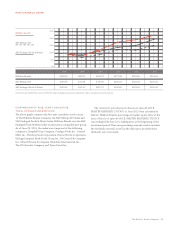

The projected benefit obligation, accumulated benefit obligation

and fair value of plan assets for pension plans with accumulated

benefit obligations in excess of plan assets were:

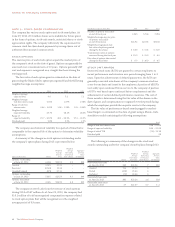

In millions 2013 2012

Projected benefit obligation $1,555 $1,351

Accumulated benefit obligation 1,555 1,350

Fair value of plan assets 1,431 1,180