Sara Lee 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 9

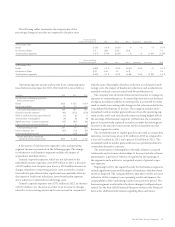

NET SALES

Net sales in 2013 were $3.920 billion, a decrease of $38 million, or

1.0% versus 2012. Net sales were impacted by dispositions after the

beginning of 2012, which reduced net sales by $55 million. Adjusted

net sales increased $17 million, or 0.4% due to a 1.4% increase in

volumes, which were only partially offset by an unfavorable shift in

sales mix and pricing actions in response to lower commodity costs.

Sales were negatively impacted by a material one-time reduction in

inventory levels held by a large retail customer in the fourth quarter

of 2013 and issues with the lunchmeat packaging transition.

Net sales in 2012 were $3.958 billion, an increase of $74 million,

or 1.9% versus 2011. Net sales were impacted by dispositions after the

beginning of 2011, which reduced net sales by $80 million. Adjusted

net sales increased $154 million, or 4.1% due to price increases in

response to higher commodity costs and the year-over-year impact

of an acquisition made in 2011, partially offset by lower volumes.

OPERATING INCOME

Operating income increased by $221 million in 2013. The year-

over-year net impact of the change in significant items and business

dispositions identified in the preceding table of consolidated results

decreased operating income by $181 million. As a result, adjusted

operating income increased $40 million, or 12.5% due to a significant

decline in general corporate expense, excluding significant items,

lower commodity costs net of pricing actions and higher volumes,

partially offset by increased investments in MAP spending.

Operating income decreased by $151 million, or 66.5% in 2012

from 2011. The year-over-year net impact of the change in significant

items and the business dispositions identified in the preceding table

of consolidated results decreased operating income by $159 million.

As a result, adjusted operating income increased $8 million, or 2.5%

due to a significant decline in general corporate expense, excluding

significant items, partially offset by lower adjusted operating results

in the Foodservice/Other business segment.

The changes in the individual components of operating income

are discussed in more detail below.

GROSS MARGIN

The gross margin, which represents net sales less cost of sales,

increased by $61 million in 2013. The increase was driven by the

impact of lower commodity costs and the benefits of cost saving

initiatives. These were only partially offset by a negative shift in

sales mix, higher bakery manufacturing costs and the generally

weak economic conditions in the foodservice category.

The gross margin percentage increased from 27.8% in 2012

to 29.6% in 2013 due to gross margin percentage increases in

the Retail segment. The gross margin percentage was positively

impacted by lower commodity costs partially offset by higher

bakery manufacturing costs.

The gross margin decreased by $62 million in 2012 from 2011,

driven by the negative impact of higher discounts associated with

aged inventories, lower volumes, the negative impact of disruptions

associated with the Tarboro N.C. bakery plant upgrade and the gen-

erally weak economic conditions in the foodservice category, which

were only partially offset by the benefits of cost saving initiatives.

The gross margin percentage decreased from 29.9% in 2011

to 27.8% in 2012 due to gross margin percentage declines for all

business segments but primarily at Foodservice/Other. The gross

margin percentage was negatively impacted by higher commodity

costs, lower volumes and higher discounts associated with aged

inventories which were partially offset by pricing actions and

continuous improvement savings.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

In millions 2013 2012 2011

SG&A expenses in the business

segment results

Media advertising and promotion $174 $136 $121

Other 597 594 623

Total business segments 771 730 744

Amortization of identifiable intangibles 444

General corporate expenses 81 195 136

Mark-to-market derivative

(gains)/losses (1) 1 (1)

Total SG&A $855 $930 $883

Total SG&A expenses reported in 2013 by the business segments

increased by $41 million, or 5.6%, versus 2012 primarily due to

higher MAP spending.

Unallocated general corporate expenses decreased by $114 million

in 2013 over the prior year due to a $86 million decrease in charges

related to restructuring actions, costs incurred in conjunction with

the spin-off and other significant items as well as the impact of

headcount reductions, lower benefit plan expenses and a reduction

in information technology costs.