Sara Lee 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 27

each tax position. If the company determines it is more likely than

not that it is entitled to the economic benefits associated with a tax

position, it then considers the amounts and probabilities of the

outcomes that could be realized upon ultimate settlement with

a taxing authority, taking into consideration all available facts,

circumstances, and information. The company believes that it has

sufficient cash resources to fund the settlement of these audits.

As a result of audit resolutions, expirations of statutes of

limitations, and changes in estimate on tax contingencies in 2013,

2012 and 2011, the company recognized a tax benefit of $5 million,

a benefit of $1 million, and an expense of $3 million, respectively.

However, audit outcomes and the timing of audit settlements are

subject to significant uncertainty. The company estimates reserves

for uncertain tax positions, but is not able to control or predict the

extent to which tax authorities will examine specific periods, the

outcome of examinations, or the time period in which examinations

will be conducted and finalized. Favorable or unfavorable past audit

experience in any particular tax jurisdiction is not indicative of the

outcome of future examinations by those tax authorities. Based on

the nature of uncertain tax positions and the examination process,

management is not able to predict the potential outcome with respect

to tax periods that have not yet been examined or the impact of

any potential reserve adjustments on the company’s tax rate or net

earnings trends. As of the end of 2013, the company believes that it

is reasonably possible that the liability for unrecognized tax benefits

will decrease by approximately $5 million to $30 million over the

next 12 months.

• Facts and circumstances may change that cause the company to

revise the conclusions on its ability to realize certain net operating

losses and other deferred tax attributes. The company regularly

reviews whether it will realize its deferred tax assets. Its review

consists of determining whether sufficient taxable income of the

appropriate character exists within the carryback and carryforward

period available under respective tax statutes. The company considers

all available evidence of recoverability when evaluating its deferred

tax assets; however, the company’s most sensitive and critical factor

in determining recoverability of deferred tax assets is the existence

of historical and projected profitability in a particular jurisdiction.

As a result, changes in actual and projected results of the company’s

various legal entities can create variability, as well as changes in

the level of the company’s gross deferred tax assets, which could

result in increases or decreases in the company’s deferred tax asset

valuation allowance.

The company cannot predict with reasonable certainty or

likelihood future results considering the complexity and sensitivity

of the assumptions above.

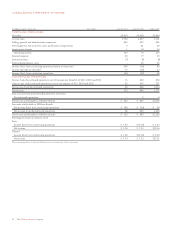

Note 18 – Income Taxes, sets out the factors which caused the

company’s effective tax rate to vary from the statutory rate and

certain of these factors result from finalization of tax audits and

review and changes in estimates and assumptions regarding tax

obligations and benefits.

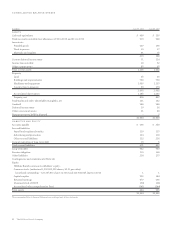

STOCK BASED COMPENSATION

The company issues restricted stock units (RSUs) and stock

options to employees in exchange for employee services. See Note 9 –

Stock-Based Compensation regarding stock-based compensation for

further information on these awards. The cost of RSUs and stock

option awards is equal to the fair value of the award at the date of

grant, and compensation expense is recognized for those awards

earned over the service period. A certain number of the RSUs vest

based upon the employee achieving certain defined service and

performance measures, either internally or externally measured.

During the service period, management estimates the number of

awards that will meet the defined performance measures. At the

time of grant, if the measures are based upon external criteria,

the Monte Carlo model is used to determine the fair value of these

awards at the date of grant. Management estimates the volatility

of the company’s stock and the initial total shareholder return to

determine the fair value of the award. If the measures are based

upon internal criteria, the cost of the RSUs is equal to the fair value

at the date of grant. With regard to stock options, at the date of

grant, the company determines the fair value of the award using the

Black-Scholes option pricing formula. Management estimates the

period of time the employee will hold the option prior to exercise

and the expected volatility of the company’s stock, each of which

impacts the fair value of the stock options. The company believes

that changes in the estimates and assumptions associated with

prior non-performance based grants and stock option grants are

not reasonably likely to have a material impact on future operating

results. However, changes in estimates and assumptions related

to previously issued performance based RSUs may have a material

impact on future equity.