Sara Lee 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 11

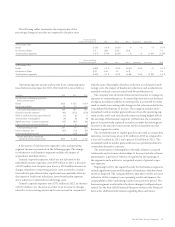

INCOME TAX EXPENSE

The effective tax rate on continuing operations in 2013, 2012 and

2011 was impacted by a number of significant items that are shown

in the reconciliation of the company’s effective tax rate to the U.S.

statutory rate in Note 18 – Income Taxes. Additional information

regarding income taxes can be found in “Critical Accounting Estimates”

within Management’s Discussion and Analysis.

In millions 2013 2012 2011

Continuing operations

Income (loss) before income taxes $«256 $÷«(35) $«÷85

Income tax expense (benefit) 72 (15) 27

Effective tax rates 28.1% (44.2)fi 31.8%

2013 versus 2012 In 2013, the company recognized a tax expense

for continuing operations of $72 million, or an effective tax rate of

28.1%, compared to tax benefit of $15 million, or an effective tax rate

of 44.2%, in 2012. The tax rate in 2013 was impacted by contingent

tax obligations, deductions associated with domestic production

activities, non-taxable indemnification agreements, employee benefit

deductions and tax provision adjustments. See the tax rate reconcili-

ation table in Note 18 – Income Taxes for additional information.

2012 versus 2011 In 2012, the company recognized a tax benefit

on continuing operations of $15 million, or an effective tax rate of

44.2%, compared to tax expense of $27 million, or an effective tax

rate of 31.8%, in 2011. The tax rate in 2012 was impacted by non-

taxable indemnification agreements, employee benefit deductions

and tax provision adjustments partially offset by non-deductible

professional fees. See the tax rate reconciliation table in Note 18 –

Income Taxes for additional information.

INCOME (LOSS) FROM CONTINUING OPERATIONS

AND DILUTED EARNINGS PER SHARE (EPS)

FROM CONTINUING OPERATIONS

Income from continuing operations in 2013 was $184 million,

an increase of $204 million over the prior year. The improvement

was due to a $165 million decrease in net after tax charges incurred

in conjunction with the spin-off, restructuring actions and other

significant items. Loss from continuing operations in 2012 was

$20 million, a decrease of $78 million over the prior year. The decline

was due to net after tax charges incurred in conjunction with the

spin-off, restructuring actions and other significant items.

Diluted EPS from continuing operations was $1.49 in 2013, a

loss of $0.16 in 2012 and income of $0.46 in 2011. Adjusted diluted

EPS was $1.72 in 2013, $1.45 in 2012 and $1.21 in 2011. The diluted

EPS from continuing operations in the current year is unfavorably

impacted by higher average shares outstanding as a result of the

exercise of stock options and the accelerated vesting of RSUs due

to the spin-off.

DISCONTINUED OPERATIONS

The results of the company’s North American fresh bakery,

refrigerated dough and foodservice beverage businesses and the

international coffee and tea, household and body care and European

and Australian bakery businesses, which have been classified as

discontinued operations, are summarized below. See Note 1 – Nature

of Operations and Basis of Presentation for additional information.

In millions 2013 2012 2011

Net sales $«80 $5,365 $8,223

Income (loss) from discontinued

operations before income taxes $÷«7 $÷(140) $÷«565

Income tax (expense) benefit on income

from discontinued operations 8 603 (82)

Gain on disposition of discontinued

operations before income taxes 68 772 1,304

Income tax expense on disposition

of discontinued operations (15) (367) (573)

Net income from discontinued operations $«68 $÷«868 $1,214

Net Sales and Income (Loss) from Discontinued Operations before

Income Taxes Net sales for discontinued operations were $80 million

in 2013, compared to $5.365 billion in 2012. The year-over-year

change was due to the completion of the disposition of most of the

businesses that were part of the discontinued operations prior to

the end of 2012. The net sales in 2013 all relate to the Australian

bakery operations, which were disposed of in February 2013. Income

from discontinued operations was $15 million in 2013, a decline of

$448 million compared to 2012 as a result of the completion of the

disposition of most of the businesses that were part of discontinued

operations. The year-over-year change was also impacted by the

nonrecurrence of significant impairment charges and tax benefits

that were recognized in 2012, as discussed in more detail below. The

operating results reported in 2013 relate to the Australian bakery

operations, as well as adjustments of prior year tax provision estimates

related to the business dispositions completed in 2012.