Sara Lee 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIVIDENDS

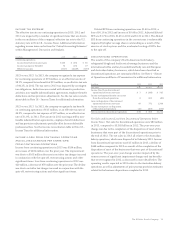

The quarterly dividend amounts paid in 2013 were $0.125 per share,

or $0.50 on an annualized basis. On August 8, 2013, the company

announced it had increased its next quarterly dividend to $0.175 per

share, or $0.70 on an annualized basis. The amount of any future

dividends will be determined by the company’s Board of Directors

and is not guaranteed.

BUSINESS DISPOSITIONS IN 2013

In February 2013, the company closed on the sale of its Australian

bakery business to McCain Foods for 82 million AUD (approximately

$85 million U.S. dollars). Also included in the transaction were the

license rights to certain intellectual property used by the Australian

bakery business in the Asia-Pacific region.

BUSINESS DISPOSITIONS IN 2012

In September 2011, the company closed on the sale of its North

American refrigerated dough business to Ralcorp for $545 million.

In November 2011, the company closed on the sale of its North

American fresh bakery business to Grupo Bimbo for $709 million,

which included the assumption of $34 million of debt. In December

2011, the company closed on the sale of its North American food

service beverage operations to J. M. Smucker for $350 million. In

August 2011, the company also made the decision to divest its Spanish

bakery business to Grupo Bimbo for €115 million and closed on this

sale in the second quarter of 2012. The company also divested its

French refrigerated dough business for €115 million and closed on

this deal in the third quarter of 2012. The company closed on the

divestiture of certain of the international household and body care

businesses during 2012 and received proceeds of approximately

$117 million.

SPIN-OFF/SPECIAL DIVIDEND

In 2012, immediately after the spin-off, DEMB paid a $3.00 per

share special dividend, which totaled $1.8 billion, to the company’s

shareholders who received shares of the spun-off business.

SHARE REPURCHASES

As of June 29, 2013, approximately $1.2 billion were authorized

for share repurchase by the board of directors, in addition to a

2.7 million share authorization remaining under a prior share

repurchase program, after adjusting for the 1-for-5 reverse stock

split in June 2012. In August 2013, the company announced that

it is targeting repurchases of approximately $200 million of shares

of its common stock over the next two fiscal years under its pre-

existing stock repurchase authorizations. The timing of the share

buybacks will depend, in part, on our share price, the state of the

financial markets and other factors.

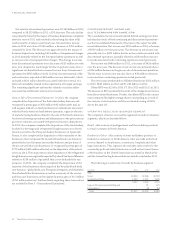

DEBT

The total debt outstanding at June 29, 2013 is $951 million, an

increase of $7 million over the prior year due to the increase in the

value of current zero coupon note debt. The company’s long-term

debt was virtually 100% fixed-rate debt as of June 29, 2013 and

June 30, 2012.

The debt is due to be repaid as follows: $19 million in 2014,

$93 million in 2015, $400 million in 2016, nil in 2017, nil in 2018

and $439 million thereafter. The debt obligations are expected to

be satisfied with cash on hand, cash from operating activities or

with additional borrowings.

From time to time, the company opportunistically may

repurchase or retire its outstanding debt through cash purchases

and/or exchanges for equity securities, in open market purchases,

privately negotiated transactions or otherwise. Such repurchases

or exchanges, if any, will depend on prevailing market conditions,

the company’s liquidity requirements, contractual restrictions and

other factors. The amounts involved could be material.

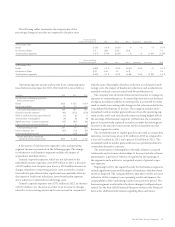

PENSION PLANS

As shown in Note 16 – Defined Benefit Pension Plans, the funded

status of the company’s defined benefit pension plans is defined as

the amount the projected benefit obligation exceeds the plan assets.

The funded status of the plans for total continuing operations is an

underfunded position of $123 million at the end of fiscal 2013 as

compared to an underfunded position of $165 million at the end

of fiscal 2012.

The company expects to contribute approximately $5 million

of cash to its pension plans in 2014 as compared to approximately

$8 million in 2013 and $9 million in 2012. The contribution amounts

are for pension plans of continuing operations and pension plans

where the company has agreed to retain the pension liability after

certain business dispositions were completed. The exact amount of

cash contributions made to pension plans in any year is dependent

upon a number of factors, including minimum funding requirements.

As a result, the actual funding in 2014 may be materially different

from the estimate.

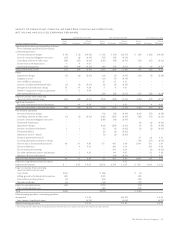

The company participates in one multi-employer pension plan

(MEPP) that provided retirement benefits to certain employees

covered by collective bargaining agreements. Participating employers

in a MEPP are jointly responsible for any plan underfunding. MEPP

contributions are established by the applicable collective bargaining

agreements; however, the MEPPs may impose increased contribution

rates and surcharges based on the funded status of the plan and the

provisions of the Pension Protection Act of 2006 (PPA). The PPA

imposes minimum funding requirements on the plans. Plans that

fail to meet certain funding standards as defined by the PPA are

categorized as being either in a critical or endangered status. We

18 The Hillshire Brands Company

FINANCIAL REVIEW