Sara Lee 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 19

have received notice that the plan to which we contribute has been

designated in critical status. The trustees of critical status multi-

employer plans must adopt a rehabilitation or funding improvement

plan designed to improve the plan’s funding within a prescribed

period of time. Rehabilitation and funding improvement plans may

include increased employer contributions, reductions in benefits

or a combination of the two. Unless otherwise agreed upon, any

requirement to increase employer contributions will not take effect

until the current collective bargaining agreements expire. However,

a five percent surcharge for the initial critical year (increasing to

ten percent for the following and subsequent years) is imposed on

contributions to plans in critical status and remains in effect until

the bargaining parties agree on modifications consistent with the

rehabilitation plan adopted by the trustees. In addition, the failure

of a plan to meet funding improvement targets provided in its

rehabilitation or funding improvement plan could result in the

imposition of an excise tax on contributing employers.

Under current law regarding multi-employer pension plans, a

withdrawal or partial withdrawal from any plan that was underfunded

would render us liable for our proportionate share of that underfund-

ing. This potential unfunded pension liability also applies ratably to

other contributing employers. Information regarding underfunding

is generally not provided by plan administrators and trustees on a

current basis and when provided, is difficult to independently validate.

Any public information available relative to multi-employer pension

plans may be dated as well. In the event a withdrawal or partial

withdrawal was to occur with respect to the MEPP to which the com-

pany makes contributions, the impact to our consolidated financial

statements could be material. Withdrawal liability triggers could

include the company’s decision to close a plant or the dissolution

of a collective bargaining unit.

The company’s regularly scheduled contributions to MEPPs

related to continuing operations totaled approximately $1 million

in 2013, $2 million in 2012 and $3 million in 2011. For continuing

operations, the company incurred withdrawal liabilities of an

immaterial amount in 2013 and 2011 and $3 million in 2012.

REPATRIATION OF FOREIGN EARNINGS

AND INCOME TAXES

The company intends to permanently reinvest all of its earnings

from continuing operations outside of the U.S. and, therefore, has not

recognized U.S. tax expense on these earnings. In 2012, the discontin-

ued operations of the international coffee and tea business recognized

$15.5 million of expense for repatriating a portion of 2012 and prior

year foreign earnings to the U.S. In addition, the company has recog-

nized $25 million of tax expense in 2012 related to the repatriation

of the proceeds on the sale of the insecticides business.

In the third quarter of 2010, the company established a deferred tax

liability in anticipation of the repatriation of foreign earnings required

to satisfy commitments to shareholders. This deferred liability was

subsequently updated each quarter as proceeds of non-US divestments

and other cash movements were realized. As a consequence of the

spin-off of the international coffee and tea business, the repatriation

of unremitted earnings was no longer required. As such, in 2012 the

company released approximately $623 million of deferred tax liabili-

ties on its balance sheet with a corresponding reduction in the tax

expense of the discontinued international coffee and tea business.

CREDIT FACILITIES AND RATINGS

The company has a $750 million credit facility that expires in June

2017. The $750 million credit facility has an annual fee of 0.15% as

of June 29, 2013 and pricing under this facility is based on the com-

pany’s current credit rating. At June 29, 2013, the company did not

have any borrowings outstanding under this facility but it did have

approximately $57 million of letters of credit outstanding under

this credit facility.

The company’s debt agreements and credit facility contain

customary representations, warranties and events of default, as

well as, affirmative, negative and financial covenants with which

the company is in compliance. One financial covenant includes a

requirement to maintain an interest coverage ratio of not less than

2.0 to 1.0. The interest coverage ratio is based on the ratio of EBIT

to consolidated net interest expense with consolidated EBIT equal

to net income plus interest expense, income tax expense, and

extraordinary or non-recurring non-cash charges and gains. For the

12 months ended June 29, 2013, the company’s interest coverage

ratio was 9.0 to 1.0.

The financial covenants also include a requirement to maintain

a leverage ratio of not more than 3.5 to 1.0. The leverage ratio is

based on the ratio of consolidated total indebtedness to an adjusted

consolidated EBITDA. For the 12 months ended June 29, 2013, the

leverage ratio was 2.1 to 1.0.

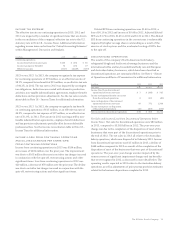

The company’s credit ratings by Standard & Poor’s, Moody’s

Investors Service and FitchRatings, as of June 29, 2013 were

as follows:

Senior

Unsecured Short-term

Obligations Borrowings Outlook

Standard & Poor’s BBB A-2 Stable

Moody’s Baa2 P-2 Stable

Fitch BBB F-2 Stable