Sara Lee 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 37

debt is not allocated to discontinued operations. Any gain or loss

recognized upon the disposition of a discontinued operation is also

reported on a separate line of the income statement. Prior to dispo-

sition, the assets and liabilities of discontinued operations are

aggregated and reported on separate lines of the balance sheet.

Gains and losses related to the sale of business components that

do not meet the discontinued operation criteria are reported in

continuing operations and separately disclosed, if significant.

Businesses Held for Sale In order for a business to be classified

as held for sale, several criteria must be achieved. These criteria

include, among others, an active program to market the business

and locate a buyer, as well as the probable disposition of the business

within one year. Upon being classified as held for sale, the recoverabil-

ity of the carrying value of a business must be assessed. Evaluating

the recoverability of the assets of a business classified as held for

sale follows a defined order in which property and intangible assets

subject to amortization are considered only after the recoverability

of goodwill, intangible assets not subject to amortization and other

assets are assessed. After the valuation process is completed, the

held for sale business is reported at the lower of its carrying value or

fair value less cost to sell and no additional depreciation expense is

recognized related to property. The carrying value of a held for sale

business includes the portion of the cumulative translation adjust-

ment related to the operation. Once a business is classified as held

for sale, all of its historical balance sheet information is included in

assets and liabilities held for sale in the balance sheet.

Businesses Held for Use If a decision to dispose of a business is

made and the held for sale criteria are not met, the business is con-

sidered held for use and its assets are evaluated for recoverability

in the following order: assets other than goodwill; property and

intangibles subject to amortization; and finally, goodwill. In evaluat-

ing the recoverability of property and intangible assets subject to

amortization, in a held for use business, the carrying value of the

business is first compared to the sum of the undiscounted cash flows

expected to result from the use and eventual disposition of the

operation. If the carrying value exceeds the undiscounted expected

cash flows, then an impairment is recognized if the carrying value

of the business exceeds its fair value.

There are inherent judgments and estimates used in determining

future cash flows and it is possible that additional impairment charges

may occur in future periods. In addition, the sale of a business can

result in the recognition of a gain or loss that differs from that

anticipated prior to the closing date.

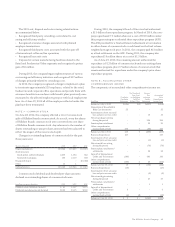

PROPERTY

Property is stated at historical cost and depreciation is computed

using the straight-line method over the lives of the assets. Machinery

and equipment are depreciated over periods ranging from 3 to 25

years and buildings and building improvements over periods of up

to 40 years. Additions and improvements that substantially extend

the useful life of a particular asset and interest costs incurred during

the construction period of major properties are capitalized. Leasehold

improvements are capitalized and amortized over the shorter of the

remaining lease term or remaining economic useful life. Repairs and

maintenance costs are charged to expense. Upon the sale or disposi-

tion of property, the cost and related accumulated depreciation are

removed from the accounts. Capitalized interest was $2 million in

2013, $5 million in 2012 and $10 million in 2011.

Property is tested for recoverability whenever events or

changes in circumstances indicate that its carrying value may not

be recoverable. Such events include significant adverse changes in

the business climate, current period operating or cash flow losses,

forecasted continuing losses or a current expectation that an asset

group will be disposed of before the end of its useful life or spun-off.

Recoverability of property is evaluated by a comparison of the carry-

ing amount of an asset or asset group to future net undiscounted cash

flows expected to be generated by the asset or asset group. If the

carrying amount exceeds the estimated future undiscounted cash

flows then an asset is not recoverable. The impairment loss recognized

is the amount by which the carrying amount of the asset exceeds the

estimated fair value using discounted estimated future cash flows.

Assets that are to be disposed of by sale are recognized in the

financial statements at the lower of carrying amount or fair value,

less cost to sell, and are not depreciated after being classified as held

for sale. In order for an asset to be classified as held for sale, the asset

must be actively marketed, be available for immediate sale and meet

certain other specified criteria.

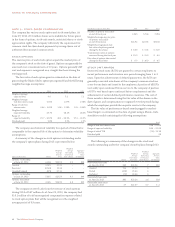

TRADEMARKS AND OTHER

IDENTIFIABLE INTANGIBLE ASSETS

The primary identifiable intangible assets of the company are

trademarks and customer relationships acquired in business combi-

nations and computer software. The company capitalizes direct costs

of materials and services used in the development and purchase of

internal-use software. Identifiable intangibles with finite lives are

amortized and those with indefinite lives are not amortized. The

estimated useful life of a finite-lived identifiable intangible asset is

based upon a number of factors, including the effects of demand,

competition, expected changes in distribution channels and the level

of maintenance expenditures required to obtain future cash flows.

Identifiable intangible assets that are subject to amortization

are evaluated for impairment using a process similar to that used

in evaluating the recoverability of property, plant and equipment.

Identifiable intangible assets not subject to amortization are assessed

for impairment at least annually and as triggering events may occur.

The impairment test for identifiable intangible assets not subject to

amortization consists of a comparison of the fair value of the intangi-

ble asset with its carrying amount. An impairment loss is recognized

for the amount by which the carrying value exceeds the fair value of

the asset. In making this assessment, management relies on a number

of factors to discount estimated future cash flows including operating

results, business plans and present value techniques. Rates used to