Sara Lee 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

long-term debt. Market risk for fixed-rate long-term debt is estimated

as the potential decrease in fair value resulting from a hypothetical

10% increase in interest rates, which would result in a maximum

potential loss of approximately $16 million. The underlying fair values

of our long-term debt were estimated based on quoted market prices

or on the current rates offered for debt with similar maturities.

The company has interest rate risk associated with its pension

and post-retirement benefit obligations. Changes in interest rates

impact the liabilities associated with these benefit plans as well as

the amount of income or expense recognized for these plans. Declines

in the value of the plan assets could diminish the funded status of

the pension plans and potentially increase the requirements to make

cash contributions to these plans. See Note 16 – Defined Benefit

Pension Plans and 17 – Postretirement Healthcare and Life Insurance

Plans for additional information.

Commodities The company is a purchaser of certain commodities

such as beef, pork, chicken, packaging, fruit, seasoning blends, flour,

corn, corn syrup, soybean and corn oils, butter, sugar, natural gas and

diesel fuel. We also raise turkeys and contract with turkey growers

to meet our raw material requirements for whole birds and processed

turkey products. Our costs for turkey are affected by the cost and

supply of feed grains, including corn and soybean meal. Commodities

are subject to price risk due to factors such as fluctuations in the

commodity market, the availability of supply, severe weather,

consumer or industrial demand and changes in governmental and

international trade, alternative energy and agricultural programs.

The company attempts to reduce the market risk associated with

these by entering into either physical forward contracts or deriva-

tive instruments. The company has policies governing the hedging

instruments that can be used. In circumstances where commodity

derivative instruments are used, there is a high correlation between

the commodity costs and the derivative instrument.

For commodity derivative instruments held, the company uses

a sensitivity analysis technique to evaluate the effect that a 10%

change in the underlying commodity price would have on the market

value of the company’s commodity derivative instruments. The

impact is not significant compared with the earnings and equity

of the company.

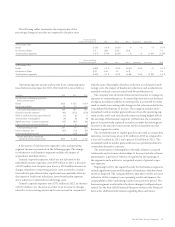

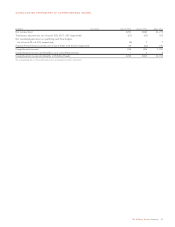

In millions 2013 2012

Effect of a 10% change in market price

Grains & oilseeds $3 $7

Energy 3 2

Other commodities 2 2

22 The Hillshire Brands Company

FINANCIAL REVIEW

RISK MANAGEMENT ACTIVITIES

The company maintains risk management control systems to monitor

the interest rate and commodity risks, and the company’s offsetting

hedge positions. The risk management control system uses analytical

techniques including market value and sensitivity analysis.

Sensitivity Analysis The sensitivity analysis is the measurement

of the potential loss in future earnings, fair values or cash flows of

market sensitive instruments resulting from one or more selective

hypothetical changes in interest rates, foreign currency exchange

rates, commodity prices and other market rates or prices over a

selected time.

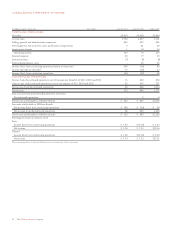

NON-GAAP FINANCIAL MEASURES

The following is an explanation of the non-GAAP financial measures

presented in this annual report. Adjusted net sales excludes from

net sales the impact of businesses that have been exited or divested

for all periods presented. Adjusted operating income excludes from

operating income the impact of significant items recognized during

the fiscal period and businesses exited or divested for all periods

presented. It also adjusts for the impact of an additional week in

those fiscal years that include a 53rd week. Results for businesses

acquired are included from the date of acquisition onward. Adjusted

EPS excludes from diluted EPS for continuing operations the impact

of significant items and the 53rd week.

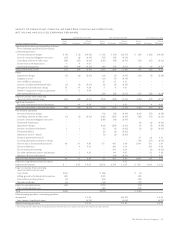

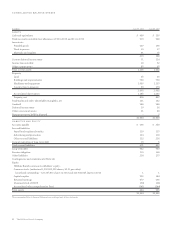

SIGNIFICANT ITEMS AFFECTING COMPARABILITY

The reported results for 2013, 2012 and 2011 reflect amounts

recognized for restructuring actions and other significant amounts

that impact comparability.

Significant items are income or charges (and related tax impact)

that management believes have had a significant impact on the

earnings of the applicable business segment or on the total company

for the period in which the item is recognized, are not indicative of

the company’s core operating results and affect the comparability

of underlying results from period to period. Significant items may

include, but are not limited to: charges for exit activities; various

restructuring programs; spin-off related costs; impairment charges;

pension partial withdrawal liability charges; benefit plan curtail-

ment gains and losses; tax charges on deemed repatriated earnings;

tax costs and benefits resulting from the disposition of a business;

impact of tax law changes; changes in tax valuation allowances and

favorable or unfavorable resolution of open tax matters based on

the finalization of tax authority examinations or the expiration of

statutes of limitations.

The impact of the above items on net income and diluted earnings

per share is summarized on the following page.