Sara Lee 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

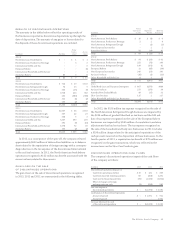

In May 2012, the company issued $650 million in senior notes

through a private placement. The offering consisted of $232 million

of 3.60% senior notes due May 15, 2019, $120 million of 3.81% sen-

ior notes due May 15, 2020, $124 million of 4.03% senior notes due

May 15, 2021 and $174 million of 4.20% senior notes due May 15,

2022. The proceeds were used to payoff existing indebtedness and

for general purposes. As part of the spin-off, the company satisfied

its obligations under these notes by effectively transferring the

$650 million of indebtedness as part of the spin-off.

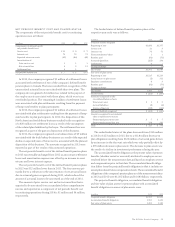

In April 2012, the company completed a tender offer for up to

$470 million of combined aggregate principal amount of three series

of its outstanding debt securities: 6.125% Notes due Nov. 2032, 4.10%

Notes due 2020 and 2.75% Notes due 2015. Upon the expiration

of the tender, the company accepted for purchase $348.4 million

of 6.125% Notes and $121.6 million of the 4.10% Notes and recog-

nized $26 million of charges associated with the early

extinguishment of this debt.

In April 2012, the company redeemed all of its 3.875% Notes

due 2013, of which the aggregate principal amount outstanding was

$500 million. A charge of $13 million was incurred related to the

early extinguishment of this debt.

Payments required on long-term debt during the years ending 2014

through 2018 are $19 million, $93 million, $400 million, nil and nil,

respectively. The company made cash interest payments of $35 mil-

lion, $73 million and $99 million in 2013, 2012 and 2011, respectively.

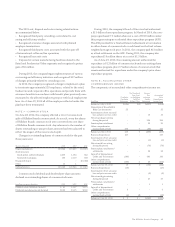

The company had a $1.2 billion revolving credit facility that

matured on the date on which the spin-off was consummated. It

was replaced by a $750 million revolving credit facility that matures

in June 2017. The credit facility has an annual fee of 0.15% of the

facility size as of June 29, 2013. Pricing under this facility is based

on the company’s current credit rating. As of June 29, 2013, the

company did not have any borrowings outstanding under the credit

facility. This agreement supports commercial paper borrowings and

other financial instruments. The company had $57 million of letters

of credit under this facility outstanding as of June 29, 2013. The

company’s credit facility and debt agreements contain customary

representations, warranties and events of default, as well as, affir-

mative, negative and financial covenants with which the company

is in compliance. One financial covenant includes a requirement to

maintain an interest coverage ratio of not less than 2.0 to 1.0. The

interest coverage ratio is based on the ratio of EBIT to consolidated

net interest expense with consolidated EBIT equal to net income

plus interest expense, income tax expense, and extraordinary or

non-recurring non-cash charges and gains. For the 12 months ended

June 29, 2013, the company’s interest coverage ratio was 9.0 to 1.0.

The financial covenants also include a requirement to maintain

a leverage ratio of not more than 3.5 to 1.0. The leverage ratio is

based on the ratio of consolidated total indebtedness to an adjusted

consolidated EBITDA. For the 12 months ended June 29, 2013, the

leverage ratio was 2.1 to 1.0.

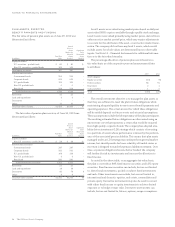

Selected data on the company’s short-term obligations follow:

In millions 2012 2011

Maximum month-end borrowings $«335 $«503

Average borrowings during the year 97 242

Year-end borrowings – 198

Weighted average interest rate

during the year 0.34% 0.31%

Weighted average interest rate

at year-end –% 0.30%

There were no short-term borrowings during 2013.

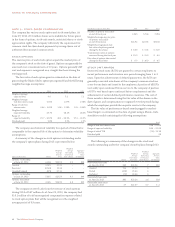

NOTE 13 – LEASES

The company leases certain facilities, equipment and vehicles under

agreements that are classified as either operating or capital leases. The

building leases have original terms that range from 10 to 15 years,

while the equipment and vehicle leases have terms of generally less

than seven years.

June 29, June 30,

In millions 2013 2012

Gross book value of capital lease assets

included in property $3 $4

Net book value of capital lease assets

included in property – 2

Future minimum payments, by year and in the aggregate, under

capital leases are less than $1 million at June 29, 2013. Future mini-

mum payments, by year end in the aggregate, under noncancelable

operating leases having an original term greater than one year at

June 29, 2013 were as follows:

Operating

In millions Leases

2014 $÷19

2015 15

2016 11

2017 10

2018 9

Thereafter 77

Total minimum lease payments $141

In millions 2013 2012 2011

Depreciation of capital lease assets $÷2 $÷1 $÷1

Rental expense under operating leases 23 22 27